Insurance carriers don’t have a customer service problem. They have a workflow problem.

Every day, your team gets bogged down in repetitive service requests – ID cards, address changes, billing questions, and policy documents. None of these is complex. But they still clog up your phones, eat up your team’s time, and frustrate both agents and policyholders.

The worst part? These tasks shouldn’t be your team’s job in the first place.

Carriers are over-investing in bloated support departments to handle work that should be managed through smarter technology and proper routing. And in the race to retain policyholders, win broker loyalty, and grow distribution, that inefficiency is killing your margins.

The good news?

There’s a better way, one that clears 90% of Tier 1 requests off your plate, strengthens agent relationships, and doesn’t require replacing your policy admin system.

Let’s break down the real problem behind service overload and how to fix it without blowing up your ops.

TL;DR

Carriers aren’t losing ground because of bad service teams but because their best people are overloaded with Tier 1 work.

In this article, we covered:

- Why current carrier portals don’t reduce support volume (and often make it worse)

- How bad workflows push simple requests back to your internal teams

- The long-term cost of doing nothing—burnout, turnover, and slow growth

- How GloveBox redirects Tier 1 service to the right place automatically

- Why it’s faster, safer, and more cost-effective than building your own solution

You don’t need more CSRs. You need fewer reasons for clients to call you.

Let GloveBox handle the busywork, so your team can focus on what actually drives business growth. Talk to our team.

The Hidden Cost of Doing Nothing

Carriers aren’t “handling” service work – they’re drowning in it

Walk into any carrier’s service department and you’ll see it: overwhelmed CSRs, long hold times, and frustrated policyholders. Not because the work is hard, but because it’s endless.

Every ID card request, every billing question, every address change – these aren’t escalated issues. They’re basic tasks. And they hit your team all day, every day.

Some carriers have entire teams dedicated to just answering the phone for these types of requests. Others have 10+ CSRs making six-figure salaries, just to keep up. That’s not sustainable.

What’s more concerning is that 90% of this service volume is preventable. Most of it stems from poor tech workflows, outdated portals, or, most commonly, forcing agents and policyholders to call because there’s no easier way.

You’re not just paying for headcount. You’re paying for:

- Missed growth because your staff is doing low-leverage work

- High turnover because reps are burned out

- Frustrated agents who stop placing business

- Slower resolution times that reduce retention

Service requests are choking growth

Every minute a service rep spends sending ID cards is a minute they’re not onboarding a new client. Every agent answering basic questions is one more touchpoint away from quoting new business.

When the service volume is this high, your business becomes reactive. You aren’t building relationships but plugging holes.

And the kicker? Most carriers think the solution is hiring more reps. It’s not.

You don’t need more people. You need fewer requests.

Why Tier 1 Work Falls on the Wrong Teams

You hired experts. Now you’re asking them to send ID cards.

Let’s be clear: the reason your service team is overwhelmed isn’t because clients are more demanding. It’s because your tech stack is broken.

Here’s what happens today:

- A policyholder can’t log in.

- They need an ID card or want to update their address.

- They call your carrier’s support line.

- That request bounces around, sometimes from support to underwriting, sometimes from one department to another, until it finally reaches the agent who wrote the policy.

That’s a six-step workflow for a 15-second task. And it happens hundreds of times a day.

The root of the problem? A lack of self-service + direct routing

Carriers adopted policy administration systems (PAS) to power internal operations – claims, documents, billing, and compliance. And they work great for that.

But they were never built to be front-facing. The client portals most carriers rely on today are an afterthought. Many haven’t been updated in years. They require login credentials that no one remembers. They crash and lack core features.

So instead of enabling self-service, these portals funnel users straight to your call center.

Carriers aren’t tech companies. They sign up for PAS vendors that bundle in a portal because “it’s included,” not because it works.

However, these portals often fail at the most basic tasks, logging in, accessing documents, and submitting changes, which leaves your support team handling tasks that should never reach their desk.

Agents can’t help either because they don’t have access

It’s not just policyholders who are frustrated. Agents are, too. They’re being looped into service requests that should have gone directly to the client or that could have been handled automatically.

The most common pain point? Agents don’t have visibility. They lack a straightforward interface that enables them to track service tickets, view policyholder requests, or efficiently cross-sell.

