Marketing for insurance companies has changed.

Old-school tricks like networking events and business cards don’t work like they used to.

Today, insurance is sold online. It’s sold on phones, in videos, and through local search.

Most agencies still follow the old ways. That’s why they struggle.

But the ones that are growing fast? They use content, ads, tools, and smart partnerships to get more leads and sell more.

In this guide, we’ll break down everything you need to know about doing marketing for insurance companies.

Simple. Clear. No fluff.

Let’s get started.

Stop Selling Like It’s 1995 – Go Digital Instead

In the past, most insurance agents grew by shaking hands, showing up at local events, and relying on word of mouth.

That worked back then, but not anymore.

People don’t wait for an agent to show up at their doors. They Google. They scroll on Instagram. They watch videos.

If your agency isn’t online, it doesn’t exist.

Going digital doesn’t mean giving up on local. In fact, local still matters a lot. But now, local happens online.

People search for “home insurance in Phoenix” or “auto policy near me.” They check your Google reviews. They click your website. They check your Instagram to see if you’re active.

That’s how they decide if they can trust you.

To grow today, your agency needs to show up in local search results, run local ads, and post content your community cares about.

Modern insurance marketing is both local and digital. You can’t pick just one.

Customers buy from the insurance agencies they trust. And to build that trust, you need to “appear” in front of them wherever they go.

We call it “omni-channel” marketing. You need to be on the first page of Google. You need to be present in their social feeds. They need to get “recommendations” about you.

So, how do you do all of this?

That’s what we’ll cover in this article. First, let’s start with the 4 pillars of marketing for every insurance agency.

The Four Pillars of Marketing for Insurance Agencies

If you want to grow your insurance agency, you need a system. Not random tactics.

There are four main ways to bring in more customers and grow your book of business:

- Content marketing

- Paid ads

- Cross-selling

- Referral marketing

These four work best when used together.

Content builds trust.

Ads bring traffic.

Cross-selling gets more from what you already have.

Referrals bring warm leads.

Now, let’s break down (on a high-level) every marketing pillar for an insurance company, and later, we’ll explore exact strategies & tactics for each of these pillars.

Content Marketing for Insurance Companies

Content is how people find you, trust you, and remember you.

It’s not about going viral. It’s about showing up often and providing value.

There are a few content types and channels that you can use as an insurance agency:

Content Types:

- Blog posts

- Facebook/Instagram/LinkedIn posts

- Short video clips (for Reels and TikTok)

- Longer, educational videos (for YouTube)

- Lead magnets that you can share to prospective insureds (but more on that later)

These content types can be shared on different channels (what channel you’ll use depends on whether you’re selling to customers or businesses):

- Your website (for Google search optimization (SEO) purposes)

- TikTok

- YouTube

But how do you create content your prospective customers will love to consume?

Start with what people care about.

Think local. Think about real problems they’re facing day-to-day.

Post things like:

- Tips for saving money on car insurance in your city

- What to do after a hailstorm

- How home insurance works in your state

- Common questions (and answers) your clients ask you every week

Record short videos. Use reels or TikToks. Keep them under 30 seconds. Talk to the camera like you’re helping a friend.

Gibb Agency does a good job with their blog and publishes 3-5 new articles every month:

YouTube works great for longer content.

Make videos that answer more significant questions like:

- What home insurance do I need in [Your City]?

- Auto insurance myths most people believe

- 3 ways to lower your insurance bill right now

Always say where you’re based. Make it clear you’re local. Say things like: “I’m an insurance agent here in Dallas…”

How to create a lot of content without consuming too much time

Creating different types of content for multiple channels will consume a ton of time and resources you probably don’t have on your disposal (all of this costs time and money).

Fortunately, with a good system, you can create a lot of content with multiple formats.

We recommend first creating the long-form video content for YouTube.

Pick a topic and record it.

Once you record that video, there are two things you need to do:

- Get a transcript and use that transcript to quickly create a blog post

- Use that video to create 5-10 short clips out of that one video

This way, from one long-form video, you quickly have 15-20+ content pieces for different channels.

Here’s the high-level overview of the process:

Paid Ads for Insurance Agencies

Paid ads help you get in front of the right people fast.

There are two main ways to run paid ads:

- Facebook/Instagram ads

- Google Ads.

Facebook and Instagram work great for local B2C leads.

You can target people in your city or zip code. Run simple ads like:

“Car insurance rates going up in [City]? We’ve got more options.”

“Buying a home in [City]? Don’t forget to get covered.”

