Choosing the right technology doesn’t require a deep technical background or an expensive advisor. It requires understanding the core functions of your agency and selecting tools that directly address your biggest bottlenecks. Independent insurance agencies benefit from choosing technology that fits their unique operational requirements and supports their autonomy. This guide will walk you through the three essential pieces of technology every independent agent needs. By focusing on these core systems, you can immediately save thousands and set your agency up for scalable growth. Choosing the right management system is crucial for your agency’s success, as it directly impacts growth and efficiency.

Piece 1: Agency Management System (AMS)

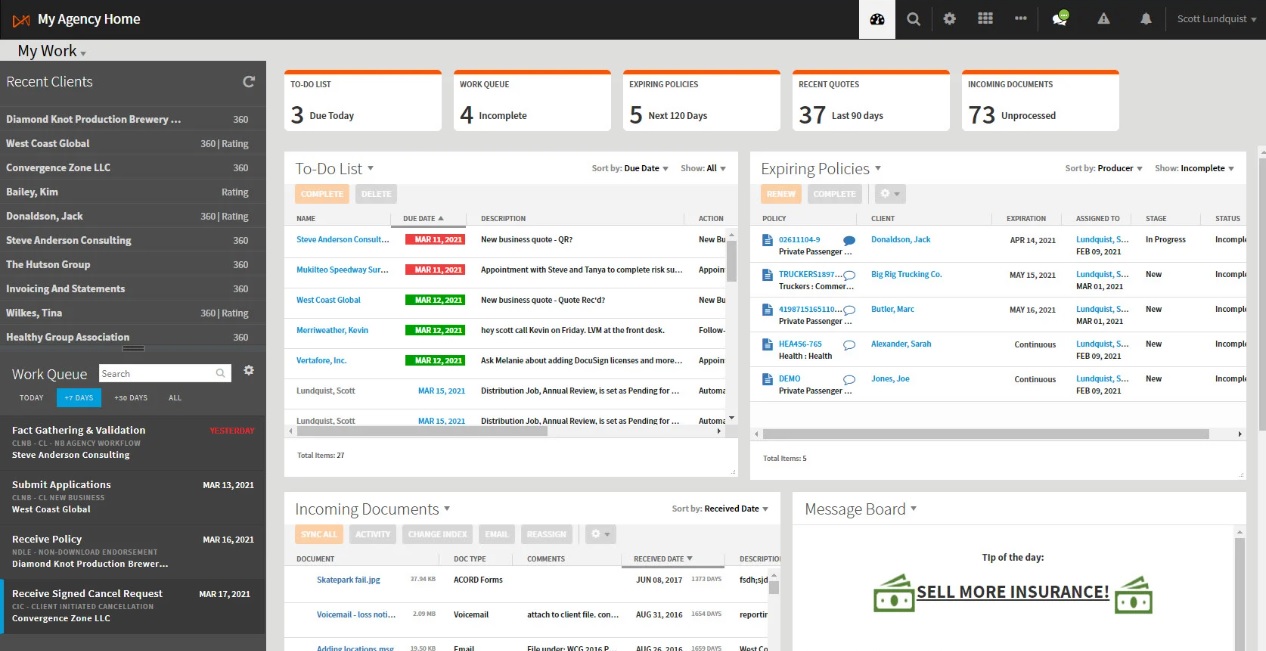

Think of an Agency Management System (AMS) as the central nervous system of your agency. An AMS is a type of agency management software and insurance agency management system, essential for streamlining daily workflows, servicing, and supporting overall insurance agency management. A reliable Agency Management System (AMS) is the foundation of any modern agency. It’s the digital hub where all your critical information lives, from client data and policy details to commission tracking and accounting. Without an AMS, you’re likely juggling spreadsheets, paper files, and scattered notes—a recipe for errors and inefficiency.