So every time they get pinged, they’re starting from scratch: locating a document, formatting it, attaching it, and sending it, all while trying to manage their pipeline and hit growth targets.

This is the operational strain that GloveBox is built to eliminate. But before we get to solutions, let’s walk through why current portals fail, and how that failure is quietly costing you millions.

Why Current Carrier Portals Fail

Built for compliance, not experience

Most carrier portals weren’t designed with the end user in mind. They were built to check boxes: “We offer online access,” “We have a mobile app,” “We have a support system.” But they fail at the one thing that matters: giving agents and policyholders an easy, intuitive way to actually use them.

When GloveBox analyzed common PAS-based portals, the same patterns emerged:

- Login friction is sky-high. Most require policy numbers, zip codes, registration IDs, and email verification just to get in. For policyholders logging in once or twice a year, that’s a guaranteed call to your support line.

- Outdated UI/UX. Many portals haven’t seen a redesign in years. They crash on mobile. They’re not ADA-compliant. They break on certain browsers. It’s annoying and erodes trust.

- No embedded value. Even once inside, users often can’t perform basic tasks, such as changing addresses, updating drivers, downloading proof of insurance, or submitting requests directly. The portal is a passive display case, not a functional tool.

- Zero routing intelligence. If a client submits a request, where does it go? Often, nowhere. Or worse, it gets routed to a general support inbox, where a rep has to sort and re-assign it manually. That means delays, repeat calls, and wasted time.

Why does this hurt policyholders and agents

Policyholders today expect Amazon-level ease. They expect to log in with their phone number or email and instantly access their account. They expect to make changes in seconds, not call three departments.

When that doesn’t happen, frustration sets in and so does churn. People don’t just leave over premium. They leave because they had to wait 45 minutes to get an ID card. Or because the app crashed when they tried to submit a claim.

Agents feel the pain, too. Instead of focusing on quoting and relationship-building, they’re looped into Tier 1 tasks that the portal was supposed to handle. Every time a client calls them for a document or update, it’s because the carrier portal failed to deliver.

What portals should be, but aren’t

A true client portal is more than a login screen. It should:

- Offer real-time, synced access to billing, documents, and policy data.

- Allow clients to self-serve 80–90% of their needs.

- Route requests smartly, straight to the agent when it makes sense, or to support when needed.

- Be simple enough for anyone to use in under 30 seconds.

But traditional carrier portals don’t do this. They weren’t built for modern client behavior. Updating them is expensive, time-consuming, and outside most carriers’ technical capabilities.

That’s why GloveBox doesn’t try to fix them. It replaces their function entirely, without disrupting the PAS underneath.

Next, we’ll walk through how it works.

How GloveBox Solves the Problem

A layer, not a replacement

GloveBox doesn’t ask carriers to rip and replace their Policy Administration System (PAS). It functions as a layered solution, integrating with your existing infrastructure. That’s the first mental shift carriers need to make.

