For decades, growing an insurance agency meant one thing: writing more business. Hire more producers, chase more quotes, and hope the numbers eventually add up. That playbook doesn’t work anymore.

In 2025, growth isn’t just about top-line revenue. It’s about building an agency that scales without breaking under its own weight. That means tighter operations, smarter use of technology, and a client experience that keeps customers coming back year after year.

Our survey of 110+ agency executives revealed the reality of today’s market: most agencies are small, lean, and resource-constrained. Nearly 80% have 15 employees or fewer. Most have only 1–5 producers and 1–5 CSRs. In that environment, every inefficiency is magnified. Every unnecessary call or repetitive task is time stolen from sales and client retention.

The agencies that win are better at selling and running their business like a business. They document processes, they invest in the right tools, and they design an experience that agents and policyholders actually want to use.

In this article, we’ll break down five proven strategies for sustainable agency growth, focusing less on brute force sales and more on efficiency, retention, specialization, talent, and tech infrastructure. Together, they form the foundation of an agency that continues to grow and thrive.

TL;DR

Growing an insurance agency is about smarter infrastructure. In this article, we covered:

- Why efficiency is the hidden growth multiplier for agencies

- How documenting SOPs and automating Tier 1 tasks increases CSR capacity

- Why niche specialization beats generalist models in today’s market

- How lean staffing + offshore/augmented support reduces burnout and turnover

- What the “stack that scales” looks like, and why GloveBox is at the center of it

Growth = Retention + Efficiency + Client Experience. Agencies that invest in these three pillars now will lead the market in 2025.

Schedule a GloveBox demo to design your client experience layer today.

Strategy 1: Build Efficiency Into Operations From Day One

The single biggest mistake new agencies make is assuming they can fix efficiency later. They focus on selling policies, hire a few CSRs to keep up with the service load, and only after the phones start ringing off the hook do they realize their operations are broken. By that point, the inefficiency is baked in.

Efficiency isn’t a luxury but the foundation of growth. Our survey showed that most agencies still operate with 1–5 CSRs, many of whom spend 30–40% of their day on repetitive Tier 1 tasks like sending ID cards, processing billing questions, or digging up documents. When those tasks pile up, they cap your growth. Producers spend more time chasing paperwork than writing business, and service teams burn out under the volume.

The most successful agencies reverse that dynamic. They invest in documented workflows, automation, and self-service tools from day one. A well-designed client experience platform (CXP) cuts phone calls and frees CSRs to manage 1,200–1,500 households instead of 400–500. That means fewer hires, lower overhead, and more capacity to scale revenue without scaling payroll.

Think of efficiency as EBITDA fuel. Every process you streamline directly improves profitability, and profitability is what drives valuation. Investors and buyers don’t care how many policies you sell if every renewal drags your staff into the weeds. They care whether your agency can scale cleanly without doubling headcount every three years.

Agencies that master operational efficiency early create a compound advantage. They reduce burnout and turnover, they avoid the trap of bloated service teams, and they give producers more time to focus on selling and retention. In short, they set the foundation for every other growth strategy to work.

Strategy 2: Prioritize Retention Over Constant New Sales

Every agency loves the thrill of new business. Producers chase new deals, leaders celebrate growth in policy-bound areas, and marketing budgets pour into lead generation. But the truth is simple: retention is the real growth multiplier.

Our survey confirmed what most operators already know but often ignore: client retention ranked as the #1 strategic goal across agencies. Why? Because replacing a lost client costs far more than keeping an existing one. Worse, high churn creates a treadmill effect, and your producers work harder every year just to stand still.

