For years, “client experience” was seen as a soft metric, something nice to have, but not essential. A good UI, maybe an FAQ page, and a friendly call center. That was enough.

Not anymore.

In 2025, client experience is one of the most powerful levers carriers can pull for operational efficiency, retention, and revenue growth. It’s no longer just a front-end layer. It’s infrastructure.

Because today’s policyholders don’t want to wait on hold, search through outdated portals, or re-explain themselves to every new rep. They want fast, mobile-first access to their documents, billing, and support. And when they don’t get it, they leave.

The data is clear: high adoption of self-service tools leads to lower churn, higher retention, fewer service calls, and stronger relationships with agents.

Carriers that treat client experience as a strategic investment, not a cosmetic fix, are already seeing the results. The ones who delay are paying for it, silently, through bloated service costs, lost renewals, and shrinking market share.

This guide lays out the business case for investing in client experience – what carriers get wrong, where the hidden costs lie, and how to fix it without disrupting your core systems.

Let’s get into it.

TL;DR

Client experience isn’t a soft metric. It’s a core growth lever. It drives retention, reduces service costs, and strengthens agent loyalty.

In this article, we covered:

- Why portals and call centers alone don’t cut it anymore

- The hidden costs of poor CX – bloated teams, low referrals, and churn

- Which KPIs actually improve when self-service works

- How CX impacts agent behavior and quote-to-bind rates

- The biggest objections and how to reframe them

- Why GloveBox delivers measurable ROI without disrupting your PAS

- What’s at stake for carriers that delay investing in client experience

Better margins, relationships, and growth. It all starts with experience.

What Carriers Get Wrong About Client Experience

Most carriers think they’ve already solved client experience. “We have a portal. We have a call center. What more do they want?”

The answer: a lot more.

The problem isn’t that carriers lack technology. The issue is that the technology isn’t built for the people using it. What many carriers call “client experience” is actually just customer service dressed up with a login screen.

They confuse CX with customer support (“we have reps”), or user interface (“we updated the portal design”). But real client experience is about control, convenience, and consistency.

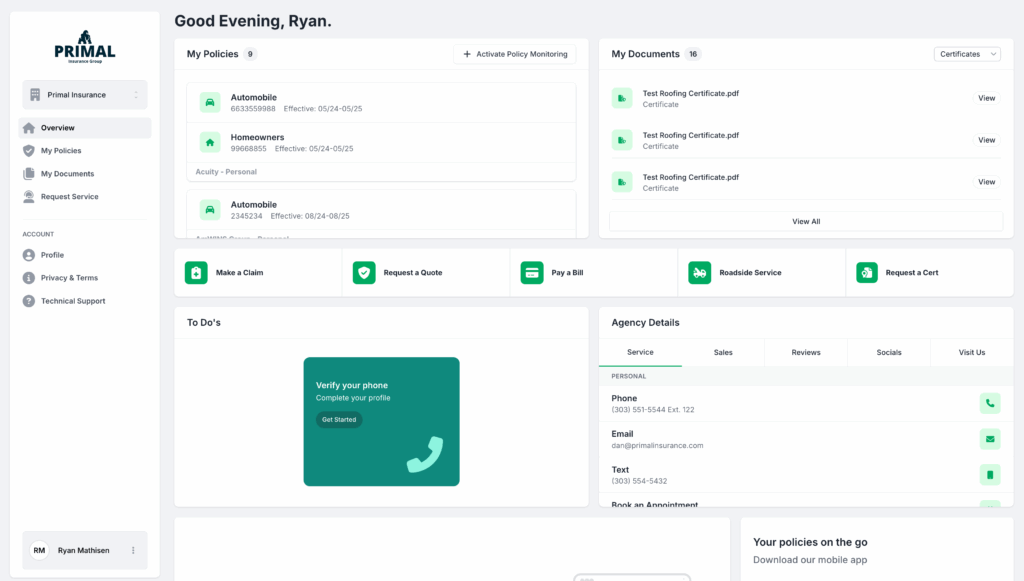

Today’s policyholders want to:

- Log in without a registration key, policy number, or account ID.

