Picking the right insurance agency management system can feel overwhelming.

Every AMS promises to save time, grow your book, and make life easier.

But not all of them deliver the same way.

We’ve used the top five systems ourselves – Applied Epic, AMS360, QQ Catalyst, HawkSoft, and the EZLynx management system, a comprehensive, cloud-based platform that streamlines agency operations.

And we’re here to give you honest feedback based on real use and results.

You’ll get a clear breakdown of what each system does well and where it falls short.

And at the end, we’ll show you something most agencies still miss.

A way to fix what your AMS doesn’t solve.

If you’re choosing an insurance agency management system, this guide is for you.

We used and reviewed the top 5 AMS platforms and here’s what we learned:

All of them are good for your staff, but none are built for your clients.

- Applied Epic is powerful and highly customizable, but it’s pricey and has a steep learning curve.

- AMS360 is user-friendly and solid for accounting, but customization is limited.

- QQ Catalyst is great for small agencies and easy to use, but lacks advanced features.

- HawkSoft is clean and reliable, with top-notch support, but has fewer integrations.

- The EZLynx management system offers a lot in one system, including rating and marketing, but takes time to master.

That’s where GloveBox comes in by:

- Giving your clients 24/7 access to their policies, billing, and documents through a customer portal, which enhances client engagement.

- Freeing your team from busywork so they can focus on selling and advising, while self service portals improve operational efficiency.

- Improving productivity, cross-sells, and retention.

Looking to build a modern, scalable, client-first agency? Start by pairing your AMS with GloveBox.

What Exactly is an AMS? (Quick Definition)

An AMS, or Agency Management System, is the central hub your insurance agency runs on. It keeps track of your clients, policies, documents, and accounting – all in one place.

Think of it as your agency’s digital filing cabinet, task list, and reporting tool combined.

Most AMS platforms help you store and manage customer and policy data.

They also handle renewals, commission tracking, and manage agency accounting.

Many systems connect with carrier systems to download policy data and speed up the quoting process.

And they let you run reports using analytics tools and business intelligence dashboards so you can get real-time insights and stay on top of your daily operations.

In short, it’s the internal system your team uses to stay organized, improve workflow efficiency, and remain efficient.

But as you’ll see, even the best AMS tools don’t do everything.

How We Evaluated These 5 AMS Solutions

During this analysis, we didn’t just click around a few dashboards.

We used each of these systems in real agency settings and paid attention to what actually matters.

- Ease of use – How fast can your team learn it and actually use it day-to-day? We also considered how the platform impacts team efficiency, streamlining workflows and boosting collaboration.

- Features – Does it cover the essentials? Are there any standout tools that give you an edge? We looked for features that help track agency performance and provide insights into your agency’s performance through dashboards and reporting.

- Customization – Can you shape it to fit how your agency works, or are you stuck with what’s there?

- Integrations – How well does it connect with other tools, carriers, and platforms?

- Support – What happens when something breaks or you need help fast?

- Pricing – Is what you get worth the cost?

We also read dozens of reviews from real agency users. Not just what the vendors say, but what agents say after months or years of using the product.

What follows is our honest take on each system. No fluff. Just facts.

Implementation Process: What to Expect When Adopting a New AMS

Adopting a new agency management system (AMS) is a major step for any insurance agency, whether you’re a small team or a growing independent agency. The right AMS can transform your entire business—streamlining business processes, strengthening client relationships, and setting the stage for real agency growth.

The implementation process usually starts with a deep dive into your agency’s current setup. This means assessing your existing management systems, reviewing business processes, and identifying where your agency management software can make the biggest impact. It’s about finding the right agency management system that fits your unique needs, from policy management and sales pipeline management to client communications and commercial lines submissions.

Once you’ve chosen your AMS, the next phase is configuration and data migration. Agency principals and staff work closely with the AMS provider to tailor the system to your workflows. This includes setting up document management, automating manual tasks, and integrating all the tools your team relies on. The goal is to create a centralized platform that supports your entire agency—making it easy to manage policies, track sales pipelines, and deliver exceptional client experiences.

Training is a key part of the process. The best insurance agency management systems offer comprehensive onboarding, so your team can hit the ground running. You’ll learn how to use workflow automation, leverage data analytics for data-driven decisions, and maximize efficiency across your agency. Ongoing support ensures that any questions or challenges are quickly addressed, so your agency can maintain compliance and keep operations running smoothly.