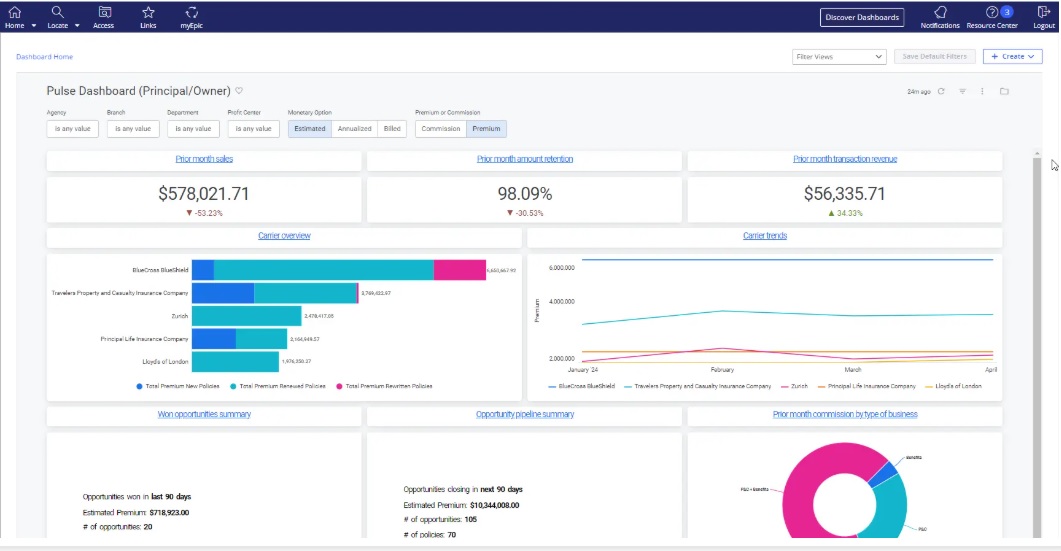

Why do you need it? An AMS is your single source of truth. It automates the flow of information from carriers, eliminating hours of manual data entry and ensuring accuracy. It organizes your client and policy data, manages renewals, and tracks your agency’s financial health. Insurance agency management systems also provide comprehensive reports, analytics tools, and performance dashboards that enable agencies to measure and benchmark the agency’s performance, leading to improved operational effectiveness and supporting the agency’s success. Agency management systems help independent insurance agents organize their books of business and more effectively run their businesses. Your team can access everything they need from one place, allowing them to serve clients faster and more effectively.

What it solves:

- Disorganization: Centralizes all client, policy, and financial data.

- Manual Work: Automates carrier downloads and reduces data entry.

- Compliance: Keeps a clear record of actions for E&O purposes.

- Inefficient Workflows: Manages renewals, tasks, and follow-ups systematically.

- Sales and Operations: AMS solutions help with pipeline management, payment plans, and servicing, and support both personal lines and commercial lines.

Popular AMS Options:

- Applied Epic: A powerful, highly customizable platform ideal for larger, growing agencies with complex needs. It has a steeper learning curve but offers deep features.

- AMS360: A user-friendly system known for its strong, integrated accounting features. It’s a solid choice for small to mid-sized agencies.

- HawkSoft: Praised for its simplicity, reliability, and excellent customer support. It’s easy for teams to learn and is great for agencies that value a straightforward, stable platform.

These software solutions are trusted by other agencies, including smaller agencies, and are designed to meet the unique needs of insurance agents.

Key Features to Look for in an AMS

- Cloud-based access

- Automated carrier downloads

- Integrated accounting

- Task and renewal management

- Customizable reporting

- E-signature and document management

Having a cloud-based AMS allows teams to work from anywhere with an internet connection.

ACORD forms integration is also important for streamlining data entry and improving productivity.

Integration with other tools—like CRM, marketing automation, and quoting platforms—can further boost efficiency. Agency management software often includes additional services and solutions, such as cybersecurity services and lead generation services, to further support agency growth.

Key Features to Look for in an AMS

Choosing the right agency management system is about more than just storing client data—it’s about empowering your insurance agency to operate at its highest potential. The best management systems are designed to streamline policy management, enhance client relationships, and drive your business forward with efficiency and insight.

Here are the essential features to look for in an AMS:

- Comprehensive Policy Management: Your AMS should make it easy to manage every aspect of your clients’ policies, from renewals to endorsements, all in one system. Policy lifecycle management includes managing all stages from new policy issuance to renewals and cancellations. This ensures your team can access up-to-date policy information quickly, improving service and reducing errors.

- Built-in Workflows and Automation: Look for built-in workflows and AI tools that automate daily tasks, such as renewals, follow-ups, and document management. Automation reduces manual tasks, freeing your team to focus on building client relationships and growing your agency.

- Commission Tracking: Accurate commission tracking is vital for both agency owners and producers. A robust AMS will help you track commissions in real time, ensuring transparency and supporting your agency’s financial health.

- Customizable Dashboards and Analytics Tools: Customizable dashboards and advanced analytics tools allow you to monitor your agency’s performance at a glance. Use these insights to make data-driven decisions, identify cross sell opportunities, and optimize your business strategy.

- Seamless Integration with Carrier Systems and Third-Party Applications: The ability to connect with carrier systems and other third-party applications is crucial. Integration streamlines data flow, reduces manual entry, and improves client communications across your entire agency.

- Advanced Reporting: Detailed reporting tools help you analyze everything from sales performance to client retention rates. With access to actionable data, you can spot trends, address issues early, and capitalize on new business opportunities.

