For most carriers, “client experience” still means a call center and a login page. Maybe there’s a basic portal, buried behind forgotten credentials and registration codes, and maybe there’s an app no one uses. But in 2025, that’s not enough. Not for your agents. Not for your policyholders. And not for your growth.

Policyholders no longer tolerate clunky systems and long hold times. They expect real-time access to their policies. They expect billing, claims, and service to happen on their phone – fast, intuitive, and self-directed. And they’re comparing your experience not to other carriers, but to their bank app, their streaming platform, and their rideshare service.

That’s where the gap emerges.

The top five carriers? They’ve closed it. They’ve built real digital infrastructure – client portals, mobile apps, self-service tools – and it shows. Their adoption is high, their retention is strong, and their reputation reflects it. Everyone else? They’re falling behind. Many still rely on policy admin systems that weren’t built for modern user experiences, offering outdated portals that see less than 5% adoption.

It’s more than a tech problem. It’s a business risk. Because when a client portal fails, policyholders pick up the phone, or worse, they pick another carrier.

Let’s see how to avoid that scenario.

TL;DR

The future of policyholder experience is already here, and most carriers are falling behind.

This guide covered:

- Why most portals see <5% adoption and frustrate more than they serve

- What today’s policyholders actually expect from their carriers in 2025

- The must-have elements of a modern experience (mobile-first, API-connected, agent-integrated)

- How broken UX and missing self-service drive retention loss and higher service costs

- What a complete, ideal journey looks like from quote to renewal

- Why investing in client experience is no longer optional

The policyholder doesn’t care how complex your backend is. They care about getting what they need now, not later.

The Current State of Policyholder Experience (And Why It’s Broken)

Outside of the top five national carriers, most insurance companies still offer outdated, hard-to-use systems for their policyholders. The standard setup? A throw-in portal bundled with the policy admin system, designed for backend data storage, not client interaction.

These portals weren’t built with the end user in mind. They’re confusing to register for, require policy numbers or account codes that people don’t have on hand, and often demand usernames and passwords that clients never remember. The experience is frustrating from the start.

And even after jumping through all the hoops to log in, the value is underwhelming. Most portals offer little more than confirmation that coverage is in place. No real-time billing info. No document access. No digital claims submission. No direct communication with agents. Just a glorified PDF viewer, if that.

This is the environment policyholders are stepping into in 2025. And it feels wildly out of step with the rest of their digital lives.

They can pay rent, book flights, and manage investments from their phones in seconds. But when it comes to their insurance? They’re still calling 1-800 numbers, waiting on hold, and getting bounced between departments just to find a declaration page or update a phone number.

That experience isn’t just frustrating. It’s driving policyholders away.

Most carriers using default PAS portals see adoption rates under 5%. That’s not just low, it’s a signal. It tells us policyholders would rather call than fight with outdated tools. And every one of those calls is time your team didn’t need to spend.

More importantly, every one of those moments is an opportunity for churn. Because when the experience is clunky, clients leave. And when retention drops, the cost of doing business rises. You’re stuck replacing lost clients just to maintain flat revenue.

The scary part? Many carriers don’t even realize they have a problem. They see a portal in place and assume the box is checked. But until it’s easy, mobile, real-time, and self-service, policyholders won’t use it. And if they won’t use it, it isn’t working.

Why Default Portals and Apps Fail

Most insurance carriers technically offer a portal, but few offer one that actually works for policyholders.

The problem starts with how these systems are built. Policy admin systems (PAS) like Majesco, Duck Creek, and Guidewire are designed for internal operations – data storage, compliance, and workflows between underwriters and agents. They were never intended to be client-facing tools. But because they come bundled with a basic portal, many carriers rely on them by default.

That default setup is the root of the problem.

Logging in is a chore. Portals often require obscure account or policy numbers, multi-step authentication, and passwords that policyholders rarely use and therefore never remember. These systems are also typically web-only. No mobile app. No single sign-on. No integration with the rest of the customer’s digital life.