For small agencies, the process is often more straightforward, but the benefits are just as powerful. With the right insurance agency management software, even smaller agencies can compete with larger players—automating daily operations, improving client retention, and unlocking new revenue opportunities.

Ultimately, implementing a new AMS is about more than just upgrading your software. It’s about giving your entire team the tools to work smarter, not harder. With features like customer portals, marketing automation, and actionable insights, your agency can deliver exceptional client experiences, make strategic decisions, and drive business growth.

By understanding what to expect during the implementation process and choosing the right agency management system, independent insurance agents can position their agency for long-term success. The result? A more efficient, client-focused, and competitive insurance business—ready to thrive in today’s fast-paced market.

Insurance Agency Management System #1 – Applied Epic (by Applied Systems)

Applied Epic is one of the most widely used insurance agency management systems in the market.

It’s built for agencies that want a powerful, all-in-one platform with deep features, robust business intelligence and analytics tools for actionable agency insights, and solid integrations with carrier systems.

Applied Epic does well at improving operational efficiency for agencies, streamlining workflows, and supporting growth.

Ease of use

Applied Epic isn’t the easiest system to learn.

It has a steep learning curve, especially for smaller agencies or teams that don’t have a full-time admin or IT person.

The interface feels a bit outdated in some areas, and first-time users will need time and training to become comfortable.

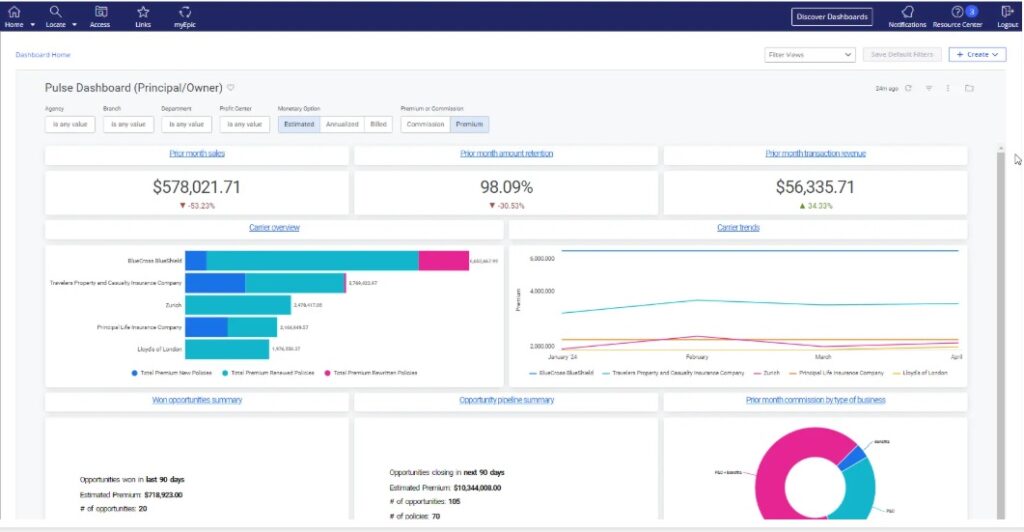

Features & customization

Features are where Applied Epic shines. It covers almost everything – policy management, accounting, quoting, reporting, renewals, marketing, and more.

If your agency has complex needs across different departments, Epic can handle it. Custom dashboards and role-based workflows are a plus for improving workflow efficiency.

Applied Epic’s analytics tools and business intelligence capabilities provide real-time data and actionable insights, helping agencies make data-driven decisions to optimize performance and drive growth.

Applied Epic is highly customizable, but that flexibility comes at a cost, both in time and effort.

You’ll likely need help from Applied’s team (or a consultant) to set up more advanced workflows.

You can tailor user roles and reporting, but it’s not drag-and-drop simple.

Integrations & support

Applied has strong integrations with major carriers and carrier systems, as well as a wide range of third-party tools.

Its partner ecosystem is one of the best in the industry, making it easier to connect quoting tools, CRMs, software solutions that enhance agency operations, and even payment solutions into one system.

Support is solid but varies depending on your service level.

The knowledge base is extensive, and the training resources are deep.

Some users report slower response times during busy periods, but most agree that the support team is helpful once engaged.

Pricing

Applied Epic is not cheap.

