Your policy admin system isn’t the problem, but it’s not the whole solution, either.

Carriers have invested millions into platforms like Duck Creek, Majesco, Guidewire, and others – rightfully so.

These policy admin systems (PAS) are essential for managing data, processing policies, and routing internal workflows. They’re the operational backbone of the insurance industry.

But while your PAS keeps things running on the back end, it likely leaves a major gap on the front end. What’s it actually like for your agents and policyholders to use your system?

The truth is, that most policyholder portals that come bundled with PAS platforms are clunky, outdated, and poorly adopted.

They’re hard to log into. They lack core self-service functions and weren’t built with today’s digital expectations in mind.

And that’s where things start to break down.

Support calls skyrocket. Agents get bogged down with Tier 1 requests. Retention suffers. Growth stalls.

Modernization doesn’t mean ripping out what works. It means reinforcing it with tools that fill the gaps.

That’s where GloveBox comes in.

It doesn’t replace your PAS but complements it. It layers on top to deliver the user experience your clients and agents have been asking for all along.

TL;DR

Policy Admin Systems are essential but incomplete. They manage data, not experience. And that gap creates unnecessary service volume.

GloveBox doesn’t replace your PAS. It layers on top to modernize your portal, boost client adoption, and give agents back their time.

In this article, we covered:

- What PAS systems like Duck Creek and Majesco do well—and where they fall short

- Why “we already have a portal” is no longer a valid excuse

- How GloveBox integrates directly with your PAS without disruption

- Real case studies of agencies slashing support volume and increasing retention

The infrastructure’s already in place. Now it’s time to make it work for the people who use it.

Schedule a GloveBox demo.

What Your PAS Is Actually Built to Do

Every carrier and MGA needs a policy administration system (PAS). It’s not optional.

It’s the central nervous system of your organization, the platform that manages policy issuance, endorsements and renewals, rating and quoting, claims data, regulatory compliance, etc.

Think of it as the backbone of internal operations.

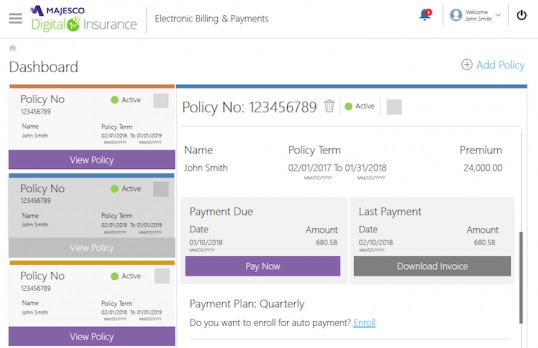

Systems like Duck Creek, Majesco, Guidewire, and BriteCore were built to streamline underwriting workflows, centralize policyholder data, and enforce process controls across business units. They bring structure to complex organizations, ensuring accuracy, auditability, and scalability.

That’s why implementation is so expensive and so critical.

It’s not uncommon for carriers to spend years and millions of dollars configuring and integrating a PAS. APIs are mapped, workflows are re-engineered, and IT teams are built around them. A successful PAS rollout is the foundation for operational longevity.

But that same strength is also a limitation.

These systems were built to serve carriers, not clients. They weren’t designed for the agent sitting in a storefront or the policyholder trying to pull an ID card on a Tuesday night.

They’re secure and accurate, but not intuitive.

And when the agent or client experience suffers, the business suffers. That’s where the disconnect begins.

The Front-End Gap PAS Platforms Can’t Solve

Policy admin systems weren’t designed to be front-end experiences. They weren’t built for client logins, mobile usability, or Tier 1 service interactions. And when carriers try to bolt on a portal or app as a checkbox feature, the cracks start to show.

Most PAS platforms include some kind of customer portal. But here’s what we’ve consistently seen:

- They’re hard to access. Logging in typically requires an account number, policy number, zip code, and a password the client forgot 11 months ago. It creates frustration and leads to unnecessary service calls.

- They’re clunky and outdated. A quick scan of App Store reviews tells the story – frequent crashes, poor responsiveness, features that don’t work on mobile, and an overall experience that feels a decade behind.

- They offer minimal functionality. At best, users can view basic policy info. Need to update an address? Request a quote for a second vehicle? Refer a friend? Good luck.

The result: clients give up and pick up the phone. What should have been a 30-second task, like downloading an ID card, becomes a 20-minute call to your support team. That volume stacks up fast, especially for large books.

And agents aren’t immune either. If they need to retrieve a document, they log into multiple systems, download PDFs, open emails, and manually send data that should have been client-accessible from the start.

These inefficiencies are not because your PAS is broken. They exist because it wasn’t built for this part of the journey.

The mistake is assuming that your PAS can also serve as your experience platform. It can’t. Not well. That’s like expecting your accounting software to handle your CRM. Different jobs require different tools.

So when a carrier says, “We already have Duck Creek” as a reason not to modernize, they’re missing the point. You don’t need to replace your PAS, but you do need to complement it.

That’s where the conversation shifts from replacement to reinforcement.