You can also use paid ads to distribute lead magnets (i.e. calculate how much your home insurance can cost), and in exchange, you get their email and phone numbers, which you can use to follow up with them and seal the deal.

Use clear images. Show your face if possible. Keep your message short and direct.

You don’t need fancy videos. Just be real and local.

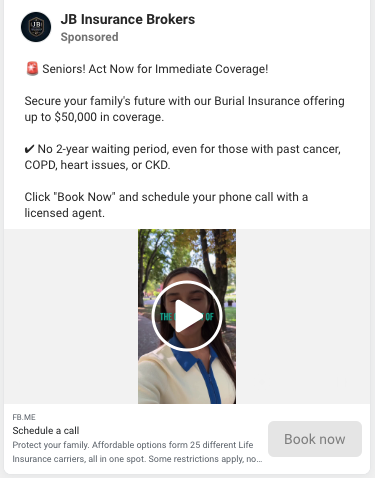

Here’s a good Facebook ad example by JB Insurance Brokers. It is video-based, but it also features nice and crisp offer in the description:

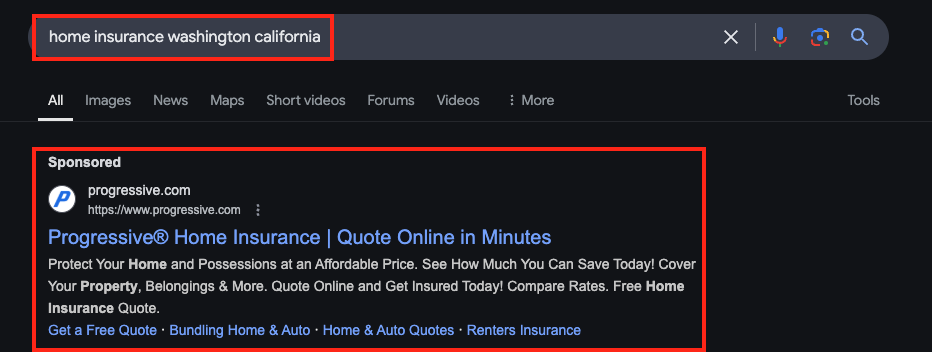

Google Ads are perfect for targeting people already looking to buy insurance.

If someone types “business insurance in Austin” or “motorcycle insurance quote,” you can be at the top.

It works for both B2C and B2B.

Want an edge? Run ads for niche policies in specific areas like:

- Classic car insurance Wisconsin

- Fire insurance California

- Short-term rental coverage Washington

There’s less competition in those spaces, and it’s easier to stand out.

Paid ads are powerful, but only if you follow up fast. If someone clicks your ad and fills out a form, don’t wait hours to reply. Call them right away.

Speed wins.

Cross-selling for Insurance Companies

Cross-selling means selling more policies to the clients you already have.

It’s the easiest way to grow. You don’t need to chase new leads. You just need to talk to people who already trust you.

If someone has home insurance with you, offer them auto.

If they have auto, offer them renters.

If they’re a business owner, offer them workers’ comp or general liability.

Most agencies ignore this. But it’s where the money is.

How do you make cross-selling easy and automatic? Use GloveBox.

GloveBox helps you find cross-sell chances inside your current book of business. It knows what your client has – and what they don’t.

If a client opens the app to check their policy, GloveBox can show a smart offer right there.

For example:

“Add auto insurance and save $200/year.”

The client clicks. You get the lead. It’s all automatic.

Cross-selling works. And with the right tools, it works without lifting a finger.

Referral Marketing for Insurance Agencies

Referral marketing is when your happy clients send new customers your way.

It works because people trust people. A warm referral is always better than a cold lead.

The best part? These leads already believe in you before you even talk to them.

But most agencies don’t make it easy to refer. They hope it happens. They never ask. And they lose out.

Fortunately, you can automate this process with GloveBox.

GloveBox has a built-in referral feature. Your clients can tap a button in the app and send your info to a friend by text or email.

It’s fast. It’s easy. No one has to look up your number or search your website.

You get a notification when a referral comes in. You follow up right away.

Referral marketing works best when you ask for it. After a claim is handled. After a policy is bound. After someone says, “Thank you.”

That’s the moment to say, “If you know anyone who needs help with insurance, just tap the referral button in your app.”

You can also offer different incentives for existing clients for referring you to their peers and friends.

So far, we’ve covered four main marketing strategies for insurance companies. But now, let’s dive a bit deeper into them and explore different marketing tactics and playbooks you can use as a part of these strategies.