Pricing starts around $1,000 for a one-time fee, with ongoing costs of $230 per month per user.

Setup costs reportedly range from $10,000 to $25,000, depending on complexity.

That means first-year costs could easily reach $100,000 or more for a mid-sized agency.

For larger or growing agencies, the investment may make sense. However, for smaller teams, the price and the complexity may be too much.

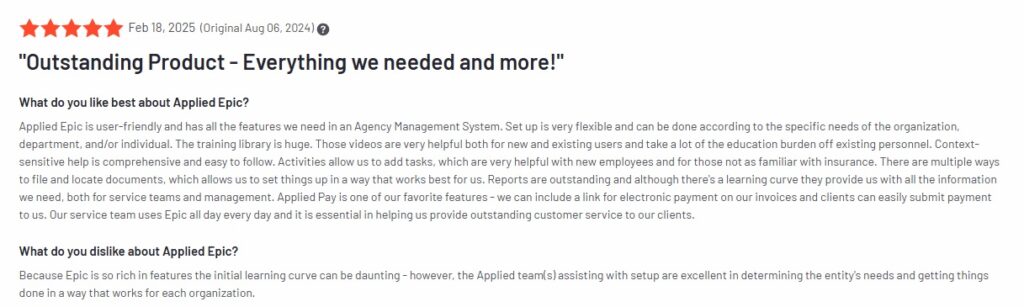

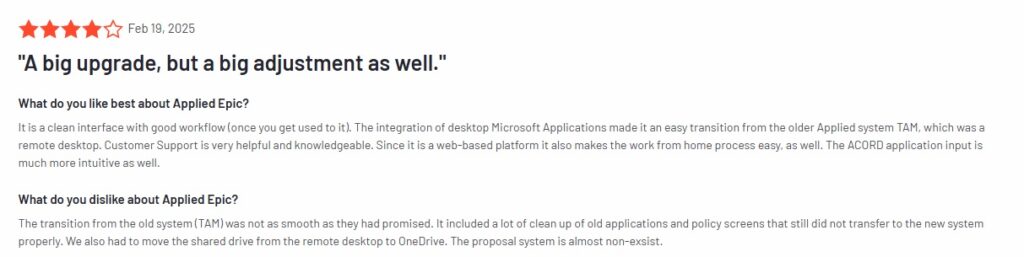

What users say

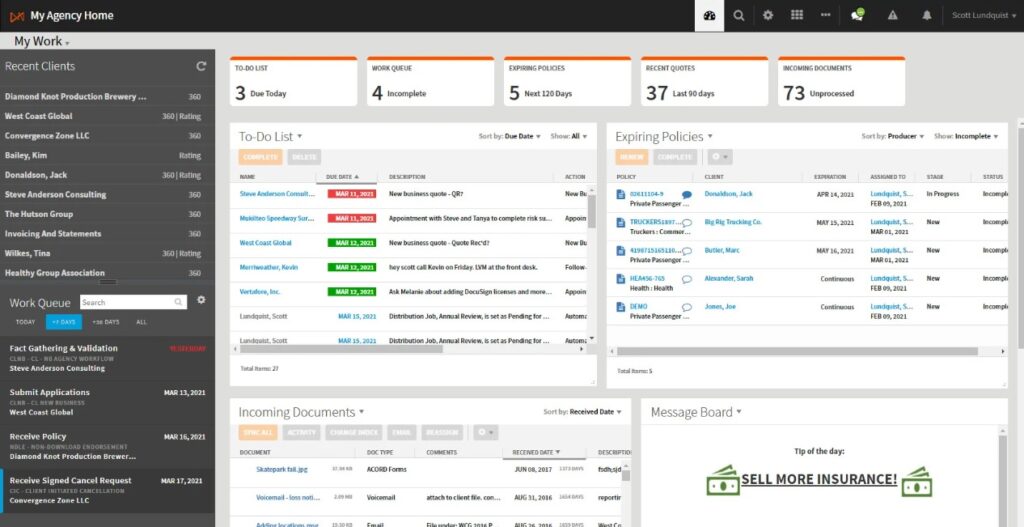

Insurance Agency Management System #2 – AMS360 (by Vertafore)

AMS360 is a long-standing AMS designed for independent insurance agencies.