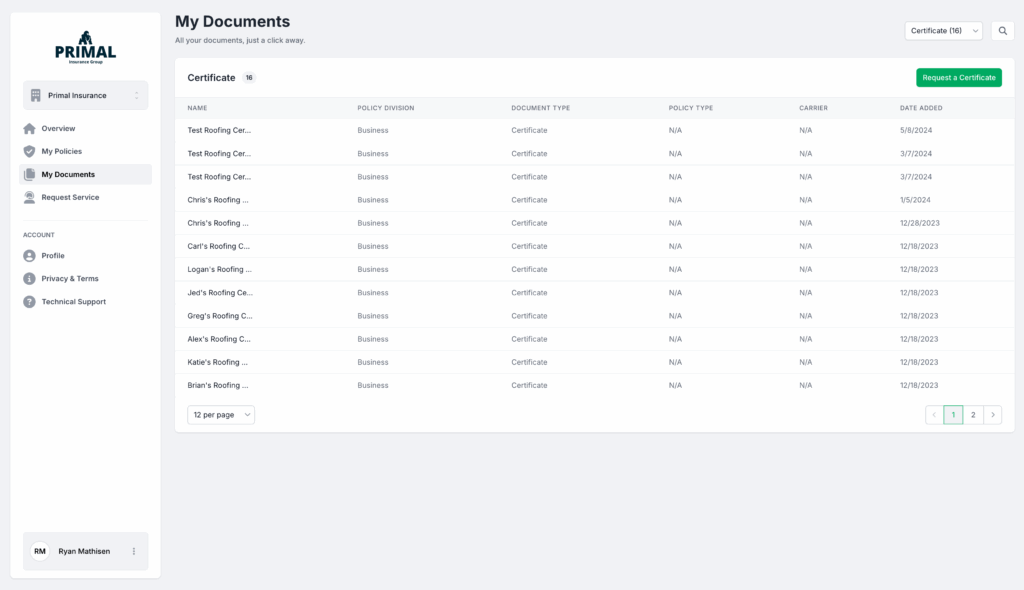

- Access their documents in seconds, not request them.

- Pay bills, download ID cards, and update details without calling.

Submit claims and track status without being passed around.

Yet most carrier portals can’t deliver that. They’re hard to access, frustrating to use, and often missing key features. Even when they technically exist, policyholders don’t use them because they weren’t built with the user in mind.

And when policyholders don’t engage with your portal, they call instead. That creates friction, raises service costs, and erodes loyalty over time.

Still, the bigger mistake is strategic: assuming the status quo is “good enough.” It’s not.

Carriers sticking with default policy admin portals or throwing more bodies into the call center aren’t protecting their margins. They’re burying inefficiencies under payroll and betting against rising consumer expectations.

The Hidden Cost of Poor CX

Most carriers don’t see the real price they pay for weak client experience because it doesn’t show up on a single line item. It shows up everywhere else.

It shows up in bloated service teams fielding unnecessary calls, in rising churn, where policyholders leave not because of price, but because they’re frustrated, and in missed referrals, delayed quoting, and the slow grind of inefficiency that quietly kills growth.

Let’s be specific.

When policyholders can’t access their ID card, pay a bill, or update contact info in seconds, they call. Every one of those calls becomes a support ticket. And every ticket comes with a cost, whether that’s the salary of a CSR, the opportunity cost of time spent, or the workflow interruption that slows everything down.

Multiply that across thousands of clients, and the numbers get ugly fast. Carriers spend millions each year just to answer questions that could’ve been resolved in-app.

Then there’s churn.

When a policyholder can’t self-service, they don’t stick around. They find an agency that lets them download what they need, when they need it. Adoption rates plummet. Retention follows.

And if you’re constantly losing 10–15% of your book every year, you’re not growing, but replacing.

Low portal adoption doesn’t just mean missed engagement. It means high attrition, high operating costs, and zero leverage for scaling.

That’s the real cost of poor CX. It doesn’t come all at once. It comes in small, expensive pieces until the whole system starts to feel broken.

KPIs That Actually Move

Carriers often treat client experience as a soft metric, something nice for marketing or brand loyalty. But the truth is, CX moves complex numbers. When done right, it affects the metrics executives care about most: retention, service cost, revenue per policyholder, and operational efficiency.

Retention rates go up

When policyholders can access what they need without calling, they stay. Friction is the #1 reason people switch.

In contrast, carriers with intuitive portals and mobile apps, where clients can view documents, pay bills, or submit claims in minutes, see a measurable lift in retention. GloveBox clients often see year-over-year retention improve 3–5x, not from gimmicks, but from making it easier to stay than to leave.

Service ticket volume goes down

Each ID card request, payment question, or address change that goes through a CSR is a drain on payroll. Carriers with low self-service adoption pay to handle thousands of these every month.

GloveBox flips the ratio, clients handle routine tasks on their own, CSRs deal with higher-impact issues, and ticket queues shrink. One agency reported saving over 90 CSR hours annually from self-service logins alone. Now scale that to carrier-level volume.