4 Marketing Playbooks and Tactics for Insurance Agencies to Get More Customers

1. Win Locally with Laser-Focused Targeting

Insurance is a local game.

People want someone who knows their area. Someone nearby. Someone real.

That’s why your marketing should speak to your town, your city, and your streets.

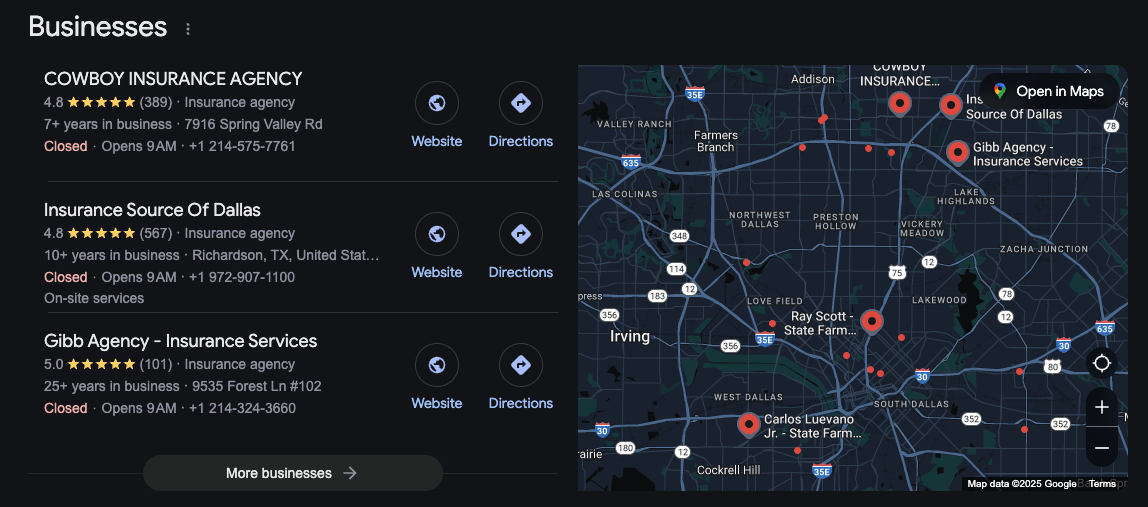

Start with Local SEO

Make sure your Google Business Profile (GMB) is claimed, updated, and active. Add your address, phone number, and hours. Add photos. Ask happy clients to leave reviews.

This helps you show up when someone searches “insurance agent near me.”

Also, when writing blog posts, make sure to write articles targeting keywords that follow this formula:

[insurance type] [city]

[insurance type] [agency] [city]

[insurance type] [broker] [city]

[insurance type] [state]

[insurance type] [agency] [state]

[insurance type] [broker] [state]

Variations with the prefix “Best”

For example:

- Home Insurance Arizone

- Best life insurance Chicago IL

- Auto insurance agency Boston

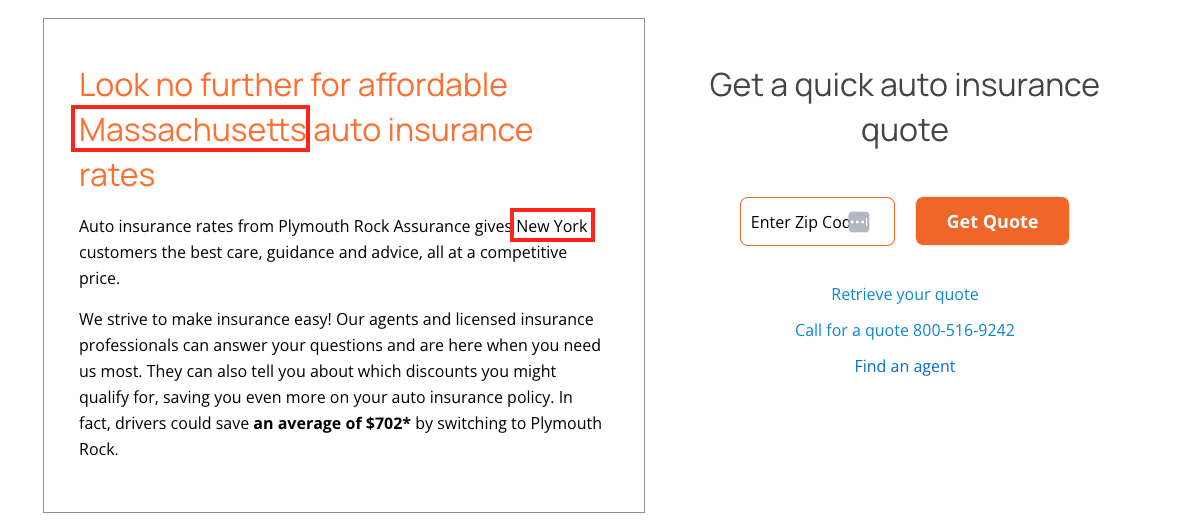

Here’s an example of how one insurance agency from New York used “geotargeting” inside their website copy:

Use geotargeted ads and social media posts

On Facebook, Instagram, and Google, you can target by zip code or city. That way, you don’t waste money on people outside your area.

