Starting an insurance company has never been simple, but in 2025, the challenge is more complex (and the opportunities are bigger) than ever before. Regulations are tighter, technology expectations are higher, and clients are less forgiving of outdated experiences. At the same time, capital is flowing into the industry, niche markets are opening up, and digital tools make it possible for even lean teams to scale faster than agencies of the past.

What hasn’t changed is the foundation: you still need licensing, capital, and a clear business model. But what will define success for the next generation of agencies is how well they build operational infrastructure from day one. The agencies that thrive aren’t the ones that simply write policies quickly. They’re the ones that design efficient processes, adopt the right technology stack, and deliver a seamless client experience.

This guide is designed to be your blueprint. We’ll cover every stage of starting an insurance company, from regulatory hurdles and staffing strategy to building out the tech stack that keeps you competitive. Along the way, you’ll see where new founders often go wrong, what today’s benchmarks look like, and how the smartest startups are turning efficiency into valuation growth.

By the end, you’ll understand not just how to launch, but how to build an agency that scales, attracts investment, and survives the next decade of industry disruption.

TL;DR

Starting an insurance company in 2025 requires more than capital and carrier appointments.

In this article, you’ll learn:

- The regulatory and financial requirements every new agency must meet

- Why operational efficiency, not just revenue, is the real growth driver

- How to structure sales and service teams without burning out CSRs

- The distribution strategies that actually scale (and why retention beats chasing new sales)

- How efficiency links directly to EBITDA and valuation multiples

- The most common mistakes new agencies make, from bloated service staff to in-house tech failures

- Why GloveBox is the essential client experience layer for modern agencies

The winners in 2025 won’t be the loudest or the largest. They’ll be the agencies that build scalable infrastructure, focus on retention, and deliver a modern client experience from day one.

Schedule a GloveBox demo to design your client experience layer today.

Laying the Groundwork – Regulatory & Capital Requirements

Every insurance agency begins with the same foundation: compliance. Before you can sell your first policy, you need to understand the rules that govern how agencies operate and prove that you have the financial stability to back your business. Skipping steps here can slow you down and potentially sink your agency before it even starts.

Licensing and legal structure

The first step is choosing how your agency will be structured: independent agency, managing general agency (MGA/MGU), or niche boutique. Each has different compliance needs. Independent agencies typically need state-level licensing for producers and the entity itself. If you’re leaning toward an MGA/MGU model, you’ll need additional authority from carriers to underwrite, bind, and sometimes even handle claims.

Licensing is state-specific in the U.S. That means if you want to operate in multiple states, you’ll have to secure non-resident licenses for each one. Most agencies start local and expand gradually. Skipping this planning can create expensive compliance headaches when growth opportunities arise.

Capital and financial requirements

Unlike carriers, agencies don’t need hundreds of millions in statutory reserves. But you still need capital. States often require proof of financial responsibility to issue licenses, and carriers won’t partner with an agency that looks underfunded. Most new agencies should plan on having at least $50,000–$150,000 in startup capital, which should cover licensing, technology, E&O insurance, and early payroll expenses.

The real key is working capital for the first 12–18 months. Commission revenue ramps up slowly, especially in commercial lines, where sales cycles can stretch over months. Without sufficient capital to cover salaries and operating costs, agencies often find themselves stuck in a state of survival before they can build momentum.

Errors & omissions (E&O) coverage

Every agency needs E&O coverage from day one. This isn’t optional. Carriers require it, and it’s the only safety net protecting you if a mistake, like failing to bind coverage properly, leads to a client loss. Premiums vary based on size and lines of business, but expect $2,000–$6,000 annually for a small team.

Compliance as a strategy

Treat compliance as more than a box to check. Agencies that maintain immaculate records, stay audit-ready, and proactively manage licensing renewals are more attractive to carriers and future buyers. A clean compliance record supports higher trust and, eventually, higher valuation multiples.

Defining Your Market & Business Model

Launching an insurance agency isn’t about selling “insurance to everyone.” That approach is the fastest way to dilute your efforts and stall growth. The agencies that succeed define their market with precision, choosing who they serve, what they sell, and how they generate revenue.

Choosing your lines of business

The first decision is personal vs. commercial lines. Personal lines (auto, home, and renters) offer a faster sales cycle and lower barriers to entry, but margins can be thin, and competition is fierce. Commercial lines (general liability, property, workers’ comp) bring larger accounts and steadier renewals, but producers need specialized expertise and longer sales cycles.