What Carriers Risk by Doing Nothing (The Hidden Cost of “Good Enough” Tech Stacks)

Most carriers recognize that their portals could be improved. However, many still hesitate to act, either because they’ve already spent millions on a PAS upgrade or because they assume clients and agents will tolerate a few extra steps.

The truth? That hesitation is more expensive than you think.

1. Policyholder churn

A poor experience frustrates and drives attrition. When clients can’t easily find their documents, pay a bill, or make a change, they start looking elsewhere. Not because of price. Because of friction.

Clients compare your digital experience to Amazon, not to other carriers. If your app crashes, if your portal feels like a relic, they don’t complain – they leave. And the cost of replacing a lost policyholder is 5–7x higher than keeping one.

2. Agent frustration

Every friction point in your workflow creates one for your distribution partners, too. Agents already juggle multiple carriers, each with its own portal, process, and idiosyncrasies.

If your platform takes longer, requires more service follow-up, or feels like extra work, they’ll deprioritize you. We’ve heard it directly from agents: “I send more business to the carrier that has GloveBox because it’s just easier for me and my clients.”

If you’re trying to grow through independent agents, their experience matters just as much as the policyholder’s.

3. Overbuilt support teams

Carriers who haven’t solved the front-end problem tend to solve it the old-fashioned way – by hiring. More CSRs, more internal support roles, more people answering phones and chasing documents.

That creates massive overhead, and the irony is that none of those people are addressing the root issue. They’re just putting out fires caused by outdated workflows and broken UX.

GloveBox clients have reduced Tier 1 service volume by up to 60%, unlocking 6–7-figure cost savings and freeing teams to focus on higher-value work.

4. Slower growth, less profit

When your internal teams are overloaded, your agents are bogged down, and your policyholders are annoyed, you’re not growing. You’re treading water.

And when your competitors invest in better tech, they grow faster and leaner. That means better margins, stronger retention, and more capital to reinvest.

So no, sticking with your “good enough” portal isn’t a neutral decision. It’s a compounding drag on every part of your business.

How Does GloveBox Make Your PAS Better

Carriers have invested millions in systems such as Duck Creek, Majesco, Guidewire, and others. These PAS platforms are robust, deeply integrated, and essential to daily operations. So when a vendor like GloveBox enters the conversation, there’s one immediate concern:

“We already have a PAS. Why would we need this?”

Here’s the answer: GloveBox isn’t here to replace your core system. It’s here to make it usable by your clients, your agents, and your service team.

The role of PAS: Built for internal operations

Your policy administration system is designed for backend control – policy data, billing workflows, documentation, and compliance. It does that job well. But it was never designed to provide a smooth, modern user experience to agents or policyholders.

In fact, most PAS systems offer only a generic, outdated portal experience (if they offer one at all). Logging in requires obscure credentials. Interfaces are clunky. Updates are rare. And most portals force clients to make a phone call anyway.

That’s where GloveBox comes in.

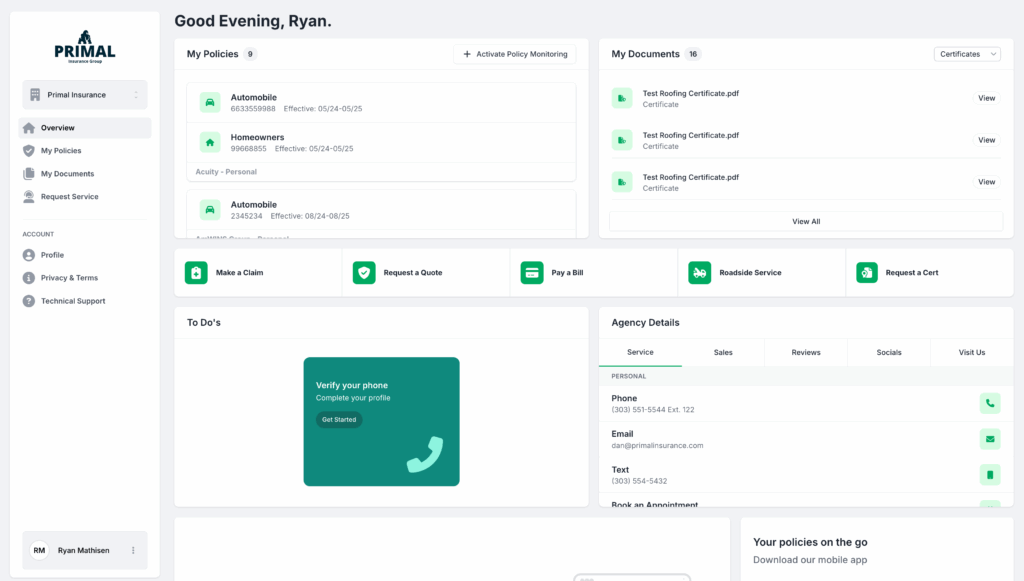

GloveBox: The experience layer your PAS is missing

GloveBox sits on top of your PAS, not as a replacement, but as a purpose-built experience layer. Through secure API connections, it pulls in real-time data from your PAS and presents it in a modern, branded portal that both policyholders and agents can actually use.