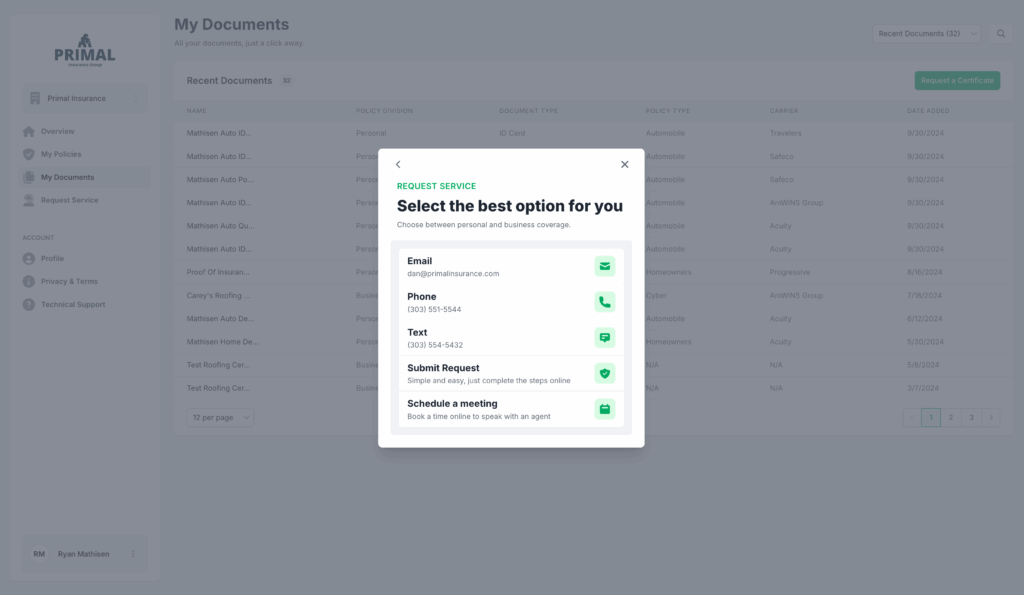

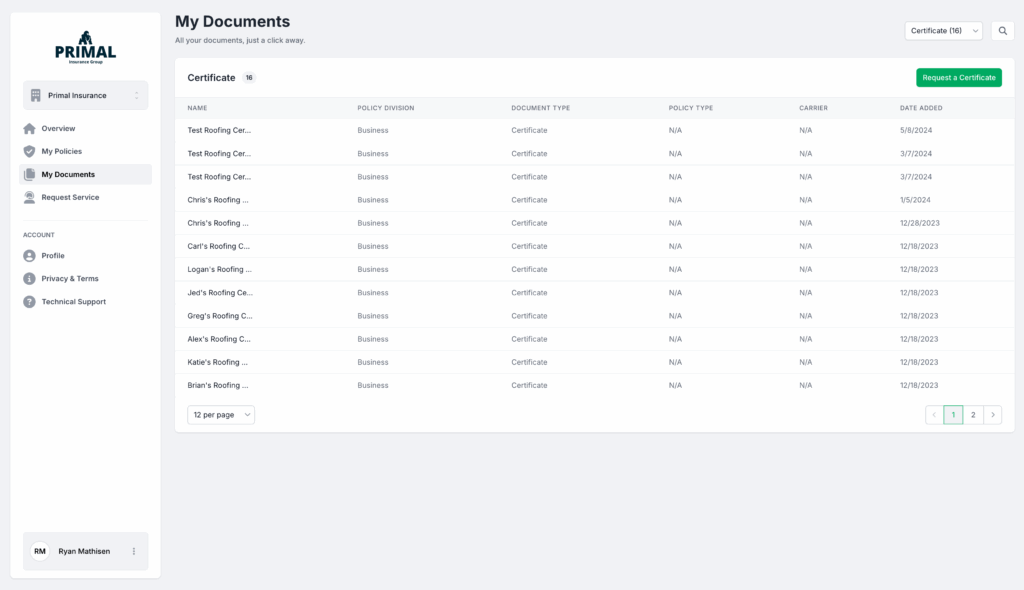

The numbers tell the story. Agencies with strong self-service adoption report 6–10x higher retention rates compared to those relying solely on phones and emails. That’s because modern policyholders expect the same ease of use from their insurance provider as they get from their bank. If they can’t download an ID card, update a driver, or check a bill online in minutes, they’ll start shopping elsewhere at renewal.

Retention isn’t just about convenience but about relationships. When Tier 1 service is automated or handled through a client experience platform, CSRs can stop being switchboard operators and start being advisors. They have time for proactive renewal conversations, cross-selling, and genuine relationship building. Producers gain the bandwidth to nurture their best accounts instead of chasing down clerical tasks.

For growth-focused agencies, the math is undeniable: a 5% lift in retention can drive profitability increases of 25% or more. That’s the kind of efficiency that compounds over time. The agencies that win are the ones keeping the clients they’ve already earned, year after year.

Strategy 3: Specialize and Differentiate Your Distribution

The agencies that break out of flat growth aren’t the ones trying to be all things to all people. They’re the ones who go deep in a niche. Contractors, cyber liability, mortgage brokers, whatever the lane, specialization allows you to compete on expertise instead of price. A contractor who feels you understand certificates, audits, and risk transfers will stay with you even if your quote isn’t the absolute lowest.

Distribution is where many agencies fall behind. Too often, leadership leans entirely on either traditional producers pounding the phones or digital marketing experiments that don’t scale. The reality is the winners in 2025 will be those who build hybrid distribution models: digital touchpoints to capture and qualify leads, paired with producers who bring the personal touch when it matters most.

Think of your funnel as a cycle, not a straight line: Awareness → Quote → Bind → Retain → Cross-sell. Too many agencies stop at “bind” and reset the clock. But growth accelerates when retention and cross-sell are treated as core distribution levers. Renewing and expanding with your existing book is always more cost-effective than targeting cold prospects.

This is why digital-first carriers and agencies have sprinted ahead in recent years. They’ve learned that retention and cross-sell are not back-office activities but distribution strategies in their own right. A seamless client experience platform, combined with smart renewal automation, turns every renewal into an opportunity for another line of business. That’s how niche specialists turn their expertise into exponential growth.

Strategy 4: Optimize Your Talent Model

Most agencies run lean when it comes to people. Survey data shows 70% of agencies have just 1–5 producers, and 68% operate with 1–5 CSRs or account managers. That means a handful of people are responsible for driving all new revenue and servicing the entire book of business. The model works…until it doesn’t.