Quote-to-bind speed increases

Client experience directly impacts sales velocity. When agents are no longer bogged down by service requests, they can respond, send quotes, and close deals more quickly.

That response time edge can make or break deals, especially in personal lines, where speed matters more than brand loyalty.

CSR staffing costs drop

A fully staffed service team might feel like a strength. But it’s often a symptom of deeper inefficiencies. Without self-service options, the only way to handle growing volume is to hire more reps.

With self-service in place, carriers can either reduce headcount or scale the same team further, improving margins along the way.

Referral volume goes up

Happier policyholders talk. If the app is easy to use, if renewals are seamless, if everything just works, people notice. GloveBox includes built-in referral features that route new clients directly to the original agent, making it not just a CX tool but a growth engine.

It’s not theoretical. The numbers are in the dashboard.

Carriers using GloveBox don’t need to guess. They can see daily adoption rates, logins, document views, referral volume, and the real impact on retention, right inside their agency metrics dashboard.

A better experience isn’t a brand play. It’s operational infrastructure. And the numbers prove it.

The Long-Term Risk of Waiting

When carriers delay investing in client experience, they’re they’re falling behind.

Every month without a modern client portal is another month of poor retention, bloated service costs, and frustrated policyholders choosing competitors who make it easier to do business. The risk isn’t hypothetical. It’s already happening.

The gap is widening

Some carriers are doubling down on digital infrastructure, investing in intuitive portals, seamless quoting, and self-service functionality. Others are stuck with outdated systems, call-heavy workflows, and low adoption portals bundled with their PAS.

The difference in outcomes compounds quickly:

- Tech-forward carriers expand into new markets and scale without overhiring.

- Lagging carriers plateau, burning out staff, and watching churn rates climb.

In one to two years, that gap becomes impossible to ignore. Clients notice. Agents notice. And revenue shows it.

Agents and policyholders will gravitate toward better experiences

Agents don’t want to write business with carriers who bog them down with service work.

They want fast quoting, smart automation, and portals that reduce their ticket volume, not add to it. When a competitor makes their life easier, they’ll shift their book.

Policyholders are no different. The next generation of insurance buyers expects convenience. If your experience feels outdated, they’ll leave and they won’t come back.

Delaying costs more than acting now

Some executives say: “Let’s revisit this next year.”

The question is: what will change between now and then?

You’ll still have the same systems. The same adoption problems. The same retention issues. The only difference is 12 more months of missed referrals, higher payroll costs, and policyholders quietly leaving for easier options.

Every delay is a growth opportunity lost and a cost you keep paying.

Strategic ROI: Why Agents Care Too

Client experience doesn’t just affect policyholders. It shapes the entire producer relationship. Carriers often focus on agent commissions and product variety as ways to attract and retain distribution partners. But the silent factor driving agent loyalty is how easy, or painful, it is to work with you after the sale.

Faster service = more deals closed

When agents place business with a carrier, they expect responsiveness. A portal that allows policyholders to self-service reduces the agent’s involvement in repetitive tasks like payment updates, ID cards, or claims status checks. That means less time spent on service and more time selling. Faster quoting, quicker document access, and fewer follow-ups lead directly to more bound policies.

And when quoting turnaround goes from five days to same-day, bind rates increase because agents aren’t losing deals to faster competitors.

Lower service workload = more capacity

Every call a policyholder makes, when it’s not handled by a portal, creates downstream work for agents. Even if the carrier’s CSR takes the first call, policy changes or document requests often bounce back to the writing agent. Multiply that by hundreds of clients, and you’ve got a book that’s harder to manage and less profitable to grow.

By contrast, when policyholders can handle basic needs themselves, agents reclaim time. That reclaimed time turns into pipeline growth, relationship management, and, most importantly, revenue.

Referral engine = inbound leads for agents

Great CX doesn’t just reduce friction; it increases upside. GloveBox routes referrals directly back to the agent of record. No carrier-level reshuffling. No manual tracking. Just clean attribution and a consistent feedback loop that rewards good service with more business.

Agents don’t just want a better client experience. They benefit directly from it. When carriers invest in tools that support service automation and visibility, they make themselves easier to sell, easier to trust, and easier to grow with.

In short, carriers who make life easier for agents will win more of their business. Not with bribes. With systems.

Objections & Reframes

When it comes to modernizing client experience, most carriers don’t argue against the idea – they stall. They default to common objections that feel safe, familiar, and operationally “responsible.” But in practice, these objections protect the status quo at the cost of growth, efficiency, and relevance.

Let’s unpack the most common pushbacks and why they don’t hold up.

Objection: “We’ll lose our personal touch.”