Write ad copy that sounds local. For example:

“Protect your home in St. Louis”

“Top-rated car insurance for Austin drivers”

You can also mention landmarks or other “locally-relevant” things in your posts and videos.

Talk about the weather, the traffic, the schools – anything that makes people think, “Yep, they’re from here.”

Local trust starts with local talk.

Don’t try to sound big. Try to sound close.

2. Build Referral Engines That Bring You Insureds

Referrals don’t have to be random.

You can build a system that brings in warm leads every single month.

Start with partnerships.

Find local professionals needing insurance to close deals (or businesses that serve complementary customers/insurance is a good add-on), such as real estate agents and loan officers.

They already talk to people buying homes, getting loans, and starting businesses. All those people need insurance.

Build a simple deal – You send me your clients. I take care of them. I will send some your way, too.

But how can we take that to the next level as well?

Run ads to get leads for them. For example, run Facebook ads to find people looking for mortgages. Give those leads to your loan officer partner.

In return, they send you all their home insurance business.

Now, you’re not just asking for referrals – you’re bringing them value first.

GloveBox makes this even easier.

With GloveBox, clients can send referrals right from the app. No need to search for your number or email.

It also tracks the referral, notifies you right away, and keeps everything in one place.

So, instead of chasing leads, you can build a steady flow of warm introductions month after month.

3. Stand out with client portals & use the client experience platform

Every insurance agency sells the same thing.

Same policies. Same prices. Same coverages.

So why should someone choose you?

You stand out by how you serve, how you sound, and how you show up.

Start by embracing new technology.

Most agencies still do everything by phone, PDF, or email. It’s slow and messy.

Instead, use GloveBox to offer your customers branded client portals and also save over 40% of your time servicing those clients (since with the client portal, clients can do all the basic tasks by themselves – ask for new insurance, provide needed documents, etc).

With GloveBox’s client portal, your insureds can:

- Access their policies anytime

- Download documents without calling you

- Request service or make changes on their own

It’s like giving them a self-service bank app – but for insurance.

That experience sticks. People remember it. And they talk about it.

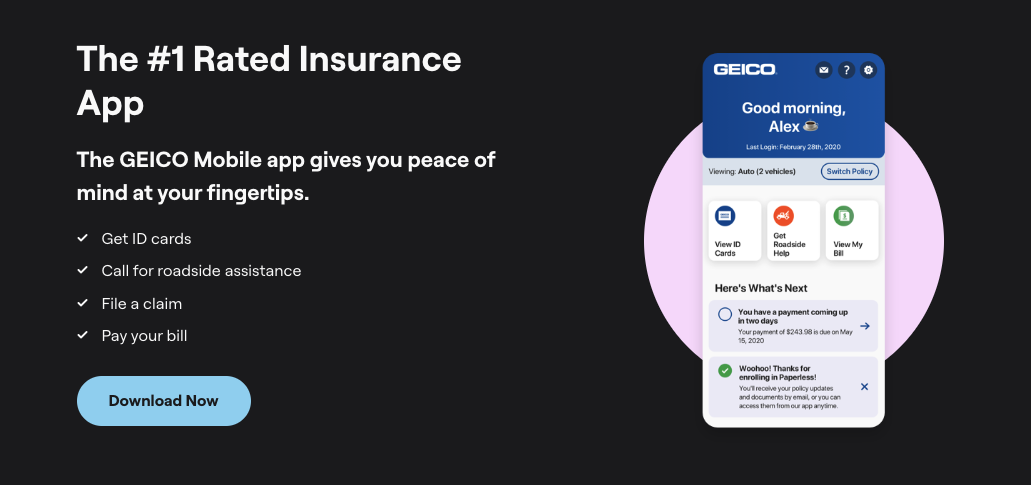

For example, Geico insurance agency is using the fact that they have a custom-branded app for clients as one of the main unique selling points:

It makes them stand out from the competition and get more clients.

