Choosing the right technology for your agency can feel overwhelming. The market is flooded with tools promising to solve every problem, but the fear of making the wrong choice is real. Technology purchases represent a significant investment for insurance agencies. Many agents have been burned by past purchases that overpromised and underdelivered, leading to expensive, unused software and a deep sense of skepticism.

Before making a decision, it’s crucial to have a clear understanding of both the technology and the vendor. This guide will walk you through a practical framework for vetting technology and the companies behind them. You’ll discover real success stories, actionable tips for overcoming common psychological barriers, and insights into what makes technology like GloveBox stand out. We’ll also address the importance of expectations—because tech isn’t a magic pill; it’s how you scale what already works.

The Practical Steps to Vetting Tech Purchases

Before you can overcome the mental hurdles, you need a solid, repeatable process for evaluation. Follow these steps to make decisions with clarity and confidence. These steps help businesses select the right software for their needs, ensuring a solution that supports efficiency and growth.

Step 1: Define Your Needs

Start by identifying the specific problem you need to solve. Are your CSRs overwhelmed with simple service requests? Is your sales follow-up process inconsistent? Are you struggling to provide a modern client experience? Your needs may be specific to managing commercial lines, personal lines, or health insurance policies—such as streamlining quoting, submissions, or compliance for these segments. A reliable Agency Management System is the foundation of any modern agency, providing the tools needed to address these challenges effectively.

Be specific and measurable. For example:

“I need to reduce the number of inbound calls for ID cards and billing questions by 30% this quarter.”

A clear goal will make it much easier to assess whether a tech solution is the right fit for your agency.

Step 2: Research the Market

Explore tech tools and software applications built for independent insurance agencies. Independent agents need insurance tools that are fast, flexible, and easy to use, ensuring they can adapt quickly to changing client needs and market conditions. An effective CRM can transform how your agency manages sales, communication, and renewals, making it a cornerstone of modern agency operations.

-

Read online reviews and industry forums

-

Request demo videos or case studies

-

Compare features and integration options, including compatibility with different platforms

-

Evaluate the vendor’s track record for performance, innovation, and customer support

-

Ask around in agent groups or social communities

Look for direct user feedback, especially from agencies with similar size or specialization.

Step 3: Evaluate the Vendor

The company behind the technology matters.

-

How often do they update their platform?

-

Do they offer integration with insurance carriers?

-

Do they have a reputation for helpful support and ongoing training?

-

Is their onboarding process well-reviewed? Choose a vendor that’s invested in your long-term success, not just a quick sale. Look for vendors that provide valuable insights through advanced reporting and analytics features.

Data security is a priority when expanding your insurance tech stack, especially due to sensitive information. Insurance agencies handle large volumes of sensitive client data and are increasingly targeted by phishing and ransomware. KnowBe4 is widely known for its employee training and phishing simulation programs, which help reduce human error and strengthen an agency’s cybersecurity posture.

Step 4: Test the Product

Never buy software without seeing it in action!

-

Schedule a personalized live demo

-

Ask detailed questions about your agency’s workflows

-

Test automation features and pipeline management capabilities during the demo

-

Try a risk-free trial if possible

Let your team test drive the platform and report back with their honest impressions.

Step 5: Assess Agency Management System Scalability and ROI

Will the solution grow with you?

-

Can it support your agency as you add producers or CSRs?

-

How does it support onboarding new employees and reduce the learning curve for new hires?

-

Does it replace multiple existing tools by consolidating them into one system (saving money and confusion)?

ROI Tip: Map out potential time savings (e.g., 40% fewer service calls) and estimate the dollar value based on staff salaries or opportunity cost. Effective tech should pay for itself many times over.

Investing in scalable technology is essential for future success, ensuring your agency can adapt and thrive as it grows.

Leveraging Analytics Tools for Informed Decisions

In today’s competitive insurance industry, leveraging analytics tools is essential for insurance agents and insurance agencies aiming for sustainable business growth. Analytics tools empower insurance professionals to track client interactions, monitor policy management, and streamline claims processing, all while providing valuable insights into customer behavior and business performance. Robust reporting capabilities in insurance management systems further enhance this by helping analyze data and track key metrics, enabling agencies to make informed decisions and optimize their operations.