By prioritizing these features in your agency management system, you’ll equip your agency with all the tools needed to deliver better service, retain clients, and drive sustainable business growth.

Piece 2: Customer Relationship Management (CRM)

While your AMS manages policies and data, a Customer Relationship Management (CRM) system manages your relationships. It’s your sales and communication engine, designed to track every interaction with leads and clients. Insurance customer relationship management (CRM) focuses on managing the relationships between an insurance agency and its customers. If your AMS is your back office, your CRM is your front office.

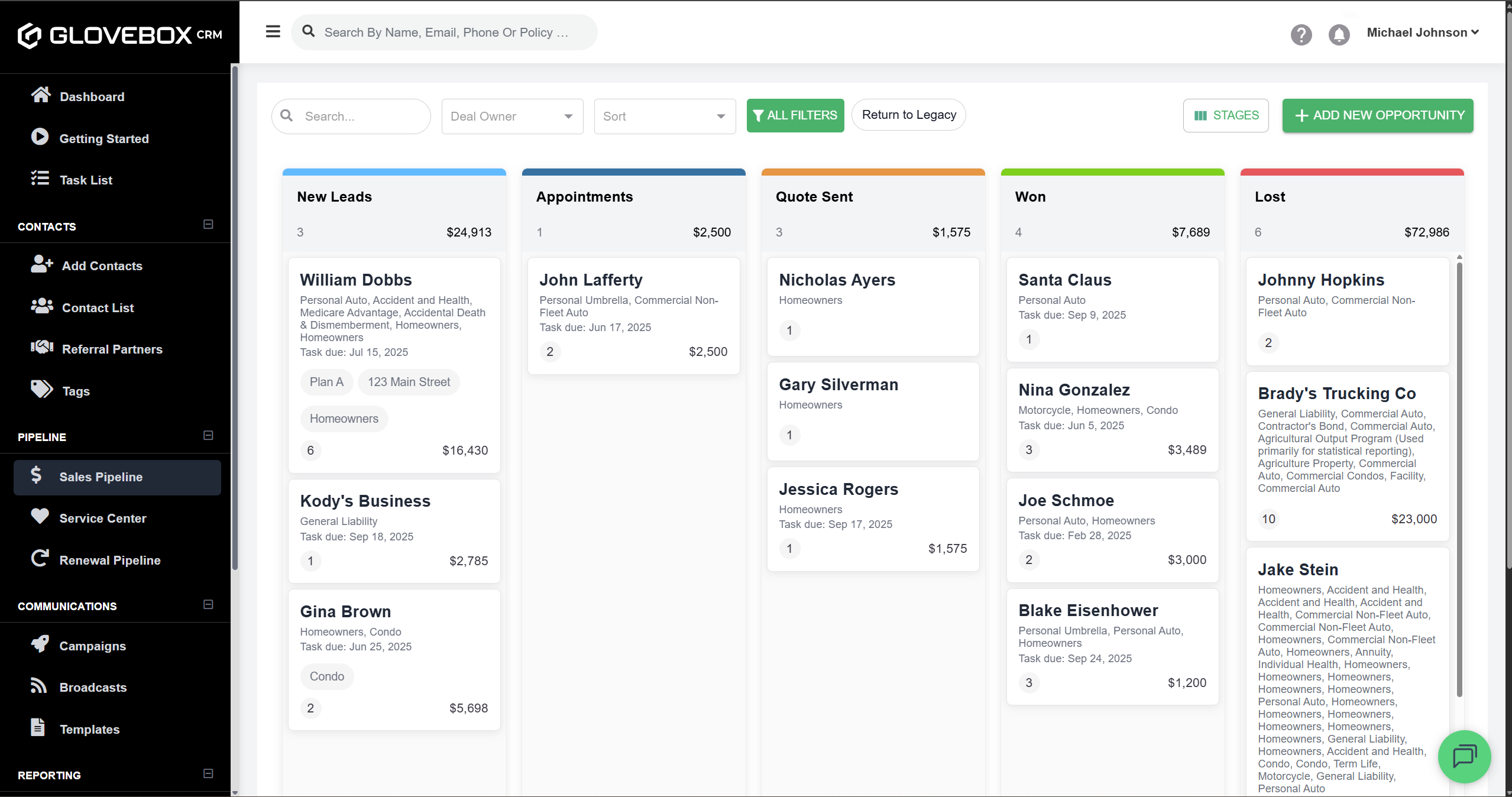

Why do you need it?A CRM helps you systematize your sales and retention efforts. It ensures no lead falls through the cracks by tracking follow-ups, automating communication, and providing a clear view of your sales pipeline. CRM systems are essential for client engagement and improving client retention by enabling ongoing, personalized communication with clients. When a producer logs in, they know exactly who to call and what to say next. This consistency drives growth and prevents missed opportunities.