It’s part of Vertafore’s ecosystem and aims to centralize client, policy, accounting, and commission tracking workflows in one system, improving operational efficiency for agencies. AMS360 also integrates with carrier systems to enable seamless data exchange and automation across quoting, policy servicing, and claims processing.

Ease of use

AMS360 is easier to pick up than more complex systems like Applied Epic.

The layout is clean and logical, and most team members can learn the basics quickly.

It’s still a full-featured platform, so advanced functions take some time, but day-to-day tasks are pretty intuitive.

Features & customization

AMS360 offers solid core features: policy management, accounting, reporting, document storage, commission tracking, and carrier downloads.

The accounting tools are a big plus. They handle trust accounting, direct bill, commissions, and commission tracking all in one system.

Customization is decent but has limits.

You can personalize reports and dashboards, and leverage analytics tools for actionable insights, but deeper workflow adjustments or automation tools aren’t as flexible, which can impact workflow efficiency.

If your agency wants high control over processes, this might feel restrictive.

Integrations & support

AMS360 integrates with major carriers and supports real-time policy downloads via IVANS, enabling seamless workflows and data exchange with carrier systems.

It also connects to other Vertafore tools, such as ReferenceConnect or InsurLink, and supports a range of third-party tools and software solutions that enhance agency operations.

Support is a mixed bag.

There are lots of help docs, webinars, and training materials.

However, some users report long wait times when contacting support directly, especially during busy periods.

Pricing

Vertafore doesn’t publish pricing, but according to various sources, AMS360 tends to sit in the mid-to-high pricing tier.

Agencies have reported monthly per-user pricing of around $150–$200, although total costs vary depending on the modules and setup needs.

It’s more affordable than Applied Epic for many users, but still a serious investment for smaller agencies.

What users say

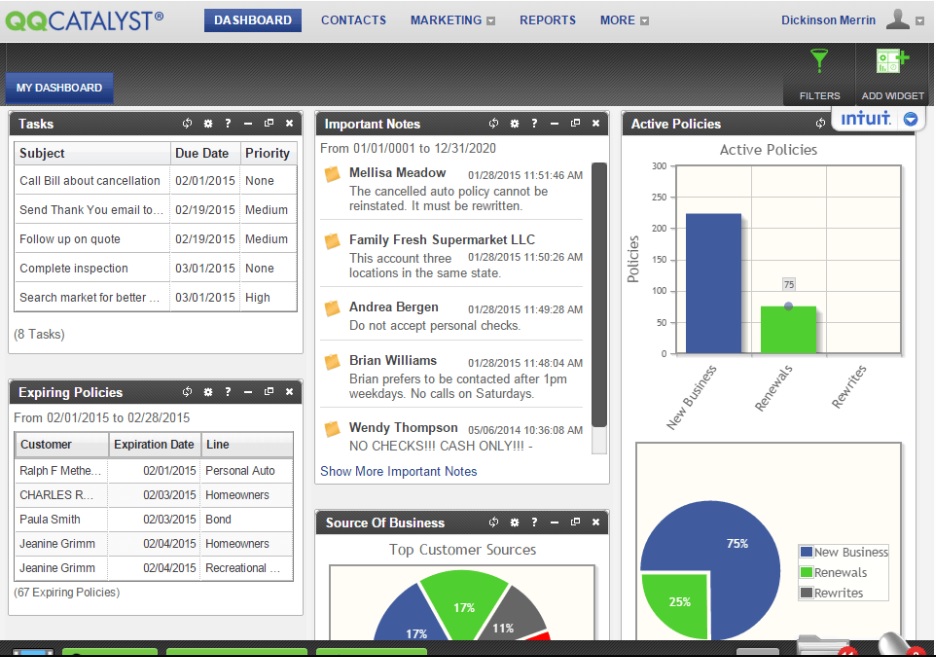

Insurance Agency Management System #3 – QQ Catalyst (by Vertafore)

QQ Catalyst is Vertafore’s cloud-based AMS, designed for smaller and mid-sized agencies as a specialized software solution tailored to the unique needs of insurance agencies.

It focuses on ease of use and affordability, while still offering a solid feature set for day-to-day operations. As an insurance agency software, QQ Catalyst provides insurance software solutions that streamline operations, improve efficiency, and support growth for smaller agencies.

Ease of use

This is where QQ Catalyst stands out most.

It’s clean, modern, and easy to learn, even for teams new to AMS tools.