Instead of having three separate logins for billing, claims, and document access, users enjoy a unified experience. Log in once, by phone or email, and access everything instantly.

What’s more, GloveBox keeps syncing with your PAS in the background. Documents, policy updates, and service changes appear automatically. There’s no double entry. No workarounds. Just one consistent, easy-to-use front end.

Custom workflows, not one-size-fits-all

Every carrier works a little differently. GloveBox is designed to adapt.

Need service requests to go to your internal team? Done. Do you prefer that change requests be routed back to the writing agent? No problem. Want billing to always route through your system, but keep document access in the portal? We’ll configure it.

GloveBox doesn’t force you into a rigid workflow. It fits the one you already use and improves it.

Built by insurance pros, not just engineers

Most carriers who try to build their own front end find out the hard way: it’s not just about design or development. It’s about understanding the insurance workflow.

GloveBox isn’t a general-purpose tech company. It was built by insurance professionals who have also founded an agency. The product reflects that DNA. Everything is tailored to how real agents, carriers, and policyholders interact every day.

Implementation without the pain

PAS implementations take years. GloveBox takes months.

With a dedicated integration team, prebuilt API connectors, and SOC 2 compliance already in place, onboarding is fast and low-risk. One technical review call is often all it takes to get started. From there, our team handles the buildout, customization, and launch support.

Proof It Works

Carriers are understandably skeptical about adding new technology. They’ve seen promises fall flat. They’ve been burned by long implementations and underwhelming adoption.

Then, they try to rewire the entire system. That’s where most modernization projects fail.

That means years of planning, seven-figure budgets, and endless integration delays.

With GloveBox, none of that is required.

Carriers keep their PAS. Agents keep their workflows. What changes is what the client sees and how efficiently your teams operate.

GloveBox works because it was built to work with your existing infrastructure, not against it.

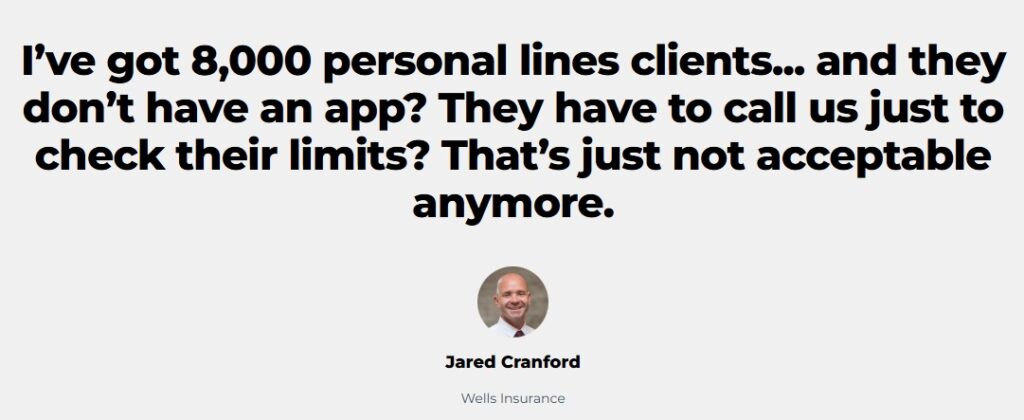

Case in point: Wells Insurance

A 105-year-old agency with 8,000+ clients and more than 40 service staff. Until recently, they had no app. No self-service. Every billing question, ID card request, and policy update went through their internal team.

Then they implemented GloveBox.

The onboarding was fast, and no internal project manager was needed. The GloveBox team handled the setup. Clients now access billing, ID cards, and policy info on their own.

The result? Fewer calls. Faster service. Happier staff.

And critically, they didn’t lose their human touch. They just removed the friction that had been weighing everyone down.

Case in point: Gaudette Insurance

Before GloveBox, Gaudette Insurance had a growing volume of support tickets and a growing frustration among both clients and staff. Their team was overwhelmed with simple, repetitive requests: ID cards, billing inquiries, and document access.

After implementing GloveBox with full support from the onboarding and success teams:

- 60% of clients adopted self-service

- 50% reduction in Tier 1 service tickets

- CSRs got their time (and sanity) back

GloveBox didn’t just lighten the workload. It helped Gaudette reimagine how a 7-location agency could scale without adding chaos.

No rip-and-replace. No portal rebuild. Just real results.

The Bottom Line

Carriers don’t need to rip and replace their PAS to deliver a modern experience. They just need to acknowledge what those systems were built for and where they fall short.

Your PAS is great at handling internal operations, workflows, and compliance. But it wasn’t designed for modern client expectations or the agents trying to serve them.

That’s where GloveBox comes in.

It’s not a system overhaul. It’s a simple, secure, low-lift layer that transforms how agents and policyholders interact with your brand, without changing a single core system.

Carriers using GloveBox experience fewer service requests, faster quoting, higher retention rates, and improved adoption. And they achieve this without disrupting their current infrastructure.

It’s not about changing what works but about making what works deliver more.

Ready to modernize your policyholder experience without ripping out your PAS?

Schedule a GloveBox demo.