If a user does manage to log in, what they find is limited. Maybe they can view a policy PDF. Maybe they can see that a payment was processed. But they usually can’t submit a claim, ping their writing agent, request coverage changes, or get real-time status updates. It’s a one-way glass – look, but don’t touch.

Even worse, these portals are prone to crashes, load slowly, and often aren’t optimized for mobile. That’s a deal-breaker for today’s users, who expect seamless, mobile-first experiences from their banks, utility providers, and healthcare apps.

And all this friction leads to two outcomes:

- Abysmal adoption. It’s not uncommon to see portal usage below 5%. Policyholders would rather call than struggle with an interface that feels outdated and useless.

- Rising service costs. When a client can’t use self-service, they call. When they call, your agents and CSRs get bogged down in tasks that should never have required human effort – sending ID cards, reissuing documents, walking someone through a billing history.

That’s a strategic issue.

When portals fail, retention drops. NPS drops. Service costs rise. And every digital interaction that should be easy becomes a reason for a client to churn.

Modern policyholders don’t tolerate that kind of friction. They leave for carriers who make insurance feel as intuitive as every other part of their digital life.

And they’re not wrong to.

What Modern Policyholders Expect in 2025

Client expectations in insurance haven’t just evolved, they’ve accelerated. What was acceptable in 2020 is now a liability in 2025.

Policyholders expect self-service instantly. They’ve been trained by Amazon, Uber, and their bank to handle everything on their phone in seconds. Insurance is no exception anymore. Whether it’s accessing ID cards, paying a bill, updating contact info, or initiating a claim, they expect it to be fast, intuitive, and always available.

And if it isn’t? They bounce. Not just from the portal but from the carrier.

The shift isn’t just about speed or access. It’s about control. Today’s policyholders want to own their experience. They don’t want to call to check on a deductible. They don’t want to email a generic service inbox and wait three days for a document. They want real-time visibility, on their terms.

That expectation is even stronger among younger demographics. Millennials and Gen Z, now buying homes, cars, and life insurance, have no patience for old-school workflows. For them, needing to call a 1-800 number is not just annoying. It signals that your company isn’t modern. And that perception sticks.

But here’s the real shift: it’s no longer just the digital-native generations who want this. Everyone does. Boomers who use online banking daily don’t understand why they can’t access their insurance information the same way. Across the board, expectations have caught up, and most carriers haven’t.

Modern policyholders expect:

- Mobile-first access, not just browser-based portals

- A login that doesn’t require a forgotten policy number

- All policies in one place, not scattered across carriers or PDFs

- Real-time data: billing, documents, coverage, claims

- The ability to ping their agent, not just a generic help desk

In short, they want insurance to work like everything else in their digital life. And if it doesn’t, they’re gone. The barrier to switching is lower than ever, and the window to impress them is shrinking.

You can’t earn loyalty with paper statements and clunky portals. Not in 2025. You earn it by making their lives easier, faster, and more transparent, before they even ask.

The Ideal Policyholder Journey: What “Good” Actually Looks Like

Delivering a modern policyholder experience doesn’t just mean throwing up a login screen or launching an app. It means designing a seamless, intuitive journey across every interaction point.

Let’s break down what that should actually look like, from quote to renewal.

1. Quote & bind: Smooth start, no friction

The experience begins at the moment of intent, not after the sale. As soon as a policy is quoted and bound, the client should receive an immediate welcome message with access to their digital account. No “wait for your policy packet.” No “please call us to activate.” Just instant access.

2. Onboarding: Instant clarity, full access

Once inside, the portal or app should show all active lines of insurance, not just one. Home, auto, umbrella – it’s all there, along with billing info, policy documents, and ID cards.

There’s no need to hunt or call for coverage details. Everything is available at a glance. It’s the digital equivalent of, “Here’s what you bought. Here’s what you’re paying. Here’s how to get help.”