Some agencies mix both, but most new agencies benefit from choosing one as their foundation. Consider your experience, existing relationships, and regional demand. For example, a coastal agency may thrive with expertise in flood insurance, while an urban boutique might excel with tailored small business packages.

Niche vs. broad market

Agencies that specialize grow faster. A niche, such as contractors, hospitality, or healthcare providers, makes your marketing sharper and your expertise more undeniable. Clients will choose a specialist over a generalist when the coverage is complex or high stakes. Broad-market agencies, on the other hand, may scale in small towns or rural areas, where client diversity is necessary to achieve volume.

Revenue model

Most agencies earn commissions from carriers, typically ranging from 10% to 15% of premiums. That means your revenue depends on two things: policy volume and retention. High churn wipes out growth. That’s why agencies with strong retention strategies (self-service portals, proactive renewals, responsive service) often outpace agencies chasing only new business.

Larger agencies or MGAs may also earn override commissions, profit-sharing arrangements, or fees for specialized services, such as risk management. However, for most startups, success often stems from building a sustainable book of renewals first.

Carrier relationships and appointments

No business model works without carrier partners. You’ll need to secure appointments – formal agreements with carriers that allow you to sell their products. Carriers vet agencies based on financial stability, market strategy, and projected volume. They’re more likely to grant appointments to agencies with a clear niche and professional presentation.

The business model in action

Think of your model as three levers:

- Who you serve (target clients, niches, geography)

- What you sell (personal, commercial, or specialty lines)

- How you deliver (traditional service vs. tech-enabled client experience)

Get those three right, and everything else – marketing, hiring, operations – falls into place.

Building the Right Tech Stack from Day One

The fastest way to overwork your future team is to treat technology as an afterthought. Insurance agencies don’t grow by adding more staff to fix broken workflows. They grow by creating infrastructure that scales before the headcount does.

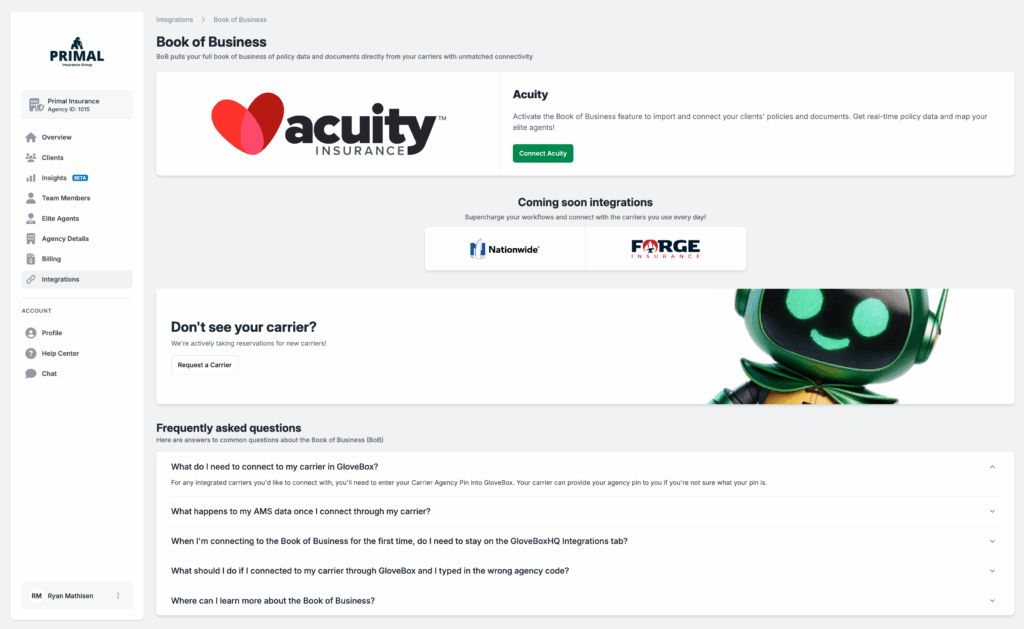

Start with an AMS (Agency Management System)

Your AMS is the backbone of the agency. It holds client records, policy data, billing, documents, and service history. Without it, you’re operating on spreadsheets, which collapse the moment you pass a few hundred clients. The choice depends on your size and ambitions:

- Small, personal-lines-heavy agencies may lean on systems like EZLynx.

- Growth-focused agencies that want stronger reporting often choose AMS360.

- Agencies with multi-office or complex operations often invest in Applied Epic.

The key is not just having an AMS, but committing to using it consistently. A half-empty database creates chaos faster than no system at all.