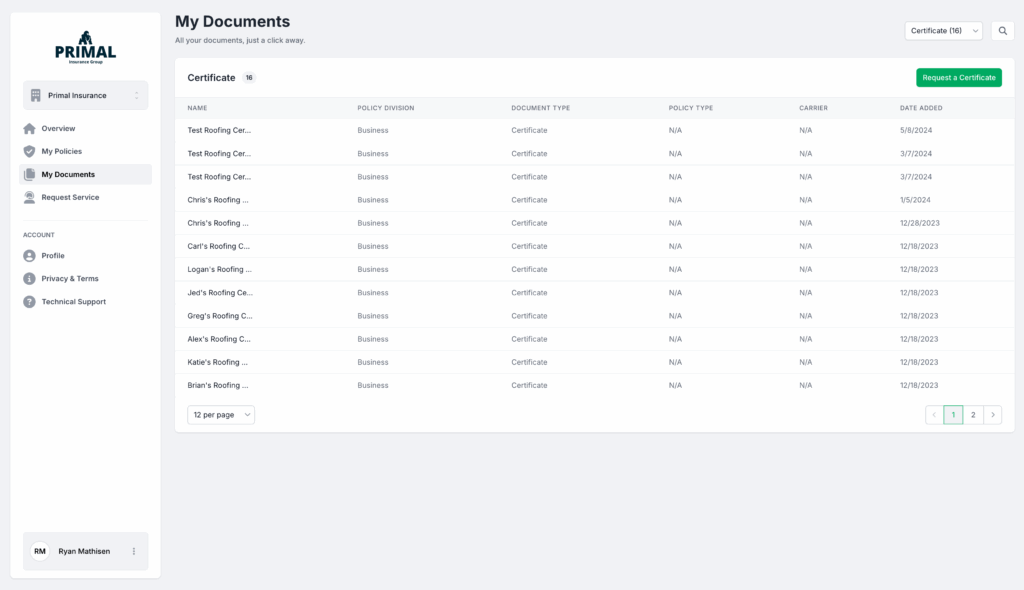

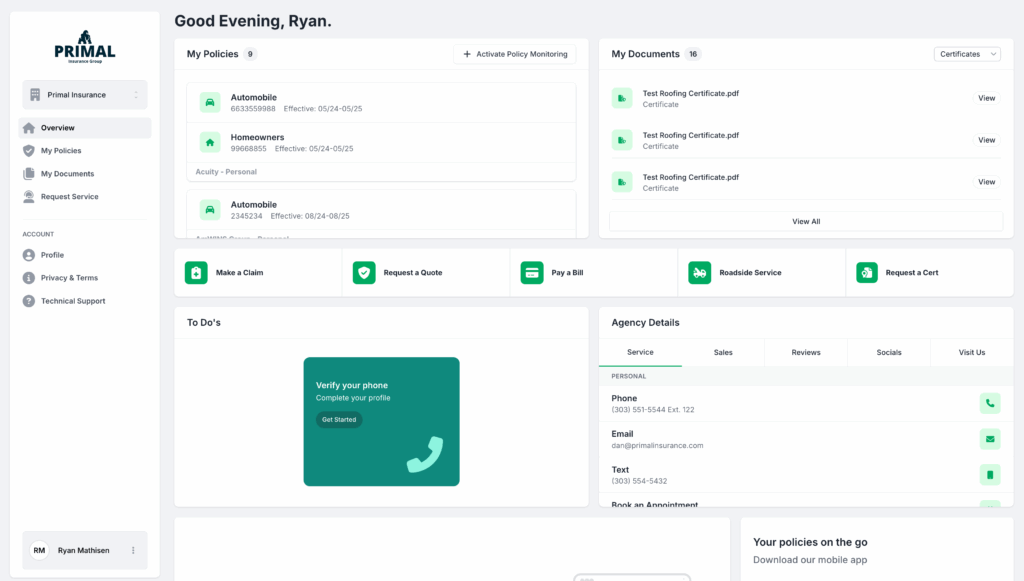

Instead of building something new from scratch or replacing an expensive PAS, GloveBox integrates directly into it. It pulls the data you already have, documents, billing, claims, and policies, and presents it through a modern, intuitive interface that clients and agents actually want to use.

Think of GloveBox as the missing front door to your carrier. The tech that turns your backend into a true experience.

Integration: Fast, secure, and PAS-compatible

GloveBox is already integrated with the most common PAS platforms like Duck Creek, Majesco, Guidewire, and Brightcore. It doesn’t require new APIs or complex overhauls. It leverages your existing data sources and API endpoints to display key information where it matters: directly on the client’s screen.

Here’s how the workflow changes:

- Clients log in via email or phone number. No more policy numbers or zip codes. Multi-factor authentication makes it secure and instant.

- Documents, billing, ID cards, and more populate in real-time from your PAS.

- Policyholders can self-service instantly: update addresses, download forms, initiate claims, and request quotes.

- Agents have a personalized portal showing only their clients. When policyholders need something, it routes straight to their writing agent, not to a general inbox.

- You control the workflow. Want address changes to be directed to internal support, but quote requests to be routed to the agent? Done. Every transaction type can have its own routing logic.

Zero burden on carrier teams

One of the biggest fears carriers have with new tech is implementation fatigue: “How many meetings will this take? How much lift from my team?”

With GloveBox, implementation requires a single technical review. From there, GloveBox’s engineering team handles the entire build, with customization options based on your desired look, feel, and routing preferences.