You don’t need hours of training to get started. For small agencies with limited tech support, that’s a big win.

Features & customization

QQ Catalyst covers the basics – client and policy management, notes, attachments, tasks, and renewals.

It also includes built-in marketing tools, such as email campaigns and lead tracking, which can help agencies identify cross sell opportunities within their existing client base.

That said, it lacks many of the advanced features and automations found in larger systems, such as robust sales automation and streamlined sales processes that optimize new business and renewals.

Customization is limited. You can personalize some screens and reports, but the workflows are fairly fixed.

It’s a great tool for agencies that don’t need a ton of bells and whistles. But if you outgrow it, you may find yourself bumping into limits.

Integrations & support

QQ Catalyst connects with most major carriers through downloads and integrates seamlessly with carrier systems for efficient workflows.

It also offers integrations with eSignature tools, email platforms, and some CRMs, providing software solutions that enhance agency operations.

Support is good overall.

Vertafore offers a clean knowledge base and a responsive help staff. Since it’s a simpler system, users tend to need less support to begin with.

Pricing

Catalyst is priced with small agencies in mind.

Exact pricing isn’t public, but most users say it’s one of the more affordable AMS options out there. It typically costs under $100 per user per month, with minimal setup fees.

For startups or lean agencies, it offers good value.

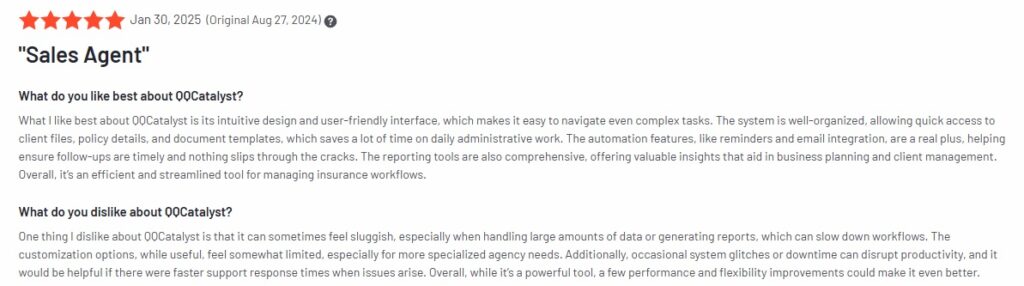

What users say

Insurance Agency Management System #4 – HawkSoft

HawkSoft is a well-known AMS that focuses on ease of use, strong customer service, and a balance of tools for both personal and commercial lines. It is designed for insurance professionals seeking reliable tools to manage their agencies effectively.

It’s built for agencies that want reliability, simplicity, great support, and improved team efficiency and workflow efficiency.

Ease of use

HawkSoft is one of the easiest AMS platforms to learn.

The interface feels familiar, like traditional Windows-based software, which many users actually prefer. Most teams pick it up quickly, and onboarding new staff is simple.

It’s not flashy, but it’s clean, stable, and doesn’t overwhelm new users.

Features & customization

HawkSoft covers everything most agencies need – client and policy management, document storage, e-signatures, quoting, reporting, and task tracking. Its analytics tools and business intelligence features provide actionable insights, helping agencies interpret performance data and make informed, data-driven decisions.

It supports both personal and commercial lines equally well.

Customization is decent. You can build your own templates and workflows to enhance workflow efficiency, but the flexibility doesn’t go as deep as more enterprise-level systems.

Still, for most independent agencies, it gets the job done without much friction.

Integrations & support

HawkSoft integrates with most carriers via download and connects seamlessly with carrier systems, enabling efficient workflows, data exchange, and automation for quoting, policy servicing, and claims processing.

It also works with popular tools and software solutions like e-signature platforms, VoIP systems, and quoting engines that enhance agency operations.

It also partners with InsurLink to provide clients with self-service.

Where HawkSoft really shines is in support.

Users consistently say the support team is fast, helpful, and truly listens. They also have a strong community, with regular updates driven by user feedback.

Pricing

HawkSoft keeps its pricing straightforward.

The typical cost is around $85–$100 per user per month, with optional fees for add-ons and integrations.

There is also a one-time setup fee that varies depending on the agency’s size.

It’s well-priced for what you get, especially for agencies that value service and simplicity.