Add a CRM & workflow layer

Your AMS runs the back office, but it won’t manage your sales funnel. That’s where CRM and workflow tools come in. They track leads, automate follow-ups, and remind producers of upcoming renewals. Many agencies use tools like AgencyZoom or Better Agency because they’re insurance-specific and integrate well with AMS platforms.

The best CRMs don’t just track deals but enforce discipline. They keep every opportunity visible and make sure producers follow the same process from quote to bind. For startups with small sales teams, this consistency is the difference between steady growth and wasted leads.

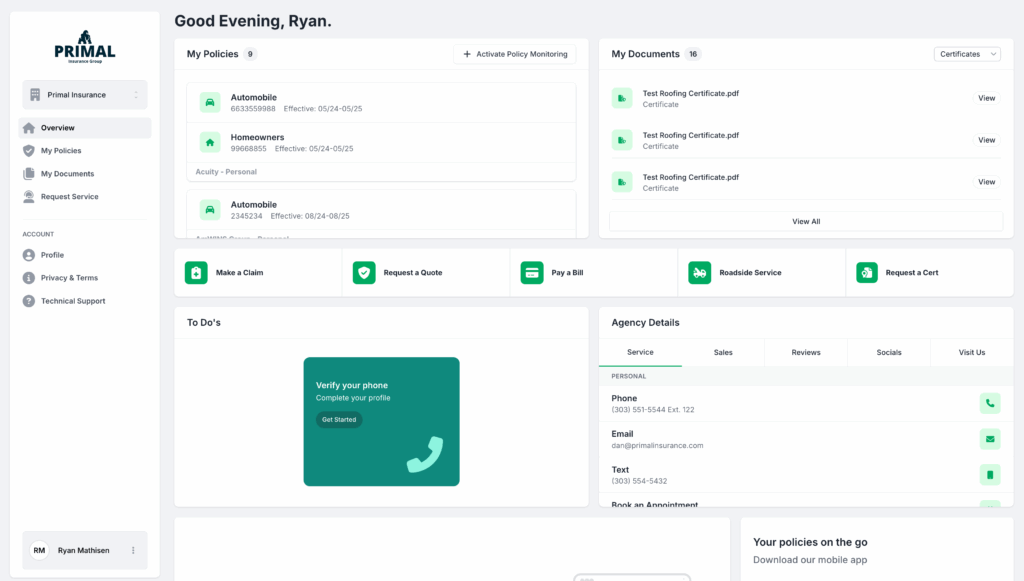

Don’t ignore the Client Experience Platform

Most startups skip the client experience layer because they assume “we’re too small to need it.” That’s a mistake. A client experience platform (CXP) like GloveBox eliminates 30–40% of the Tier 1 service work – ID cards, policy docs, billing questions – that new agencies are most vulnerable to drowning in.

When your first 100 clients start calling for documents, it feels manageable. When it’s 500, it’s overwhelming. The CXP is the safety net. It keeps clients happy while protecting your limited CSR bandwidth. And because it’s white-labeled, it makes your startup look established and modern from day one.

Quoting tools

If you’re writing personal lines, a comparative rater like PL Rating or EZLynx Rater is almost mandatory. For commercial lines, quoting platforms are less standardized, but newer tools like Semsee or RiskAdvisor are helping small agencies compete. The takeaway: without a quoting tool, you’re wasting hours on repetitive carrier submissions.

The tech mindset

The goal isn’t to buy every shiny tool. It’s to choose a minimal, integrated stack that grows with you:

- AMS for records and compliance

- CRM for sales discipline

- CXP for client-facing service

- Rater for quoting efficiency

Agencies that treat tech as core infrastructure scale cleanly. Agencies that delay tech investment end up spending their first profitable years cleaning up operational messes that could have been avoided.

Staffing & Talent Strategy

Technology is the backbone of your agency, but people are the engine. Every startup has to answer the same questions: how many producers do we need, how many service reps, and where should we lean on outsourcing? Get this balance wrong and you’ll burn through cash, or worse, burn out your team before you ever hit scale.

Producers vs. CSRs: Getting the ratio right

Survey data shows that 70% of agencies operate with just 1–5 producers. That means most shops are driven by a small group of revenue generators, often including the founder. On the service side, 68% of agencies have only 1–5 CSRs or account managers. In practice, this creates a delicate balance: too few CSRs, and producers are drawn into service work. Too many CSRs, and you’ve got payroll pressure without matching revenue.

The benchmark many healthy agencies aim for is one CSR supporting every two to three producers. In the early days, you’ll likely be wearing both hats yourself, selling new policies while also answering billing questions. The priority is to remove producers from Tier 1 service tasks as quickly as possible, allowing them to focus on growth.