By harnessing the power of analytics, insurance agencies can identify emerging market trends and industry trends, allowing them to adapt quickly and maintain a competitive advantage. These tools help insurance agents pinpoint areas for improvement, optimize their operations, and make data-driven decisions that enhance customer satisfaction and strengthen client relationships.

For example, analytics tools can reveal which services clients use most, highlight bottlenecks in claims processing, and track the effectiveness of client acquisition strategies. With this information, insurance companies can tailor their offerings, improve policy management, and deliver a more personalized client experience. Ultimately, integrating analytics tools into your agency’s workflow not only supports business growth but also ensures you’re always one step ahead in meeting your clients’ evolving needs.

The Importance of Document Management in Insurance

Efficient document management is a cornerstone of operational success for insurance agencies and insurance companies. A robust document management system enables insurance professionals to securely store, organize, and retrieve policy documents, claims records, and client information with ease. This not only reduces the risk of errors and lost paperwork but also ensures compliance with industry regulations and data security standards.

By implementing advanced document management systems, insurance agencies can streamline processes, minimize manual handling, and improve overall operational efficiency. These systems make it simple to access critical information when needed, supporting faster decision-making and enhancing client relationships through timely, accurate service.

Moreover, document management solutions can be seamlessly integrated with other software solutions, such as agency management systems, creating a unified workflow that saves valuable time and reduces administrative overhead. For insurance professionals, this means more time spent on high-value activities and less on repetitive tasks, ultimately driving better outcomes for both the agency and its clients. A good insurance management system also enhances data security measures, ensuring protection from cyber threats and unauthorized access.

The Role of Tech in Enhancing Client Experience

Technology is transforming the way insurance agents and insurance agencies interact with clients, making it easier than ever to deliver exceptional client experiences. By adopting digital tools like CRM software, agencies can efficiently track client interactions, personalize communications, and respond quickly to client needs—all of which are crucial for building strong client relationships and driving business growth. CRM systems help organize leads, track opportunities, and automate follow-ups, ensuring no potential client or renewal is overlooked.

Advanced technology enables insurance companies to offer user-friendly online portals, mobile apps, and self-service platforms, giving clients convenient access to policy information, payment options, and claims submission. This level of accessibility not only boosts customer engagement but also increases client satisfaction by putting control in the hands of the client.

Additionally, automating repetitive tasks and reducing manual data entry allows insurance professionals to focus on what matters most: building client relationships and identifying new business opportunities. By leveraging the right digital tools, insurance agencies can streamline their operations, enhance the overall client experience, and position themselves for long-term success in the insurance industry.

Overcoming the Psychological Barriers to Adoption

Vetting the tech is only half the battle. The toughest hurdles are often mental and emotional—especially for agency owners who’ve been burned before. Every insurance agent faces these challenges, and having the right tools is essential to overcome them.

Barrier #1: “I’ve been burned by tech before.”

What happens: Previous investments went unused, cost more than anticipated, or didn’t solve the problem promised. For example, an insurance company that invested in the wrong technology ended up with tools that didn’t integrate with their workflow, leading to wasted resources and frustration.

Actionable tip:

-

Review what went wrong in past purchases—was it lack of team buy-in, poor fit, or bad vendor support?

-

Make a checklist of lessons learned and use it during your current evaluation.

-

Seek out platforms offering robust training and a clear, no-surprise contract.

Barrier #2: “I’m not good with technology and don’t have time to learn a new system.”

What happens: Fear of steep learning curves leads to indecision or delays, especially if the agency relies on non-technical staff. A health insurance agent, in particular, may feel overwhelmed by new technology and unsure how it fits into their daily workflow.

Actionable tip:

-

Prioritize platforms designed for insurance, not generic business tools.

-

Ask vendors for walkthroughs, onboarding guides, and hands-on support resources.

-

Appoint a tech champion on your team who can go deep and guide everyone else.

Barrier #3: “My team will resist change.”

What happens: Staff pushback leads to low adoption and tech that gathers dust.

Actionable tip:

-

Involve the team early in the selection process to build buy-in. Independent agencies, in particular, can benefit from this approach to address unique challenges and ensure smoother adoption.

-

Start with a pilot group and expand as wins stack up.

-

Emphasize how modern tech reduces repetitive work and lets them focus on what matters.

Barrier #4: “What if this doesn’t really solve our problem?”

What happens: Analysis paralysis. You’re stuck evaluating possibilities but never commit. Concerns about changing regulations can add to the uncertainty, making it even harder to make a decision.

