Every insurance agency talks about growth. New clients, more policies, bigger revenue. However, the truth is that growth doesn’t come from chasing the next sale, but from how well your operations run behind the scenes.

Agencies that operate with discipline, structure, and efficiency consistently outperform those that rely on hustle alone. They retain more clients, get more referrals, and scale without constantly adding headcount. On the flip side, agencies that lack operational infrastructure hit bottlenecks fast: burned-out CSRs, missed renewals, frustrated clients, and declining margins.

That’s where an operations checklist comes in. It forces you to step back and ask the hard questions:

- Are your processes documented, or do they live in tribal knowledge?

- Are your CSRs spending their days on Tier 1 busywork, or driving real client value?

- Are your tools helping your team work smarter, or are they just another login screen?

This article is your benchmark. A clear, practical checklist designed to help you evaluate whether your agency is built for sustainable growth or quietly leaking time, money, and client trust.

By the end, you’ll know exactly where you stand, which gaps to fix first, and how to create the operational backbone that top-performing agencies rely on.

TL;DR

Operational efficiency is the foundation of agency growth and valuation. In this article, we covered:

- Why documenting processes, automation, and self-service are non-negotiable in 2025

- The top pain points slowing agencies down—manual tasks, tribal knowledge, tech fatigue

- How training, capacity tracking, and tool consolidation build scalable teams

- A scoring model (red, yellow, green) to assess where your agency stands today

- Why efficiency translates directly into EBITDA, retention, and acquisition multiples

The takeaway: stop running on duct tape. Start building on systems.

Book a call with GloveBox to see how your agency scores and how to move into the green zone.

Process Discipline – Do You Have SOPs in Place?

At the core of every efficient insurance agency is one thing: documented, repeatable processes. Without them, you’re building your operation on shifting sand.

Too many agencies still rely on tribal knowledge: “the way Susan does it” or “how Mark handled it last time.” This works when you’re small and everyone sits in the same office. But as soon as your team grows or turnover hits, the cracks show. New hires struggle to keep up, mistakes multiply, and clients notice the inconsistency.

Our survey revealed that 19 respondents identified workflow inconsistencies and tribal knowledge as the top operational challenge. That’s nearly one in five agencies openly admitting they don’t have a reliable playbook. And the real number is likely higher, because many agencies assume their processes are “good enough” when, in reality, they’re just undocumented habits.

The difference between agencies with strong SOPs and those without shows up directly in their numbers:

- Retention rates climb when every client gets the same high-quality experience, from onboarding to renewal.

- Training time drops dramatically when new staff can follow a documented playbook instead of shadowing for months.

- Valuation multiples rise when buyers see a system that runs independent of individual employees.

The question every agency owner should ask: If your top CSR walked out tomorrow, would the process for renewals, claims handling, or quoting fall apart, or would it continue to run smoothly?

Process discipline isn’t about bureaucracy. It’s about creating a foundation that ensures your agency runs consistently, no matter who’s in the seat. The best agencies treat SOPs like infrastructure, just as critical as their AMS or CRM.

Workflow Automation – Are You Reducing Tier 1 Work

Every insurance agency has the same silent killer: Tier 1 requests. These are the repetitive, low-value service tasks that consume hours of your team’s day, including issuing ID cards, updating addresses, resending documents, and answering billing questions.

Our survey confirmed what many already know: 30–40% of a CSR’s daily workload is spent on clerical Tier 1 tasks. That means a third of your payroll is dedicated to work that could be automated or handled through client self-service.

When Tier 1 dominates, two things happen:

- Burnout rises. Service teams feel like task machines, not client advisors. Turnover follows, which compounds training costs and disrupts client relationships.

- Growth stalls. Producers and CSRs can’t spend enough time on quoting, renewals, or retention campaigns because they’re buried in requests that technology should be handling.

The fix isn’t just “hire more people.” That’s the default solution most agencies reach for, but it only compounds the problem. You add payroll, but the root inefficiency stays. The smarter path is workflow automation and self-service enablement.