Hiring vs. outsourcing

Not every role has to be filled in-house. More than one in three agencies (37.2%) already use offshore virtual assistants (VAs) to handle clerical tasks, quoting prep, or simple service requests. Most of those agencies use just 1–3 VAs, which is enough to absorb repetitive, low-value work without adding a full-time salary.

The lesson: outsource to create leverage, not dependency. A VA can send out certificates, process ID card requests, or handle routine data entry, but client conversations, cross-selling, and renewal strategies should remain with in-house staff who know your culture and clients.

Building a culture of efficiency

One of the biggest risks in a new agency is burnout. Early CSRs often find 30–40% of their time consumed by repetitive Tier 1 tasks – ID cards, billing lookups, basic endorsements. When those tasks pile up, morale drops and turnover spikes. Replacing and retraining staff is a cost most startups can’t afford.

That’s why creating a culture of efficiency matters more than free lunches or motivational posters. Protect your team’s time by reducing avoidable service requests. Tech adoption, especially client self-service tools, saves money and preserves your people.

Training and onboarding: Why tech makes It easier

Training new hires in a startup agency can be challenging. Without systems, everything depends on “tribal knowledge,” what the founder or senior CSR remembers to explain. That’s inefficient and risky.

Every agency that scales successfully does two things early:

- Document workflows so new hires can learn without constant supervision.

- Adopt technology tools that automate those workflows.

With the right systems, onboarding a new CSR means teaching them how to use the AMS, CRM, and client portal, rather than walking them through every single manual task. Early tech adoption shortens training cycles and makes your agency less dependent on any one person’s memory.

The bottom line: staffing strategy is about creating the right mix of producers, CSRs, and outsourced support and providing them with tools that amplify their capacity instead of draining it.

Distribution & growth strategy

Once you’ve got licensing, carriers, and your first hires in place, the real test begins: how do you bring in clients and keep them? For new insurance agencies, growth isn’t about outspending bigger competitors. It’s about choosing the right distribution model, owning a niche, and building a funnel that rewards retention as much as new sales.

Traditional vs. digital distribution

Historically, agencies grew through personal networks, referrals, and local presence. That model still works, but it’s limited by geography and time. Today, digital distribution – SEO, social media, partnerships with lead platforms, and embedded insurance – expands your reach far beyond a local market. The most successful startups don’t choose one or the other. They blend traditional relationship selling with modern digital funnels, creating a steady inbound pipeline while nurturing local trust.

The power of specialization

The days of being a “generalist shop” are fading. Specialization gives you a competitive edge, whether that’s serving mortgage brokers, contractors, or cyber liability clients. A clear niche makes your marketing sharper, your processes easier to standardize, and your carrier appointments more attractive. Carriers prefer agencies that can deliver focused, profitable business consistently, not scattershot policies across dozens of verticals.

The growth funnel

Every agency has a funnel, even if it isn’t documented. The basic flow is always the same: Awareness → Quote → Bind → Retain → Cross-sell.

Most startups pour energy into the first two steps, getting leads and converting them to policies. But the real multiplier lives further down the funnel. Retention and cross-sell turn a one-time client into a lifetime revenue stream. A book of business with 90%+ retention compounds year after year, while one that loses clients at 75% has to sprint just to stay even constantly.

Retention over new sales

Survey data shows retention is the #1 strategic goal for agencies in 2025 and for good reason. It’s cheaper to keep a client than to acquire a new one, and retention feeds referrals, which remain the top organic growth driver in insurance. If your first 100 clients renew with you, cross-buy additional policies, and refer friends, you’ve created a compounding growth engine without scaling your sales team prematurely.

The lesson: distribution isn’t just about filling the top of the funnel. It’s about designing a system where every new policyholder is the start of a long-term relationship.

The Economics of Scale & Valuation

For most new agencies, growth is framed in top-line terms: more producers, more clients, more policies. But buyers, investors, and even carriers evaluating you as a long-term partner don’t stop at revenue. They look at infrastructure and efficiency because that’s what drives profitability and sustainability.

Efficiency = EBITDA = higher multiples

An agency with $5M in revenue and a 20% EBITDA margin is worth significantly more than one with $7M in revenue and a 5% EBITDA margin. Why? Because efficient agencies with documented processes and tech-driven workflows can sustain margins without adding headcount at every growth stage. Inefficient shops may look bigger on paper, but their costs eat away at value. In acquisition markets, buyers consistently pay higher multiples for agencies that run smoothly, rather than those that simply chase premium volume.

