For many carriers, the decision to build an in-house client portal feels like the obvious path. On paper, it promises complete control over the roadmap, the ability to tailor every feature to internal workflows, and a solution that fits “exactly” what the organization thinks policyholders want. Add to that a belief that internal development will be cheaper than paying a vendor, and the choice can feel like a strategic win before any code is even written.

But the reality is rarely so clean. Building a portal from scratch is a development project and a long-term operational commitment with a price tag that keeps growing well beyond the initial launch. What starts as a “one-time” build quickly turns into an ongoing cycle of bug fixes, security patches, API updates, and mobile app maintenance. Internal tech teams get tied up for months or even years, sidelining other critical initiatives. And the end product, even when technically functional, often struggles with adoption because the UX, onboarding, and self-service capabilities fall short of policyholder and agent expectations.

The result? A tool that costs more to maintain than it ever returns in value, creates friction in the client experience, and erodes agent loyalty. This is why carriers who take the in-house route often find themselves years later facing the same question they started with, only now with sunk costs and a damaged adoption record.

In the following sections, we’ll unpack the hidden costs, technical pitfalls, and strategic opportunity costs of building in-house, then show why proven, purpose-built Client Experience Platforms (CXPs) like GloveBox consistently deliver stronger ROI, faster adoption, and lower total cost of ownership.

TL;DR

Carriers often believe that building their own portal will save money and provide a better fit. In reality, it drains time, budget, and resources, while producing a tool that underperforms and is outdated within years.

In this article, you’ll learn:

- Why common assumptions about in-house builds (“we know our systems best,” “security’s easier internally”) rarely hold up

- The hidden costs beyond developer salaries—security, integrations, infrastructure, and ongoing maintenance

- How technical complexity with PAS integrations, mobile apps, and data consistency kills timelines and budgets

- Why adoption rates make or break ROI, and how GloveBox achieves 8–10x higher usage in year one

- The $2M mistake broken into churn, bloated service teams, and tech staffing costs

- How GloveBox’s build-once, deploy-anywhere model delivers faster ROI without burdening your tech team

The market’s moving fast. You don’t need to spend years building a portal—you need one that works from day one.

Schedule a GloveBox demo.

Why Carriers Default to In-House

When carriers decide to build their own portal, it’s rarely a reckless move. The choice is usually rooted in four core assumptions.

1. “We know our systems best.”

There’s truth here – carriers understand their policy admin systems, billing processes, and claims workflows better than anyone. But knowing the insurance side doesn’t mean having the technical depth to architect, code, and maintain a complex, multi-integration platform. APIs, authentication protocols, mobile architecture, and UX design are entirely different disciplines, and they’re not part of most carrier IT teams’ core skill set.

2. “We’ll control the roadmap.”

On paper, in-house control means total flexibility. You decide what gets built, when, and how. In practice, competing priorities gut this control. Your tech team still has to handle other internal projects, respond to outages, and support ongoing operations. Portal development is often prioritized alongside other tasks, which means delays are inevitable. Worse, once the portal launches, new features or bug fixes must compete for limited resources, turning your “flexible” roadmap into a constant backlog.

3. “A vendor can’t match our vision.”

The concern is that an outside platform may be rigid, forcing carriers to compromise on functionality or branding. But most modern Client Experience Platforms (CXPs) like GloveBox are designed for deep customization. They’ve already solved the most complex technical problems – secure integrations, mobile-first design, and scalable infrastructure – while allowing carriers to tailor the experience to their exact needs. This isn’t about replacing your vision; it’s about delivering it without reinventing the wheel.

4. “Security will be easier to manage internally.”

The logic is straightforward: if data stays in-house, it’s safer. The reality is more complex. Security is about the strength and consistency of protocols, testing, and monitoring. Achieving full SOC 2 compliance, running regular penetration tests, and maintaining bulletproof firewalls requires specialized expertise and continuous investment. Dedicated CX vendors build security into their entire operation, often exceeding what internal teams can sustain over the long term.

The reality gap

Carriers are insurance experts, not tech companies. They excel at underwriting, policy servicing, and claims, high-stakes, regulated work that demands deep industry knowledge. Building and maintaining a modern digital experience is an entirely different challenge. Without dedicated CX engineers, UI/UX designers, and mobile developers, the result is often a portal that works on paper but underperforms in the real world, slow to update, clunky to use, and costly to maintain.

And that’s before factoring in the opportunity cost: every month your tech team spends building or fixing a portal is a month they’re not advancing strategic projects that could grow revenue or improve competitiveness.

The Hidden Costs You Don’t Budget For

When carriers run the math on building a portal in-house, the calculation usually starts and stops with developer salaries. That’s only the surface. The real cost structure runs much deeper and often stays invisible until the project is already in motion.