Actionable tip:

-

Set clear success metrics during your trial. For example: “If this reduces CSRs’ workload by 20% in 30 days, we proceed.”

-

Ask the vendor for existing client references willing to share their results.

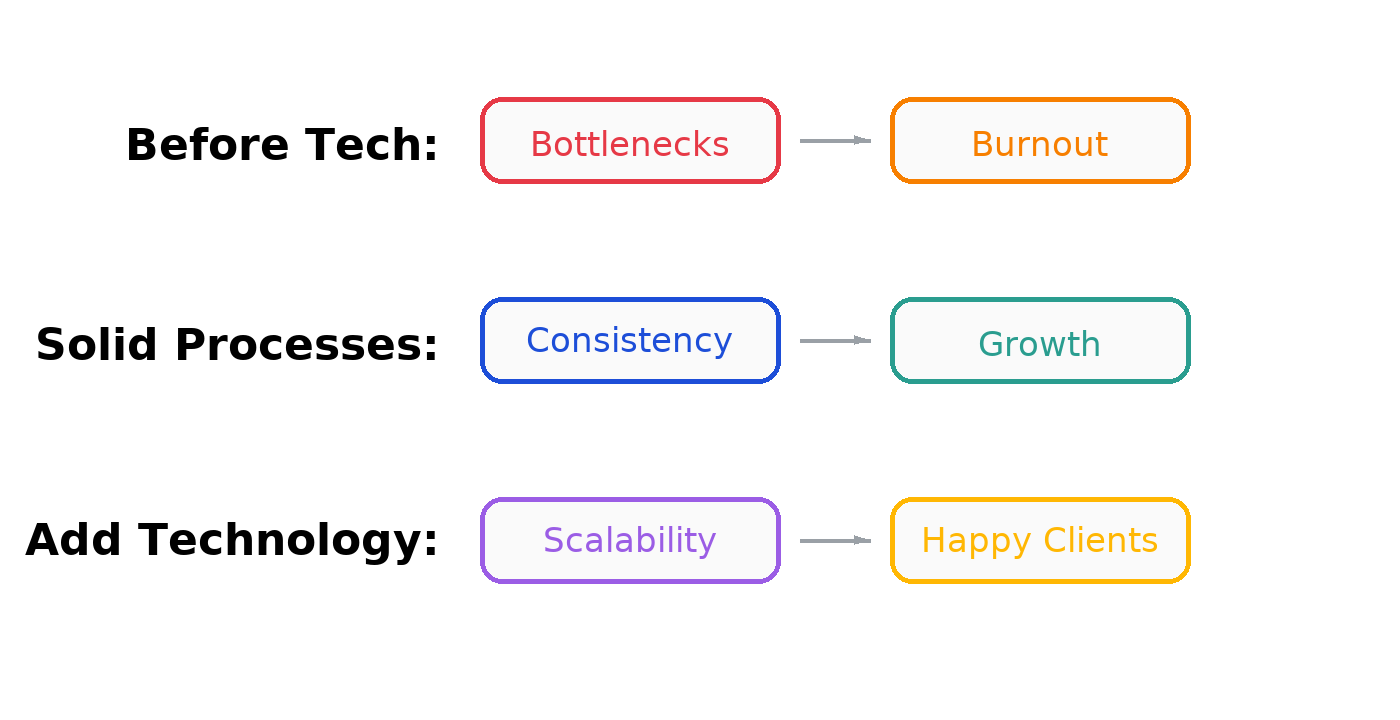

Technology Won’t Fix a Broken Process or Improve Operational Efficiency Alone

Technology is an amplifier, not a replacement for a solid process. If your agency operates with ad hoc workflows, unclear documentation, or little follow-through, a new solution alone won’t save the day.

Start here:

-

Map out your client lifecycle (onboarding, renewals, service requests)

-

Identify where bottlenecks and double work occur

-

Document what “good” looks like

-

Share these playbooks with your team

-

Review your policy administration processes to ensure they are streamlined and effective

Pro Tip: Use technology to automate and scale what already works, not to put duct tape on poor processes. Even advanced technologies like artificial intelligence can’t compensate for poor foundational processes. Implementation effort and clear expectations for every team member make all the difference. The right order: process first, then tech.