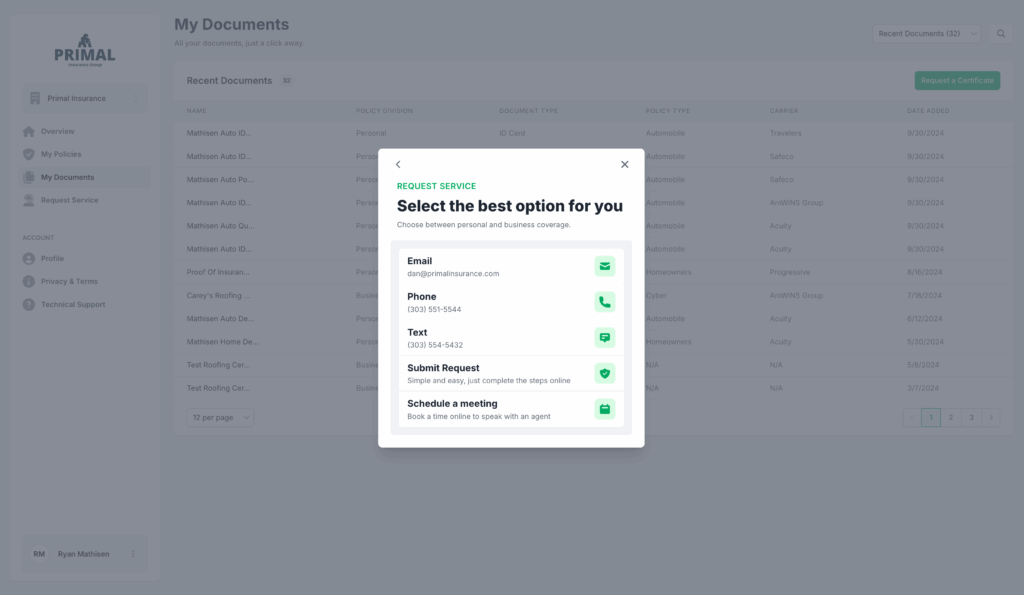

Agencies with a client experience platform like GloveBox eliminate up to 50% of Tier 1 work in the first year. Clients don’t have to call for ID cards – they download them. They don’t wait on hold for billing info, but view it instantly. And when changes do require an agent, they’re routed directly to the writing agent, not bounced around through a carrier call tree.

Automation doesn’t remove the human element – it protects it. By clearing Tier 1 noise, CSRs and producers get to focus on meaningful conversations, cross-sells, and retention campaigns. That’s where trust is built, and where revenue grows.

The question isn’t whether you have workflow automation. It’s whether you’re still wasting staff time on things a portal should do in seconds.

Self-Service Enablement – Are You Letting Clients Help Themselves?

One of the most striking findings from our survey was the significant underutilization of self-service across the industry. More than half of agencies (53.9%) admit they have a portal, but usage is low. In other words, the technology exists, but clients aren’t using it, and that means CSRs are still answering the same questions by phone or email.

The problem isn’t client willingness. Policyholders in 2025 expect digital convenience. They already bank, shop, and manage healthcare online. The gap lies in execution. Many agency portals require policy numbers, registration codes, or outdated login credentials that clients often forget. When access is clunky, adoption plummets.

The cost of low self-service adoption is twofold:

- For clients, it’s frustration. They can’t access documents when needed, can’t quickly download proof of insurance, and can’t resolve small issues without calling.

- For agencies, it’s wasted capacity. Every ID card request received by phone instead of through the portal results in 10–15 minutes of staff time being lost. Multiply that by hundreds of requests per year, and the inefficiency compounds fast.