Security compliance is one of the biggest budget shocks. Achieving and maintaining SOC 2 certification, running regular penetration tests, and hardening firewalls isn’t a one-time expense. It’s an ongoing process that requires specialized security expertise, dedicated monitoring, and consistent updates to meet evolving regulations. Every one of those tasks carries its own cost in both dollars and labor hours.

Then come integrations. A modern portal has to sync seamlessly with billing providers like Stripe, claims management platforms, and any other tools that touch the customer experience. Each integration is its own project, often requiring custom development and careful testing to avoid breaking downstream processes. These are multi-week or multi-month builds with real price tags attached.

Infrastructure is another overlooked line item. Hosting a secure, reliable portal requires more than a server. You need scalable cloud environments, redundancy planning, performance monitoring, and the necessary infrastructure to keep mobile apps live and compliant with both iOS and Android app store requirements. Missing an update or failing to meet new platform guidelines can lead to your app being pulled from the store, something that instantly erodes customer trust.

Even after launch, expenses continue. Bug fixes, version updates, and security patches are a constant reality. APIs change, carrier systems evolve, and your portal must keep pace. If a single integration breaks, whether due to a policy admin system upgrade or a vendor API update, your team has to drop everything to fix it. That reactive cycle consumes time, burns out developers, and pushes other projects further down the queue.

The biggest hidden cost isn’t on the balance sheet. It’s opportunity cost. Assigning your internal tech team to a portal build locks them into a year-long grind of coding, testing, and compliance reviews. During that time, other strategic initiatives – new distribution models, analytics capabilities, automation projects – get delayed or canceled altogether. In a competitive market, that delay is its own kind of expense, one that’s paid in lost growth, slower innovation, and reduced market share.

Why Technical Complexity Kills Timelines and Budgets

On paper, connecting a homegrown portal to your policy admin system sounds straightforward. In practice, it’s one of the biggest reasons in-house builds miss deadlines and blow through budgets. Integrations with platforms like Majesco, Duck Creek, or Guidewire are rarely as simple as tapping into an API. Each system has its own quirks, data structures, and security layers, and without deep, specialized knowledge of how information flows through them, carriers often end up with broken or incomplete connections.

Even when the connection is made, missing or misunderstood data flows are common. A field that looks trivial, like a named insured or coverage limit, might be stored in a way that’s different from what your team expects. The result is a portal that displays partial or incorrect policy information. Without a full understanding of how the PAS organizes, validates, and sends data, the user experience becomes inconsistent, and trust erodes fast.

The integration challenge gets bigger when you realize the PAS is just one piece of the puzzle. A truly functional portal also needs to connect to billing providers, claims systems, and other operational tools. If those connections aren’t built, or if they don’t work in real time, policyholders log in and find they can’t pay a bill, file a claim, or see their full account history. An incomplete portal isn’t just a disappointment; it’s an adoption killer.

Security and compliance add another layer of complexity that’s easy to underestimate. Regulations vary by state, and the standards for storing and transmitting client data are non-negotiable. A single missed requirement, such as encryption protocols or secure audit trails, can result in fines, reputational damage, and, in some cases, mandatory takedowns until the issue is resolved. These hurdles aren’t just technical; they’re legal, and they take specialized knowledge to navigate correctly.

Then there’s mobile. Carriers often view the app as an afterthought, adding it to the portal late in the build. That shortcut is why so many homegrown apps crash mid-task, leak passwords, or sit in app stores for years without updates. A stale app quickly becomes a liability, both in terms of user trust and compliance with evolving iOS and Android requirements.

Finally, all of this hinges on data consistency. If your integrations aren’t syncing cleanly across systems, you end up serving incorrect policy details, outdated billing statuses, or missing claim updates. Every error drives the policyholder back to the phone or email, increasing service volume and erasing whatever efficiency gains the portal was supposed to deliver.

Adoption & Usage: The Silent ROI Killer

A portal can look polished and technically sound yet still fail to gain traction. For most homegrown builds, the adoption problem starts at the very first touchpoint: registration. Carriers often require policyholders to enter a policy number, a registration code, and other details they rarely have at hand. That friction means fewer people complete the sign-up process. Even those who do typically log in only a few times a year, making it easy to forget usernames or passwords, can send them right back to the call center for help.