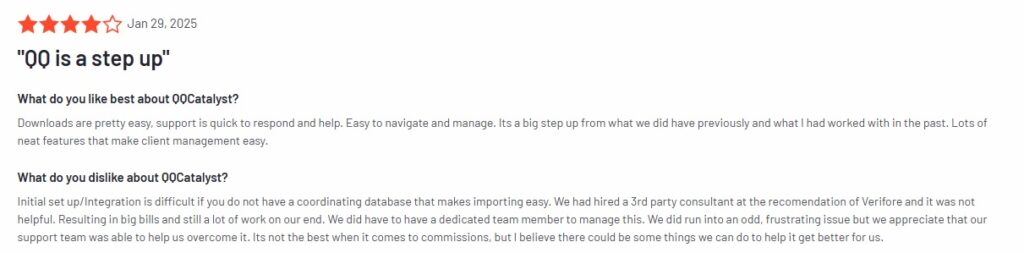

What users say

Insurance Agency Management System #5 – EZLynx

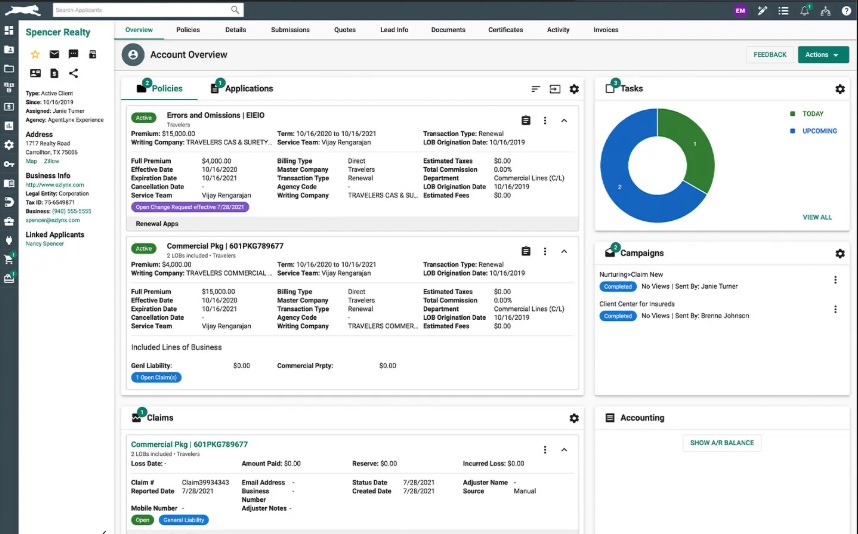

EZLynx management system is an all-in-one insurance agency software platform known for its built-in rater, customer portal for 24/7 access, client engagement features, and marketing automation tools.

It’s designed for agencies that want a system that covers both operations and customer engagement, providing insurance customers with convenient self-service options and improved communication, without having to juggle multiple platforms.

Ease of use

EZLynx is user-friendly once you get used to it.

The interface is clean and modern, but with so many tools, it can feel overwhelming at first.

There’s a learning curve, especially if your team hasn’t used a combined AMS + rater before. Still, after a bit of training, most users navigate it comfortably.

Features & customization

It packs a lot into one system.

You get policy and client management, a powerful comparative rater, email marketing, client texting, task automation, sales automation to streamline new business, and a client portal.

Also, you can customize email campaigns, reporting, and some user views. The platform helps identify cross sell opportunities and optimize sales processes, though workflow automation and deeper customization options are more limited than those of high-end AMS platforms.

It’s ideal for agencies that want a range of tools in one place, supporting revenue generating activities, even if it means giving up some flexibility.

Integrations & Support

EZLynx integrates with most major carriers and their carrier systems for real-time rating and policy downloads.

It also connects with payment solutions, eSignature tools, and client communication platforms, offering software solutions that enhance agency operations.

Support is solid but not perfect.

Most users say support is helpful, but some report slow response times during peak hours or complex issues.

Pricing

EZLynx pricing depends on the bundle and the number of users.

Basic packages tend to be affordable, but costs rise quickly as you add modules like marketing automation, client portal, or eSignature.

Most agencies report starting at around $150 per user per month, with full-featured bundles reaching over $200 per user.

Still, for agencies that would otherwise need multiple platforms, EZLynx can be cost-effective overall.