3. Ongoing service: Built for real life

Real-world needs don’t happen between 9 and 5. A modern journey means 24/7 self-service access that doesn’t depend on business hours or call centers.

Need to change an address? Upload a driver? Download an ID card before a road trip? All of it should be self-service, especially for common Tier 1 service requests. If the portal can’t handle these tasks in real time, it’s not solving the problem.

4. Renewal: Proactive, not reactive

The journey doesn’t end after purchase. It cycles. That means renewal isn’t an afterthought. It should feel like a proactive service moment, not a surprise invoice.

Modern portals should enable pre-renewal check-ins, automated reminders, and secure renewal reviews. Clients should feel like their insurance is evolving with their needs, not stagnating in last year’s policy.

Why Today’s Portals Fail

Most carriers technically have a portal. But ask any policyholder if they use it, and you’ll get a very different answer.

That’s because traditional portals weren’t built for the client. They were built for compliance. For legacy workflows. For internal teams.

And it shows.

1. Clunky, outdated login process

The first point of failure? Access.

Too many portals require a policy number, registration code, or account ID just to log in. But nobody remembers those, especially when you only log in once or twice a year.

Instead of “email and PIN,” it’s “find this document, call this number, fill out 10 fields.” That kills the journey before it begins.

Even when clients do manage to create an account, they still have to remember a username/password combo they never use. If logging in feels like resetting your bank password from 2005, adoption will stay dead on arrival.

2. Weak mobile experience

Policyholders aren’t sitting at their desks, waiting to update their auto policy. They’re on their phones – at work, at school, at a dealership.

And yet, most carrier portals still live in mobile-unfriendly browsers. The apps that do exist are often clunky, crash-prone, or missing entirely from app stores.

In 2025, the absence of a fully functional mobile app isn’t just an inconvenience. It’s a liability. Clients don’t wait until they’re home to manage their policy. If they can’t do it from their phone, they’ll call – or worse, leave.

3. Limited functionality = No use case

Let’s say the client makes it through the login gauntlet. What’s next?

In many portals, not much. You can view a static PDF, maybe check a balance, but you can’t:

- Pay a bill

- Submit a claim

- Request an ID card

- Update driver or vehicle info

- Message your agent directly

So what happens? The policyholder calls. The CSR emails. A 2-minute fix becomes a 20-minute ticket.

It’s not just poor UX. It’s a false promise: “You have a portal but it doesn’t actually do what you need.”

4. No real-time sync

Even when portals technically “work,” they’re often out of sync with core systems.

Policy documents aren’t current. Changes may not take effect for 24–48 hours. Claims statuses lag behind actual updates. So clients don’t trust the data and revert to calling for confirmation.

That defeats the entire purpose of self-service.

The High Cost of a Broken Experience

Carriers don’t typically feel the pain of poor client experience immediately. That’s what makes it dangerous. But the long-term cost? It adds up fast.

Retention drops first

The #1 hidden leak in carrier profitability is churn.

When policyholders are frustrated, unable to access documents, stuck on hold for simple requests, or forced into outdated workflows, they start looking elsewhere. And they don’t always say goodbye. They just stop renewing.

We’ve seen retention rates 3–5x higher at agencies and carriers who offer real self-service tools. Because when it’s easy to stay, people stay.

The math here is brutal: if your carrier loses 10% of customers each year and you have to replace every one of them just to tread water, that’s not growth. That’s survival mode.

Support volume becomes unsustainable

Without digital self-service, every simple task turns into a manual support request:

- “Can I get an updated ID card?”

- “How do I pay my bill?”

- “I changed my address—now what?”

These aren’t edge cases. They’re daily realities. And they bury service teams in low-value work that could be avoided with better tools.

The result?