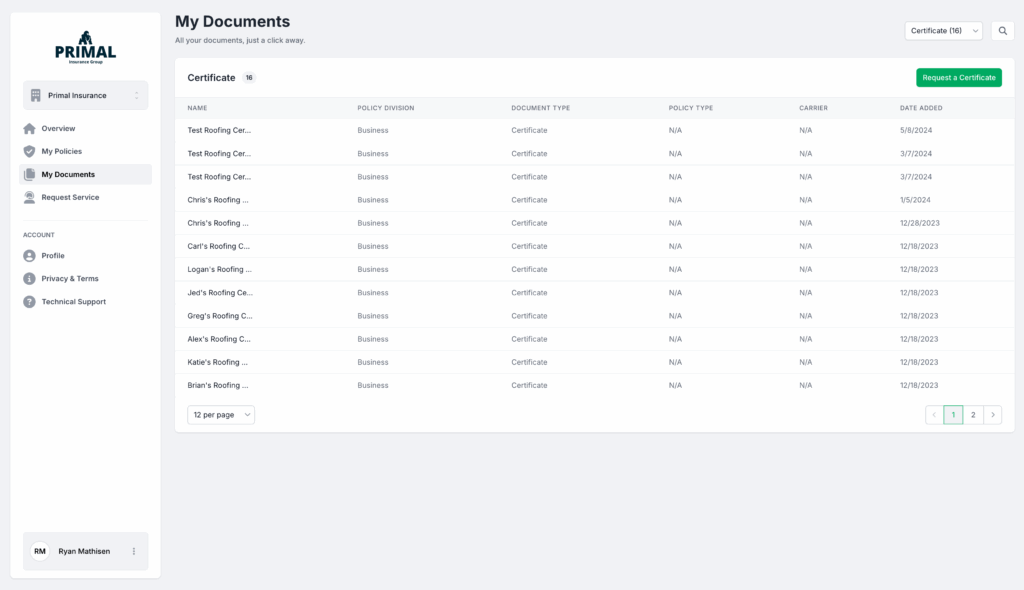

Once inside, the experience often fails to deliver. Limited or broken self-service options, such as incomplete claims forms, disconnected payment links, or missing document access, quickly teach users that the portal isn’t worth their time. In many cases, the portal becomes a static information hub rather than a true service channel, and policyholders default to calling or emailing instead. This cycle quietly drains ROI, because every unused login represents a lost opportunity to reduce service load and improve retention.

The GloveBox adoption advantage

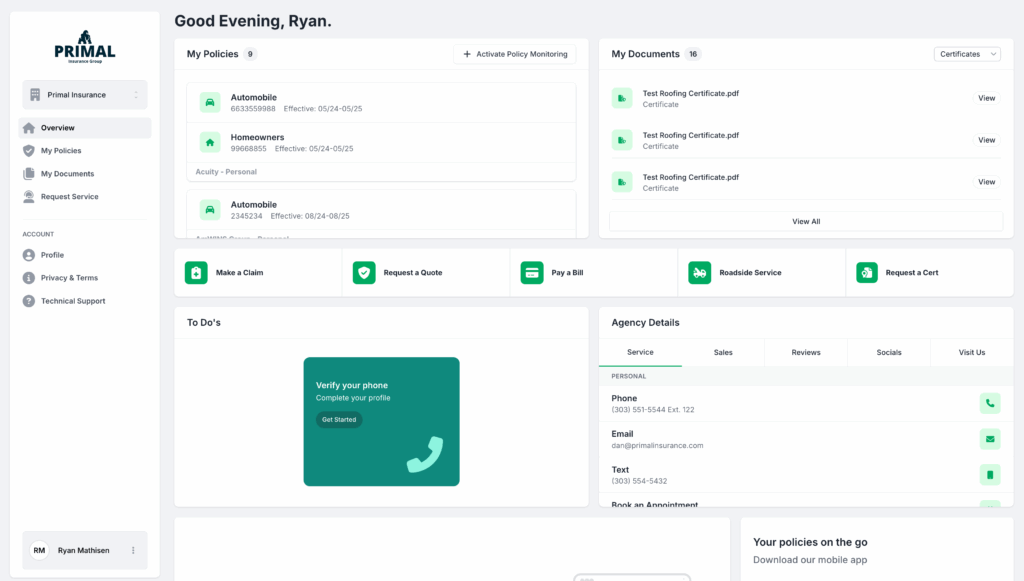

GloveBox solves the adoption challenge at its source by removing registration friction entirely. Instead of asking for obscure policy numbers, the platform uses the policyholder’s phone number or email address to recognize their account instantly. A one-time passcode (OTP) is sent, and within seconds, they’re inside a fully integrated portal.

From there, the experience delivers on every promise: paying bills, submitting claims, viewing documents, and requesting quotes, all without ever contacting a CSR. This combination of frictionless entry and complete self-service functionality leads to dramatic adoption results. Carriers typically see 8–10x higher usage in the first year compared to their legacy or homegrown portals. That early engagement compounds over time, driving both retention and measurable reductions in service volume.

Why Agent Adoption Makes or Breaks a Portal

While client experience is the headline goal of any portal, the agent experience is just as critical to ROI. Agents are on the front lines with policyholders, and their perception of a carrier’s service tools directly impacts how much business they place with that carrier. When a portal simplifies service, enabling clients to find their documents, process changes, and pay bills without calling, it frees agents to focus on selling and relationship-building.