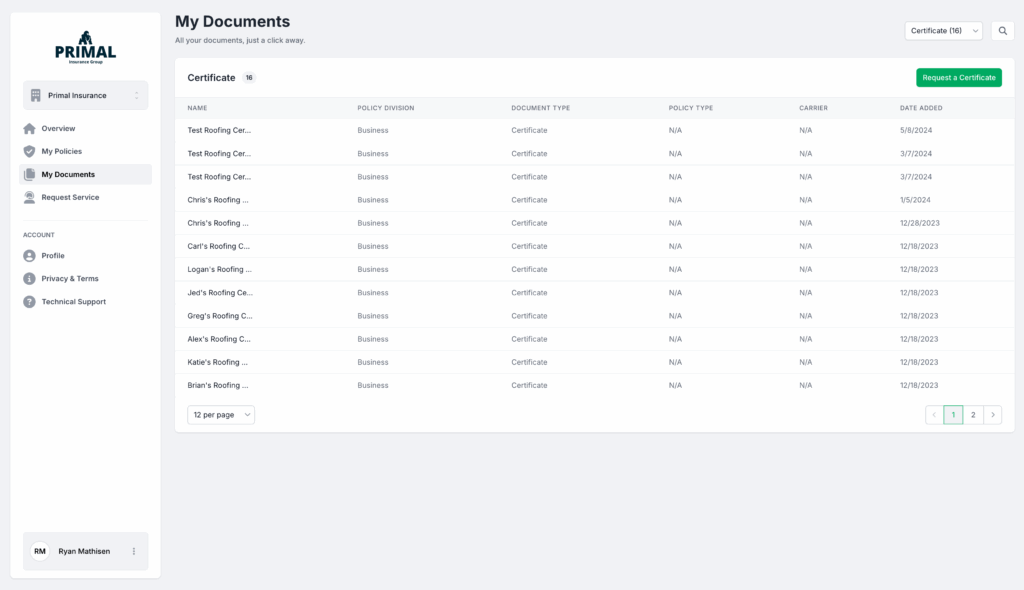

Agencies that get self-service right report a different story. With a platform like GloveBox, clients log in using only an email or phone number with one-time authentication. Adoption skyrockets because the barrier to entry is gone. In fact, agencies using GloveBox see 8–10x higher adoption in year one compared to carrier-provided portals.

And when adoption rises, efficiency follows. In one case, an agency saved nearly 100 CSR hours in a single year just by shifting document downloads and premium payments into GloveBox. That’s the time they reallocated to cross-sells and retention campaigns.

The reality is simple: if clients can’t self-service, they will call you. And if they call you for everything, you’ll never escape the cycle of reactive service.

Team Training & Capacity – Are You Setting Staff Up for Scalability?

Even the best tools and processes fall apart if your team can’t use them effectively. One of the most consistent themes in our survey was the difficulty agencies face in training new hires. Tribal knowledge still prevails, where workflows reside in the heads of senior CSRs rather than in documented SOPs. This makes onboarding slow, inconsistent, and risky if key people leave.

Capacity tracking is another blind spot. Agencies often don’t know how many policies each CSR can reasonably handle before burnout sets in. Our data shows a wide spread: some CSRs manage fewer than 400 households, while top-performing agencies report staff managing over 1,500 households each, without sacrificing service quality. The difference isn’t that one CSR works four times harder. It’s that their agency has invested in self-service, automation, and clear workflows that multiply capacity.

The result of neglecting training and capacity management is predictable: turnover. Burned-out staff leave, and agencies fall into the costly cycle of recruiting, rehiring, and retraining. High churn among CSRs also disrupts client relationships, making retention harder.

The agencies that scale sustainably treat training and capacity as ongoing disciplines, not afterthoughts. They document every process so a new CSR can be productive within weeks, not months. They track workload ratios and adjust proactively before burnout takes hold. And most importantly, they equip their staff with the right tools, automation, CX platforms, and integrated workflows, so that the majority of Tier 1 tasks never reach their desks in the first place.

If you want to retain staff, build loyalty, and scale without constantly adding headcount, your training and capacity plan is just as important as your tech stack.