- Escalation rates climb

- Ticket resolution times slow

- Your best service reps burn out doing tier-one tasks

And that’s before considering the opportunity cost. Every hour your team spends solving problems that shouldn’t exist is an hour they’re not investing in upselling, retention, or client outreach.

Agents lose confidence and business

If you’re a carrier relying on independent agents, your portal is their frontline.

When it’s clunky, unhelpful, or constantly down, they feel it because their clients are the ones complaining. Agents start steering business elsewhere, toward carriers who make their jobs easier.

Your brand doesn’t just lose deals. It loses advocates.

Referrals? Forget it.

Policyholders don’t recommend carriers with outdated systems. If your portal adds friction, they won’t tell their friends about it. They’ll warn them.

On the flip side, we’ve seen carriers using modern client-facing platforms, such as GloveBox, generate referrals daily because happy clients talk.

This isn’t just about delight. It’s about marketing math. When clients refer others, CAC drops and LTV rises. Poor experience shuts that down before it starts.

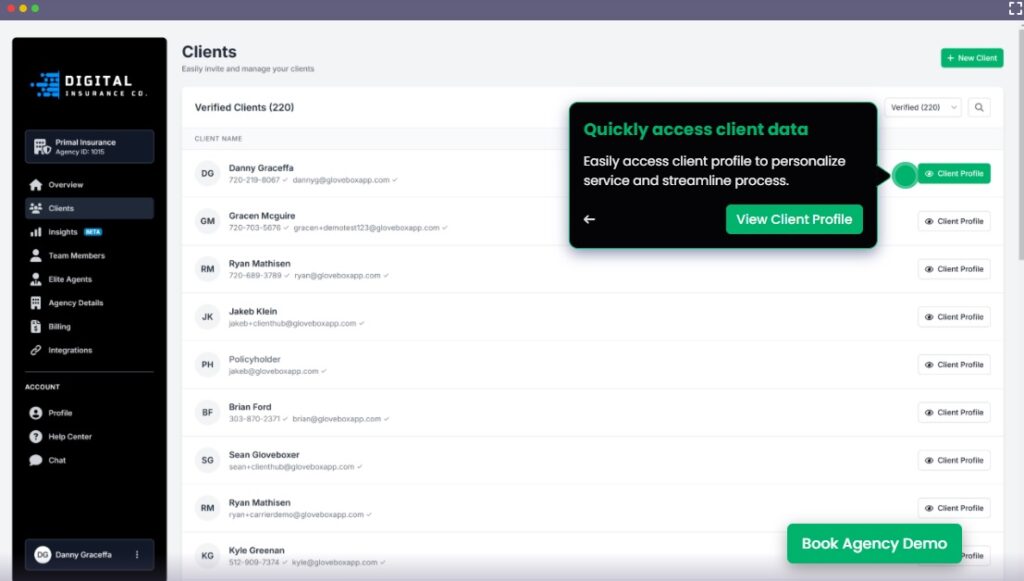

How GloveBox Bridges the Experience Gap

Most carriers already have the backend infrastructure. Their policy admin systems (PAS) handle the heavy lifting – managing data, processing policies, and supporting internal workflows. But that infrastructure wasn’t built for the policyholder. And that’s where everything breaks down.

GloveBox doesn’t replace your PAS. It sits on top of it, connecting the data you already have to the people who actually need it.

Seamless, modern client access

Instead of asking policyholders to dig up their policy number or remember a login they haven’t used in months, GloveBox lets them access everything using just an email or phone number. No clunky registration. No lost passwords. No friction.

Once inside, they can:

- View and download ID cards and policy documents

- Submit service requests and first notice of loss

- Update contact or driver information

- Pay bills and check payment status

- Get quotes or request new lines of coverage

All in one place, fully white-labeled, branded to your agency or carrier.

It’s the same experience clients expect from mobile banking, online shopping, and telehealth. Insurance shouldn’t be the outlier.