Continuously Evaluating and Improving Tech Solutions

In the fast-evolving insurance industry, continuously evaluating and improving your tech stack is vital for staying competitive and achieving your business goals. Insurance agencies and insurance companies should regularly review their software solutions to ensure they align with current business needs, support operational efficiency, and contribute to business growth.

Staying informed about industry trends and advancements in technology allows insurance professionals to adopt the latest tools and platforms, giving their agency a strategic edge. Investing in extensive training ensures your team has the technical expertise required to maximize the benefits of new software solutions, leading to rapid growth and a stronger reputation in the market.

When assessing new tech solutions, consider factors such as total cost, scalability, and integration capabilities to ensure they fit seamlessly into your existing operations. By fostering a culture of continuous improvement and regularly updating your tech stack, your agency can enhance client experience, streamline processes, and achieve lasting success in the insurance business.

Real-World Success Stories

Erb & Young: Tripling Capacity Without Adding Headcount

Erb & Young, a Florida-based independent agency, had a strong pipeline but found their CSRs maxed out at about 400 households each. After implementing GloveBox, each CSR managed 1,400+ households—a 3x productivity leap. By automating routine service, they kept clients happy, gave staff time for relationship-building, and grew revenue without hiring sprees.

How GloveBox Solves the Problem and Eases the Fear

For agencies struggling with service capacity, inconsistent client experience, or outgrown workflows, GloveBox addresses these challenges with a proven approach. By leveraging automation features and centralized information, GloveBox significantly enhances the customer experience, making communication smoother and building stronger client relationships.

Feature Highlights

|

GloveBox Feature |

What It Means for Your Agency |

Client Impact |

|---|---|---|

|

Self-Service Portal |

Clients access docs, ID cards, payments |

Fewer phone calls, more control |

|

Automation |

Advanced automation features handle Tier-1 tasks instantly |

Faster responses, no waiting |

|

White-Label Brand |

Your logo, color, and message |

Builds trust and agency loyalty |

|

Easy Integration |

Connects to major AMS & tools |

No data silos |

|

Built-In Referrals |

“Refer My Agent” button & more |

Grow word-of-mouth, hassle-free |

|

Real-Time Insights |

Dashboards on usage and requests |

Spot service gaps & improve |

|

Dedicated Support |

Hands-on training, FAQs, real people |

Less frustration, faster setup |

Why GloveBox Works:

-

Intuitive for everyone: No IT department required

-

Fast onboarding: Agencies often go live in days, not months

-

Documented ROI: See reduced call volume and happier teams

-

Scalable: Suitable for 3-person teams or 30-person operations

-

Boosts revenue: More cross-sells, higher retention, more referrals

FAQ: Vetting Tech Purchases for Insurance Agents

Q: How long does it take to implement new technology like GloveBox?

A: Most agencies complete onboarding and go live within 30 days. GloveBox provides thorough training and support, so your team feels confident from day one.

Q: What questions should I ask during a demo?:

-

Can the tool integrate with our AMS and CRM?

-

How do we get support if we run into issues?

-

Are there hidden fees or long-term contracts?

-

What training resources are provided?

-

Can I talk to an existing client?

Q: How do I calculate ROI on a tech investment?

A: List out potential time and cost savings (e.g., if each CSR handles 50% more clients, what is that worth in salary or overhead?). Include potential revenue growth from better retention or cross-sells.

Q: What if my agency is small? Is investing in client-facing tech worth it?

A: Absolutely. Small agencies benefit the most from efficiency tools that free up valuable staff time. GloveBox is priced and designed for agencies at every stage of growth. Health insurance agents in particular can leverage these solutions to streamline workflow, improve compliance, and enhance client relationship management.

Q: How do I get buy-in from my team?

A: Involve your staff early, set clear goals for adoption, and celebrate early wins. Document how the technology helps them (not just the agency’s bottom line).

Make Your Next Tech Decision with Confidence

Choosing new technology doesn’t have to be a gamble. By following a structured vetting process, addressing your internal fears, and setting realistic expectations, you can make an informed decision that sets your agency up for growth and success. Stop letting past experiences hold your agency back.

GloveBox helps agencies scale by solving the service bottleneck, modernizing the client experience, and delivering measurable ROI. It’s a tool designed to empower your team, not replace them.

Ready to see how a Client Experience Platform can transform your agency’s capacity?

Schedule a demo of GloveBox today and see how you can scale smarter.