There’s no need to pull in your internal dev team, hire outside engineers, or run a multi-year internal tech project. Most setups are completed in 6–9 months, rather than the usual 2–3 years.

The agent and policyholder win simultaneously

What makes GloveBox unique is that it isn’t just built for policyholders but for agents, too.

Policyholders get one login that shows them all their policy data, documents, and billing in a mobile-optimized, intuitive portal.

Agents get a book-of-business dashboard for every policy they’ve written. They see when a client logs in, downloads a document, or submits a request.

Both sides reduce friction. Clients don’t need to call for help, and agents don’t need to chase files or get blindsided by service tickets. This dual-view model is what finally aligns the client-carrier-agent triangle in a way most PAS tools never could.

Designed for today and tomorrow

The GloveBox platform isn’t a patch or a band-aid. It’s built for where insurance is going: full white-label branding, native mobile apps, embedded marketplace for cross-sells, referral modules for client-led growth, and dynamic workflows that evolve with your needs.

You’re solving a service issue and building a scalable client experience that unlocks retention, referrals, and revenue.

Proof It Works

Theoretical tech is easy to promise. Real results are harder to fake.

That’s why the value of GloveBox isn’t just in what it’s built to do. It’s in what it’s already doing.

Carriers and agencies using GloveBox aren’t making guesses. They’re seeing measurable outcomes that solve the exact problems this article has laid out: overwhelmed service teams, clunky policyholder experiences, and agents slowed down by Tier 1 work.

Let’s look at what that looks like in the real world.

Gaudette Insurance: 60% adoption, 50% fewer tickets

Gaudette Insurance is a multi-location, family-run agency facing a familiar challenge: an overloaded service team that fields too many calls, emails, and document requests.

Their old system wasn’t broken. It just wasn’t built for modern client expectations.

After rolling out GloveBox and using the guided launch campaigns to drive real adoption, they saw immediate change:

- 60% of clients now self-serve

- Tier 1 ticket volume dropped by half

- Their team could finally shift from reactive support to proactive client relationships

This wasn’t just about offering a portal. It was about making it work – for clients, for CSRs, and the long-term health of the agency.

Wells Insurance: Serving 8,000 clients with 40+ CSRs without burning out

Wells Insurance had a scale of 8,000 clients, four generations of trust, and over 40 service staff.

What they didn’t have was efficiency. No mobile app, no self-service. Clients had to call for everything – billing, ID cards, renewals. That meant more tickets, longer calls, and an aging support infrastructure that couldn’t keep up with client expectations.

GloveBox was implemented without disruption. The GloveBox team handled onboarding, setup, and ongoing support. No need for an internal PM. No need to overhaul the PAS. And immediately, the results kicked in:

- Clients could download ID cards and check billing instantly

- Call volume dropped

- Service teams got breathing room

- And the agency didn’t sacrifice its personal touch

Wells modernized without losing what made them successful for 100+ years.

GloveBox with carriers: What the numbers tell us

While full ROI data from all carrier partners is still in development, we know from internal usage data and agency feedback that the effects are tangible:

- Self-service adoption frequently hits 50–60% across books of business

- CSR capacity triples in many agencies, because requests disappear

- Client retention increases 6–10x, year over year, when portals are used regularly

- Service ticket volume drops, sometimes cutting 30–50% of workload overnight

And most importantly, GloveBox doesn’t create a risk of getting those results. There’s no PAS replacement. No core system disruption. No need to pull internal tech teams into endless sprints. You get better performance, without breaking the infrastructure you’ve already built.

The Bottom Line

Most carriers aren’t struggling because of poor service teams. They’re struggling because those teams are stuck doing work that shouldn’t exist in the first place.

When 90% of service requests are Tier 1, when agents can’t focus on writing business, and when CSRs burn out handling what clients could easily do themselves, it’s not a personnel problem. It’s a process problem.

GloveBox solves that, not by replacing your core systems, but by connecting them to the people who need them.

It gives policyholders real-time access. It routes requests where they belong. And it clears your service backlog without hiring another representative or building a new portal from scratch.

This isn’t a nice-to-have. It’s the difference between scalable growth and staying stuck.

Schedule a call with our team.