Mobile-first, not desktop-dependent

Most policyholder portals today are built for the desktop era. But modern policyholders live on their phones. They pay bills, manage subscriptions, and message customer support from their mobile apps, so why not their insurance?

GloveBox includes a white-labeled mobile app, available on both iOS and Android, providing policyholders with access to everything they need at their fingertips. That’s not just a design upgrade, it’s a shift in channel efficiency.

When clients can self-service at 11:30 PM without waiting on hold the next morning, your team doesn’t get dragged into work that shouldn’t be theirs in the first place.

Real-time API integration

GloveBox connects directly to your PAS through APIs, syncing in real time. That means:

- No manual uploads

- No lag in document availability

- No double data entry

- No missed updates

When an agent or policyholder makes a change, the portal automatically reflects it, reducing errors and eliminating service bottlenecks.

And because that sync can happen as often as every 15 minutes, your policyholders always have the most accurate, up-to-date view of their policies.

Fewer tickets, happier teams

When GloveBox is deployed, service volume drops immediately. Why? Because policyholders stop calling in for every small request. They can solve it themselves in seconds.

That clears the backlog for your internal team, reducing CSR workload, speeding up ticket resolution, and giving everyone more time to focus on high-value work like relationship-building and renewals.

It’s not about cutting service staff but finally letting them do the job they were hired for.

Key Metrics That Prove It’s Working

For years, “client experience” in insurance has been treated as an abstract concept – hard to define, harder to measure. But that’s no longer the case. Today, carriers can tie real numbers to real outcomes, and the data makes one thing clear: better policyholder experience delivers better business performance.

Retention rates

Policyholders who actively use their digital portal, mobile app, or website are dramatically more likely to renew. The correlation between self-service adoption and retention isn’t anecdotal; it’s predictable. When clients can get what they need without waiting on hold or digging through emails, they’re far less likely to shop around at renewal.

Agencies and carriers that modernize their portals with GloveBox report retention increases of 3–5x year-over-year compared to their previous systems.

Self-service adoption

The clearest proof that a portal works? People use it. Legacy portals bundled with PAS vendors often show dismal adoption, 3–5% in many cases, because they’re confusing, slow, or offer limited functionality.

When those portals are replaced with GloveBox, adoption surges. Agencies have reported 60%+ usage among their client base within the first year. That means thousands of calls, tickets, and manual tasks never make it to the service team.

Service volume reduction

Every document downloaded by a client is one less call. Every billing lookup completed online is time your team doesn’t have to spend on hold or triaging emails. In high-volume operations, even small improvements in client-side access translate to hundreds of CSR hours saved annually.

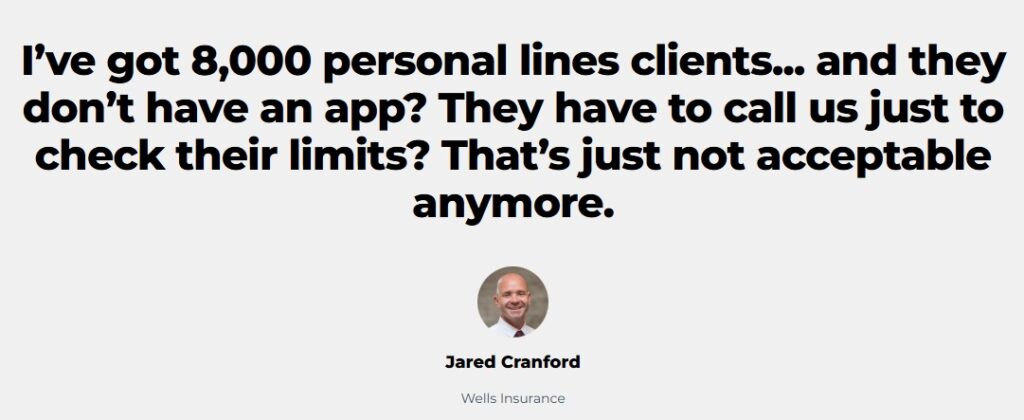

One agency, Wells Insurance, modernized its operations across 8,000 clients and 40+ service staff without disrupting daily workflows. After implementing GloveBox, clients could instantly handle billing, download ID cards, and access policy info, all without calling. The result? A dramatic drop in service volume and more time for high-impact client work. A capacity shift at scale.