Why infrastructure beats raw sales

At GloveBox, we always emphasize: “Operations over revenue.” That mindset reflects a hard truth: scaling without structure is just chaos at higher volume. Agencies that rely on tribal knowledge and bloated service teams eventually plateau because every new account creates disproportionate overhead. By contrast, agencies with workflow automation, client self-service, and a clean tech stack grow profitably and predictably.

Multiples in practice

Valuation multiples tell the story clearly. Agencies that operate chaotically – manual processes, poor retention, no client experience, often trade at 5–6x EBITDA. Agencies with efficient infrastructure, high adoption of self-service tools, and strong retention can command 8–10x EBITDA or more. That difference can mean millions in exit value, even for modestly sized firms.

A real-world example: Erb & Young

Consider Erb & Young, a mid-sized agency that doubled revenue while keeping headcount almost flat. How? By scaling operations first. Their CSRs went from managing 400 households to over 1,400 each once self-service was in place. That meant less payroll pressure, happier staff, and margins that expanded with revenue instead of shrinking. This is the exact operational profile buyers reward: scalable growth without proportional cost increases.

GloveBox as Essential Infrastructure

For a new agency, every decision about technology feels heavy. AMS, rater, CRM, accounting, it’s easy to treat “client experience” as something you’ll get to later. But that thinking is backward. Client experience isn’t an add-on. It’s the layer that enables every other system to function in a way that policyholders actually appreciate.

An experience layer

Policy Admin Systems (PAS) like AMS360, Epic, or EZLynx are designed for back-office efficiency. They store policies, generate reports, and handle accounting. What they don’t do well is deliver a client-facing experience. That’s where GloveBox comes in. It doesn’t replace your PAS but connects to it, pulls the right data, and presents it in a modern, white-labeled portal and app. It becomes the interface your clients trust, without disrupting the backend you already rely on.

Immediate client-facing value

From day one, GloveBox takes on the Tier 1 service load that otherwise clogs your phones and inboxes. Clients can log in with just their email or phone number, grab an ID card, pay a bill, or submit a claim. No long hold times, no forgotten passwords. For your agency, that means fewer service tickets and faster resolution. For your clients, it means convenience that rivals their banking or healthcare apps, raising retention before you even hire your second CSR.

Reducing the need for bloated service teams

Our recent survey shows that nearly 70% of agencies operate with 1–5 CSRs, and most are overwhelmed by repetitive requests. Agencies without self-service portals often end up hiring too quickly, which pushes payroll higher while margins shrink. GloveBox breaks that cycle. By automating the repetitive 30–40% of daily tasks it gives your existing team breathing room and keeps staffing lean as you grow.

Building agent loyalty

GloveBox isn’t just for policyholders. It transforms the agent experience, too. Every referral, every new line request, every client interaction is routed back to the writing agent. That means producers spend less time on service and more time on revenue-generating activity. It also builds trust: agents know the business they write through you stays with them, not lost in a black hole of a carrier call center.

Scales with you

The most crucial piece: GloveBox grows with your agency. Startups can launch with it on day one, giving a digital-first impression that punches above their weight. As the agency scales into new lines, new geographies, or new revenue tiers, GloveBox integrates seamlessly with the existing PAS and CRM stack. There’s no need to rebuild later, since you’ve already put the right foundation in place.

Final Verdict: The Smart Way to Start

Starting an insurance company has never been simple, but in 2025, the stakes are even higher. Licensing, carriers, and capital are still table stakes. What separates the winners is infrastructure – the systems and processes that let a small team scale without drowning in service work.

Too many new agencies make the same mistakes: hiring service staff before building workflows, treating client portals as an afterthought, or chasing revenue without fixing operational bottlenecks. Those choices slow growth and lower valuation, make retention harder, and burn out the people you worked so hard to hire.

The agencies that thrive are those that invest in efficiency and client experience from the outset. They document their processes. They automate the repetitive 30–40% of daily work. They provide clients with an easy way to self-service, freeing their teams to focus on revenue and relationships.

That’s the role GloveBox plays. It’s the experience layer that ties your AMS, CRM, and rater together, making them useful to the people who matter most: policyholders and agents.

If you’re serious about building a sustainable agency, don’t wait to figure out client experience later. Start with it. Because in this market, the carriers and agencies that will grow, attract investment, and win referrals aren’t the ones with the biggest sales teams but the ones with the strongest foundations.

Book a call with GloveBox today and design the client experience layer of your new insurance company.