The opposite is also true. Poorly designed or incomplete portals turn agents into de facto customer service reps, fielding calls for tasks that should be self-service. Over time, that frustration drives them toward competitors with better tools. In a market where agents often have multiple carrier options for the same product, a clunky portal can quietly erode market share.

How GloveBox turns agents into advocates

GloveBox is built for both sides of the relationship – policyholders and agents. Agents can log in to see their whole book of business, monitor adoption metrics, and track client activity within the portal. This visibility not only improves service follow-up but also identifies opportunities for cross-sell and retention outreach.

What truly sets GloveBox apart is its referral engine. Every quote request, coverage inquiry, or new policy interest generated inside the platform is automatically routed back to the writing agent, ensuring they get the lead and the revenue opportunity. No other client experience platform in the industry offers this level of direct agent benefit, turning the portal from a “nice-to-have” into a business growth tool agents actively promote to their clients.

The $2M Mistake: Breaking Down the Losses

The true cost of building and maintaining an in-house portal often exceeds $2 million over a five-year period, and that’s before factoring in the strategic opportunities lost along the way. The first and largest drain is churn. Poor client experience directly impacts retention, and when policyholders leave, carriers lose not only the immediate premium revenue but also the lifetime value those customers would have generated. A homegrown portal with low adoption and limited self-service forces policyholders back into high-friction service channels, increasing the likelihood they’ll shop with a competitor at renewal.

The second bucket is service staffing bloat. Without a high-functioning portal to offload Tier 1 service requests, call and email volume stays high. Every ID card request, billing question, or document retrieval takes a CSR or service rep’s time. Over the course of a year, that translates into additional salaries, benefits, and management overhead, costs that scale upward as the carrier grows.

The third bucket is tech staffing. A homegrown portal is never “done.” It requires ongoing development to maintain compatibility with carrier systems, respond to API changes from vendors, fix bugs, roll out new features, and keep up with evolving security requirements. That means keeping engineers on payroll, or paying contractors, year-round, even if portal improvements aren’t a strategic priority.

Secondary impact

Beyond the hard costs, there’s a hidden but equally damaging layer of losses. When internal tech teams are tied up maintaining a portal, other critical initiatives, such as modernizing claims workflows, deploying new underwriting tools, or expanding into new states, are delayed or canceled altogether. Growth slows, and the carrier falls behind competitors who have freed their technical resources for innovation.

Even with heavy investment, many carriers find that their in-house portal can’t keep pace with user expectations or technology changes. Within three to five years, it’s common to see carriers either rebuild from scratch or quietly abandon their portal altogether, writing off millions in sunk costs and starting the cycle over again.

Why GloveBox’s Model Wins

GloveBox’s build-once, deploy-anywhere approach gives carriers the best of both worlds: a proven, enterprise-grade client experience platform and the flexibility to customize branding, workflows, and integrations to fit their business. Instead of starting from scratch, carriers tap into a pre-built core that’s already battle-tested across the industry. That foundation drastically reduces both cost and implementation time compared to an in-house build.

The off-the-shelf model also eliminates the biggest maintenance headaches. GloveBox handles all ongoing software updates, feature enhancements, and security improvements, including full SOC 2 compliance, without the carrier’s tech team lifting a finger. Because GloveBox is purpose-built for the insurance space, every update aligns with real-world carrier and policyholder needs. The result: no internal tech burden, no resource drain, and no risk of the platform becoming outdated.

Speed to ROI

An in-house portal typically takes 12 months or more to launch, often longer once integration issues and scope creep set in. By the time it’s live, adoption is slow, self-service is incomplete, and payback drags well beyond the initial projections.

With GloveBox, carriers go live in weeks or months, not years. Frictionless onboarding – login by phone or email with a one-time passcode – drives rapid policyholder adoption from day one. Agents embrace the platform because it reduces service volume and sends referrals directly back to them, creating a multiplier effect on growth.

The impact on retention and service efficiency is visible in the first year: fewer calls and emails, lower CSR load, and measurable gains in policyholder loyalty. That early momentum compounds, turning client experience into a long-term driver of revenue and margin instead of a costly distraction.

The Smarter Way Forward

For many carriers, the instinct to build in-house is rooted in the belief that more control equals better outcomes. In reality, it often means burning time, budget, and internal resources on a product that underperforms and ages quickly. Every month spent in development is a month without measurable adoption gains, retention improvements, or reduced service costs.

In 2025, the carriers that win will be the ones who double down on their core strengths, writing business, serving clients, and supporting agents, while letting proven technology specialists handle the client experience. GloveBox delivers that advantage: a secure, fully compliant platform that launches fast, drives adoption, and protects margins. It’s the direct path to higher agent loyalty, stronger retention, and a better bottom line, without falling into the $2M trap.

Schedule a GloveBox demo.