Besides this, GloveBox’s client experience platform for insurance companies also helps you to:

- Reduce your costs and time servicing existing customers by over 40%

- Avoid doing repetitive tasks and customer support every single day

- Automatically cross-sell other policies to existing customers

- Automatically ask your existing customers for referrals

- And more…

GloveBox is perfect for insurance companies that are currently draining and wasting a lot of time handling client requests.

If you want to solve those problems and make your insurance company stand out in your local market, book a free demo with GloveBox.

4. Sell with Storytelling, Copywriting, and Fear

Good marketing isn’t just facts and prices.

It’s stories.

It’s emotion.

It’s showing people what could go wrong – and how you help them stay safe.

Fear works. That’s what insurance is built on.

People buy policies to avoid pain. To avoid loss. To protect what they care about.

Use that in your message.

Make the bad guy clear.

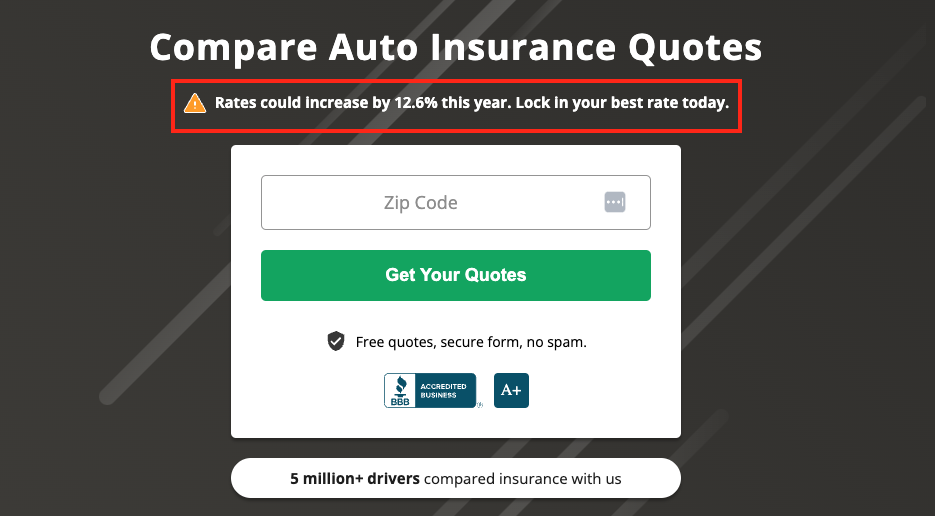

- For personal lines (B2C), the boogeyman is often the carrier. “Rates are going up. Big companies don’t care. But we have more options.”

- Or it’s other agents. “The other guy hasn’t called you in years. He doesn’t know your life has changed. We check in, we adjust, we care.”

- Also, focus on fears. “What would happen with your life if your neighbour’s house gets on fire, and the fire spreads to your house?”; “You just bought that new car, it would be a shame someone scratch it on the parking lot”.

Here’s the example of how one insurance company used insurance carriers as the “boogeyman”:

For business insurance (B2B), focus on risk.

Most business owners don’t realize how exposed they are.

And their current broker? Probably lazy. No follow-up. No strategy. No plan to reduce risk.

Your job is to show the danger and offer the solution.

Tell stories.

“Last month, a client came to us after their old agent missed a major coverage gap. One claim, and it would’ve cost them $75,000. We fixed it the same day.”

Real stories sell. So do strong words. Don’t say “we’re here to help.” Say “we protect what matters the most.”

The Bottom Line

Marketing for insurance companies has changed.

If you’re still relying on old-school tactics like networking and cold calling, you’re falling behind.

Here’s what works now:

- Go digital. Show up where your customers scroll and search.

- Focus on four pillars: content, ads, cross-selling, and referrals (you don’t need to do all of them from the get-go).

- Make your content short, sharp, and local. Offer value to your potential customers.

- Use paid ads to get leads fast – especially with smart targeting.

- Cross-sell your current clients. It’s the lowest-hanging fruit. Use GloveBox for this.

- Build strong referral systems with partners and tools.

- Stand out with tech, personality, and clear messaging.

- Use fear and storytelling to speak to real problems.

- Make content that works on every platform – from Reels to YouTube.

- Only use lead magnets if you know how to follow up the right way.

And most importantly – don’t try to do it all manually.

GloveBox helps you automate the hard parts.

From in-app referrals to cross-sell offers to a smooth client portal – GloveBox gives your agency the tools to grow faster with less effort while also reducing your service costs by over 40%.

Want to see how it works?