Quote-to-bind efficiency

Another overlooked impact of a great client experience is speed. When a policyholder can request changes or quotes directly through their portal, and that request is routed immediately to the right agent, the entire quoting process accelerates.

Fast response times drive win rates. Prospects rarely wait three days for a quote when someone else gives them one in 30 minutes. The right infrastructure turns every lead into an opportunity, and every opportunity into a bound policy, faster.

Referral volume

A modern experience doesn’t just retain customers, it creates advocates. Policyholders who love the ease of using your portal tell their friends. GloveBox makes it easy for them to refer others from inside the app. And because referrals route directly to the writing agent, it strengthens agent relationships while growing the book.

The Missing Piece: Building a Complete Experience

For most carriers, the back office is already covered. Policy admin systems handle the data. Service teams field the calls. Agent portals manage distribution. But the part actually seen and used by the policyholder, the front-end experience, is where things break down.

That’s the missing piece.

It’s not just about layering a client portal on top of what already exists. It’s about giving policyholders something they’ll actually use. That means no account numbers, no forgotten usernames, no waiting on hold. Just a branded, mobile-accessible experience that works in real time, every time.

Most default portals fail because they’re not designed with the policyholder in mind. They were built to satisfy backend system requirements, not real user needs. That’s why adoption is so low. That’s why service teams are still overwhelmed. That’s why clients leave.

A modern policyholder experience platform changes the equation. It connects to your existing tech stack, pulls in real-time data through APIs, and gives your clients access to what they need without ever picking up the phone.

More importantly, it removes friction from every part of the lifecycle:

- Faster onboarding

- Easy billing

- Seamless claims submission

- Real-time updates

- One-click document access

- Mobile-first design

It’s not about replacing what you’ve built. It’s about completing it.

The carriers that win in 2025 won’t be the ones with the biggest marketing budgets or the longest legacy. They’ll be the ones who gave policyholders an experience worth staying for, and worth recommending.

That’s the standard now. And if you’re not meeting it, someone else will.

The Future Is Already Here, Don’t Get Left Behind

The gap between tech-forward carriers and lagging competitors is no longer theoretical. It’s already widening. Carriers that adopt modern client experience infrastructure are expanding rapidly, growing across states, increasing retention, and capturing a larger market share. The ones that don’t? They’re stalling out.

Consumers now expect the same level of digital convenience from their insurer as they do from their bank, their food delivery app, or their airline. If they can check into a flight, split a bill, and access their investment portfolio from their phone in seconds, why should insurance still feel like a fax machine?

Carriers clinging to “status quo” experiences – outdated portals, login hurdles, and no mobile access – are running out of excuses. What used to be a nice-to-have is now a baseline requirement. And when prospective policyholders compare options, a poor experience can cost you the sale before price even enters the conversation.

Younger generations (Millennials, Gen Z) are aging into homeownership, car ownership, and more complex insurance needs. They’re digital natives, and they expect seamless, real-time service. They won’t tolerate a phone tree when their proof of insurance should be one tap away.

What’s coming next isn’t subtle. Over the next 12–24 months, the market will likely see a clear split between carriers that have invested in client experience infrastructure and those that have delayed.

The former will grow faster, spend less on support, and build stronger agent networks.

The latter will lose clients they could have kept, burn money on bloated service teams, and struggle to stay relevant in a tech-enabled market.

This is the trajectory of the industry. And the longer you wait, the harder it is to catch up.

Contact our team to learn more about how GloveBox can address your issues.