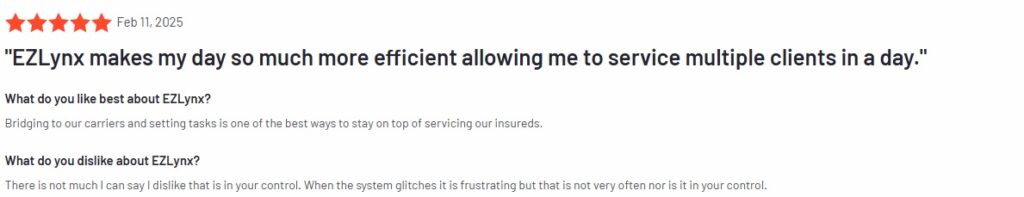

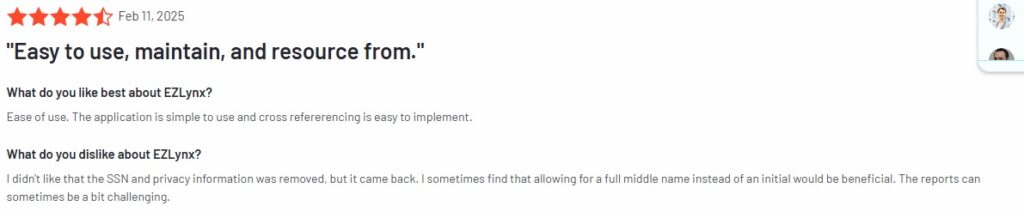

What Users Say

Why AMS Alone Isn’t Enough

All five of these AMS platforms do what they’re supposed to do.

They help your team stay organized, manage policies, track commissions, and work with carriers.

But there’s one big thing they don’t do.

They’re built for your staff, not your clients.

AMS platforms are internal tools. They keep your operations tight, but they fall short in managing customer relationships and customer interactions. They don’t deliver the kind of digital experience your customers expect today.

, a client experience platform, comes in—helping agencies focus on building client relationships and improving client engagement.

How GloveBox fits in

GloveBox isn’t a replacement for your AMS.

It’s the missing piece that makes everything else work better.

We are a Customer Experience Platform (CXP), a branded web and mobile app that gives your clients 24/7 access to their insurance info through a customer portal and self service portals.

They can view ID cards, request changes, pay bills, and check policy documents, all without needing to call or email your team.

Meanwhile, your staff stops answering repetitive questions and starts focusing on what actually drives growth – renewals, cross-sells, client relationships, and improving client engagement.

Real-Life results with GloveBox

Agencies using GloveBox have seen major results:

- CSR productivity increased 3x, going from 500 to over 1,500 households per rep.

- Cross-sell rates jumped 40% just by surfacing the right offers at the right time and identifying cross sell opportunities within the existing client base.

- Clients who use the platform are more likely to stay longer and refer others, thanks to improved client engagement and stronger customer relationships.

If your AMS is your agency’s engine, GloveBox is the experience your clients actually feel. Together, they create the kind of agency people want to work with. And stick with.

How to Choose the Right AMS for Your Agency? [Key Takeaways]

There’s no one-size-fits-all AMS.

What works for a 20-person commercial lines agency may not work for a 2-person personal lines shop.

Here’s how to make the right choice and understand the key benefits of advanced systems:

- Start by knowing your agency size and needs.

- Smaller agencies might need simplicity and a fast setup. Larger teams might need deeper features and more control.

- Look for features and integrations that match how your team actually works.

- Don’t pay for tools you won’t use.

- Make sure it connects to the carriers, platforms, and workflows you rely on.

- Think about ease of use.

- If your team avoids using it, it doesn’t matter how powerful it is.

- And don’t forget about scalability. Will it still work when your book doubles?

- And finally, no matter which AMS you pick, pair it with a customer-facing platform like GloveBox.

Your AMS keeps your back office moving. GloveBox keeps your clients happy.

That’s the winning combo for insurance professionals, independent agents, and insurance customers.

A great AMS helps your team run smoothly.

It keeps your operations tight and your data in one place.

But if you want to go from efficient to unstoppable, you need more. You need a platform built for your clients, not just your staff. The right tools can give your agency a strategic advantage in serving insurance customers and growing your business.

That’s what GloveBox brings to the table.

It’s not about replacing your AMS.

It’s about unlocking its full potential.

Don’t stop at internal tools.

Explore how adding GloveBox to your tech stack can lead to faster growth, happier clients, and stronger margins.