The biggest risk is burnout. When producers and CSRs spend their time on Tier 1 service requests – ID cards, billing questions, address changes – they’re not doing what they were hired to do. Producers should be selling, and CSRs should be focused on higher-value client relationships. Instead, too many end up as human call centers, which drives turnover and stalls growth.

Smart agencies are solving this problem by rebalancing talent. That doesn’t always mean hiring more people. For many, the correct answer is to leverage offshore virtual assistants (VAs) or staff augmentation partners for routine clerical work. This lets your core team stay lean while still freeing up their bandwidth for higher-value activities. In other words, you’re scaling without bloating payroll.

Culture matters too. Agencies that grow are intentional about creating a culture of efficiency, where technology handles the repetitive work, and people focus on the relationships and decisions that actually move the business forward. When staff aren’t drowning in busywork, they stay longer, build deeper client connections, and drive growth instead of just firefighting.

Strategy 5: Build a Scalable Tech Stack

Growth doesn’t just depend on people. It depends on the systems that support them. By 2025, your tech stack will either be an accelerant or a bottleneck.

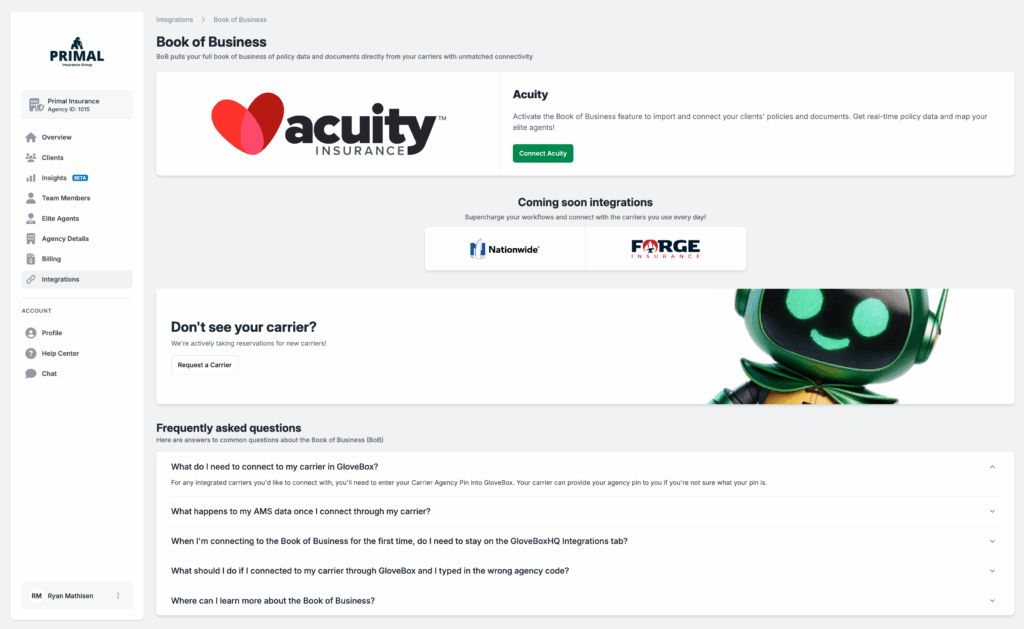

Survey data shows the backbone is clear: AMS360, Applied Epic, and EZLynx dominate the AMS layer. That’s where policies, billing, and documents live. Additionally, more than 78% of agencies now utilize a Client Experience Platform (CXP), primarily GloveBox, to enable clients to self-serve. And AI adoption is progressing rapidly – 23.7% of users regularly utilize AI, while another 28.9% use it occasionally for tasks such as quoting, service, marketing, and internal workflows.

The “stack that scales” follows a simple pattern: AMS (backbone) + CRM/workflow (pipeline) + CXP (GloveBox) + automation/AI. Agencies that adopt this combination see higher retention, lower service volume, and more capacity per CSR. The payoff is measurable: instead of one CSR managing 400 households, modernized agencies report capacities of 1,200–1,500.

But here’s the catch – too many agencies overbuy. They layer on tools that don’t integrate or don’t get used, creating “tech fatigue” instead of efficiency. The lesson is to right-size your stack. For startups, a “Starter Pack” may be as simple as AMS + GloveBox. For growth-stage agencies, the “Scaler Pack” adds CRM and automation. For larger shops, the “Pro Pack” includes AI layers and deeper integrations.

The goal isn’t to have the most logos on your vendor page. It’s to have a stack that actually reduces friction for staff, agents, and policyholders alike.

Final Verdict: Growth = Retention + Efficiency + Client Experience

Growing an insurance agency in 2025 isn’t about brute force. It’s not just hiring more producers or adding headcount to your service team. The agencies that win are those that reduce friction at every level – from internal workflows to client experience.

Invest in operational efficiency so your team isn’t drowning in Tier 1 tasks. Specialize in niches where you can stand out, rather than competing as a generalist. Build a lean talent model that combines in-house staff with scalable support. And most importantly, design a tech stack that grows with you, anchored by a Client Experience Platform like GloveBox.

The path is clear: retention fuels growth, efficiency protects margins, and client experience cements loyalty. Agencies that modernize now will outpace those who wait.

Book a GloveBox demo to see how to scale your agency efficiently in 2025.