Tech Consolidation – Is Your Stack Working Together or Against You?

The average agency today operates on a patchwork of tools: an AMS for data, a CRM for pipeline management, a quoting tool for rate calculations, an email platform for campaigns, and possibly a client portal. Each of these systems is valuable on its own, but when they don’t connect, they create more work instead of less. Our survey highlighted this pain clearly: 24 agencies cited lack of integration as one of their biggest daily bottlenecks.

When staff spend hours copying data between systems or troubleshooting login issues across platforms, efficiency disappears. Worse, the client feels it. A policyholder doesn’t care if their billing info lives in one system and their documents in another. They just want one place to get answers fast. Agencies that fail to consolidate their stack often find themselves hiring extra CSRs to patch the gaps rather than solving the root problem with integration.

The winning agencies have flipped this script. They start with the AMS as the backbone and build around it deliberately: CRM for sales, CXP (like GloveBox) for client-facing needs, and carefully chosen automation tools to fill the gaps. By consolidating logins, automating data syncs, and removing redundant software, they reduce not only licensing costs but also mental fatigue across the team.

This isn’t about buying every shiny new platform. It’s about choosing fewer tools that do more together. Agencies that master consolidation see adoption rates climb, training times decrease, and service requests handled more efficiently. The tech stack becomes an enabler of growth, not an obstacle to it.

The question for your agency isn’t how many tools you own. It’s whether your stack actually works as one coherent system or whether it’s quietly draining efficiency, dollars, and client satisfaction every single day.

Scoring Your Agency

An operations checklist is only useful if it drives action. That’s why the final step is to score your agency honestly across the five categories we’ve covered: documentation, workflow automation, self-service, training, and tech consolidation.

The model is simple but telling:

- 0–1 checks per category = Red Zone. Your agency is running on duct tape and tribal knowledge. Growth will be unpredictable, and valuation will take a direct hit. Investors and acquirers don’t reward chaos. They discount it heavily.

- 2–3 checks per category = Yellow Zone. You’ve made progress, but gaps remain. Some processes are documented, and some tools are working, but inefficiencies still appear in service load and staff turnover. You’re not at risk of collapse, but you are vulnerable to competitors who run tighter ships.

- 4+ checks per category = Green Zone. You’ve built a foundation for scalable growth. Service teams spend more time on clients and less time on clerical tasks. Producers write more business instead of chasing paperwork. Valuation multiples trend higher because buyers see a business that doesn’t rely on heroics. It runs on systems.

Why does this matter? Because efficiency is no longer just about saving time. It directly drives EBITDA, valuation, and growth potential. Agencies in the green zone retain more clients, spend less on overhead, and attract stronger acquisition offers. Those stuck in the red zone, on the other hand, end up with higher payroll, weaker margins, and books of business that erode faster than they grow.

The checklist isn’t just a scorecard. It’s a roadmap. Where you land today tells you how far you have to go to build an agency that doesn’t just survive but scales, competes, and grows its value year after year.

Turn Your Checklist Into Action

Running an insurance agency in 2025 isn’t just about building an operational engine that can sustain growth, reduce costs, and keep clients loyal. The agencies that will win aren’t necessarily the ones with the biggest books today, but the ones with the cleanest processes, the most scalable infrastructure, and the client experience layer that keeps both policyholders and agents engaged.

The checklist you’ve just worked through serves as the baseline for how investors, buyers, and competitors will evaluate you. Whether you’re in the red, yellow, or green zone, the good news is this: every inefficiency you eliminate translates directly into higher margins and stronger valuation.

GloveBox provides agencies with the immediate self-service infrastructure to transition from firefighting to scaling. By eliminating Tier 1 work, empowering policyholders, and routing opportunities back to agents, it turns your checklist from a scorecard into a growth engine.

The gap between optimized and outdated agencies is widening. Where you land in that gap is up to you.

Schedule your GloveBox demo.