Reframe: You’re not replacing the relationship; you’re giving it room to grow.

Carriers often assume that a portal or self-service tool creates distance between them and the policyholder. In reality, it clears the path for more meaningful interaction.

When clients can handle Tier 1 tasks (like billing, ID cards, address changes) without waiting on hold, service teams aren’t buried in reactive support. That frees up time for proactive outreach, personalized support, and faster resolution on complex needs.

Personal touch doesn’t disappear. It finally gets to show up where it matters.

Objection: “Let’s revisit this next year.”

Reframe: What exactly will change in 12 months, other than more lost clients?

Postponing CX investment is rarely a strategic move. It’s usually a deferral based on bandwidth, budget cycles, or other “priorities.” But here’s the reality: every month spent waiting is another month of preventable churn, another quarter of missed referrals, and another year of agent frustration.

What changes between now and next year if nothing in your infrastructure evolves? Nothing, except the number of competitors passing you by.

Objection: “This feels like a cost center.”

Reframe: It’s a margin protector and a growth multiplier.

Hiring another 10 CSRs to deal with growing service volume? That’s a cost center. Investing in a platform that reduces your ticket load by 30–50% while increasing retention? That’s strategic infrastructure.

Modern client experience tools pay for themselves in hard dollars saved and new revenue generated. Fewer tickets, smaller service teams, higher retention, more referrals, faster quoting.

That’s not a line item. It’s a flywheel.

These aren’t philosophical arguments. They’re operational realities. Every objection to investing in client experience has a clear, measurable counterpoint if leadership is willing to look past comfort and focus on outcomes.

How GloveBox Delivers ROI Without Disruption

For many carriers, the biggest hurdle to improving client experience isn’t doubt. It’s fear of disruption. Replacing core systems feels risky. Building something in-house sounds expensive. And onboarding new tech often means long timelines, IT bottlenecks, and internal pushback.

GloveBox removes those barriers entirely.

You don’t have to rip out your PAS

GloveBox isn’t a replacement for your Policy Admin System (PAS). It’s an overlay.

It plugs directly into your existing infrastructure, pulling real-time data from your PAS via secure APIs and translating that backend complexity into a sleek, branded front-end experience for policyholders.

No need for a migration. No need for a rebuild. You keep your core system. GloveBox just makes it usable for the people who actually need to interact with it.

You don’t have to build it in-house

Some carriers consider building their own portal or mobile app from scratch. The idea is appealing until they see the time and cost.

Internal teams need to scope, hire, design, develop, QA, deploy, and maintain the product. That means months of dev cycles, hundreds of thousands in engineering costs, and constant upkeep.

GloveBox shortcuts that entire process. You get a white-labeled portal and mobile app built specifically for policyholders, with proven UX, real adoption metrics, and continuous improvements, without ever touching your dev queue.

You don’t have to lead implementation

One of the biggest value props of GloveBox is the rollout.

The GloveBox team doesn’t just hand you a product. They execute the launch, from technical setup to internal training to client adoption campaigns. Carriers don’t need a dedicated project manager. You don’t need to reassign resources or stretch your ops team. It’s fast, supported, and hands-off.

This isn’t your typical “plug in the software and hope for the best” scenario. GloveBox is a done-with-you rollout that delivers adoption from day one.

You get real returns – fast

GloveBox impacts both sides of the ledger.

- Lower cost: Fewer service tickets, smaller support teams, no internal dev investment.

- Higher revenue: Increased retention, more referrals, faster quote-to-bind workflows.

And because all usage is tracked through the internal dashboard, carriers don’t have to guess whether it’s working. They can see it – login frequency, document views, payments processed, tickets avoided, referrals triggered. The ROI isn’t theoretical. It’s visible.

The Bottom Line: CX Isn’t a Soft Metric But a Strategic Advantage

Too many carriers still treat client experience as a secondary initiative, something for marketing to manage or service teams to patch.

But real CX is infrastructure. It’s not about bells and whistles. It’s about how efficiently your organization retains clients, grows business, reduces costs, and keeps agents loyal. That makes it one of the most important strategic levers in today’s insurance landscape.

The best-run carriers understand this:

- They see every self-service interaction as a cost saved and a client retained.

- They see faster quoting as the difference between closing or losing business.

- They see every happy policyholder as a potential referral and every referral as compound growth.

And most importantly, they don’t wait for a complete PAS overhaul to get there. They modernize from the outside in.

GloveBox lets you do exactly that, by adding real-time, mobile-first self-service to your existing stack, without ripping or replacing core systems.

It’s fast. It’s proven. And it moves the metrics that matter.