What it solves:

- Inconsistent Follow-up: Automates email and text sequences for leads and clients.

- Lost Leads: Provides a visual pipeline to track every opportunity from start to finish.

- Lack of Accountability: Offers dashboards to monitor producer performance and sales activity.

- Poor Onboarding: Helps you create automated welcome campaigns for new clients.

Popular CRM Options:

- AgencyZoom: A sales-driven CRM focused on automation and performance tracking. Its clean interface and producer-focused features make it a popular choice for growth-oriented agencies. AgencyZoom is designed specifically for insurance agents and includes sales pipeline tracking, automation features, and onboarding workflows.

- GloveBox CRM: An all-in-one platform that comes with over 100 pre-built campaigns for sales, service, and renewals, making it easy to get started quickly.

Piece 3: Client Experience Platform (CXP)

You have a system for your operations (AMS) and a system for your sales (CRM). But what about your clients? A Client Experience Platform (CXP) is the missing piece that modernizes how customers interact with your agency. It provides a branded, self-service portal where clients can get what they need, 24/7, without having to call or email your team.

**Why do you need it?**Your team spends up to 40% of its day on low-value service tasks like fetching ID cards, answering billing questions, and providing policy documents. A CXP automates these requests, freeing up your staff to focus on revenue-generating activities like cross-selling, renewals, and building relationships. Self-service portals empower clients to access policy information and submit claims at any time. Leading CXPs also enable agencies to send automated text messages to clients for instant communication and service updates. It also meets the modern customer’s expectation for instant, digital access.

What it solves:

- Overloaded Staff: Drastically reduces inbound calls and emails for simple service tasks.

- Poor Client Satisfaction: Gives clients the fast, on-demand service they expect.

- Service Bottlenecks: Allows clients to self-serve, improving your team’s capacity and productivity.

- Stagnant Growth: Frees up your team to focus on activities that grow the business.

The Leading CXP Option:

- GloveBox: A white-labeled mobile and web app that gives your clients 24/7 access to their policy documents, ID cards, and billing information. Agencies using GloveBox report a 3x increase in CSR productivity and a significant boost in client retention and referrals.

Improving Commercial Lines with Modern Software

For insurance agencies, commercial lines can be one of the most complex and time-consuming areas of the business. Modern agency management systems are transforming how agencies handle commercial lines submissions, policy management, and client relationships—making it easier than ever to stay competitive and efficient.

A comprehensive agency management system, like Applied Epic, brings all the tools your agency needs for commercial lines into one user-friendly platform. Built-in workflows and AI tools automate manual tasks, from gathering client information to tracking commercial lines submissions, so your team can focus on building stronger client relationships and identifying cross sell opportunities. With customizable dashboards, you can monitor your agency’s performance in real time, spot trends, and make data-driven decisions that drive growth.

Commission tracking and policy management features ensure that every detail is accounted for, reducing errors and improving service for your commercial clients. Enhanced client communications—through automated updates and reminders—help you retain clients and deliver a better overall experience. By leveraging the latest insurance technology, your entire agency can streamline operations, improve efficiency, and unlock new opportunities for cross sell and upsell.

Modern software solutions are designed to support the unique needs of insurance agencies, making it easier to manage complex commercial lines accounts, deliver better service, and grow your business. With the right management system in place, your agency can turn commercial lines into a true engine for success.

Unlocking Savings with Data Analysis and AI

Modern insurance agencies are discovering that the real power of their tech stack lies in harnessing insurance-specific data and AI-driven analytics tools. Automation of repetitive tasks allows agencies to deliver richer customer experiences. By leveraging these technologies, agencies can unlock significant savings, improve efficiency, and elevate the client experience.

Here’s how data analysis and AI can transform your agency:

- Optimize Commercial Lines Submissions: Data analytics can reveal bottlenecks in your commercial lines submissions process, helping you streamline workflows and reduce manual tasks. This leads to faster turnaround times and a more competitive edge.

- Enhance Client Retention: AI tools can analyze client behavior and policy data to identify at-risk accounts, automate timely follow-ups, and suggest personalized service strategies. This proactive approach helps you retain clients and strengthen long-term relationships.

- Uncover New Business and Cross Sell Opportunities: With actionable insights from analytics tools, your agency can spot trends and gaps in coverage, making it easier to cross sell and upsell to existing clients. AI-powered recommendations ensure you never miss a chance to grow your book of business.

- Automate Routine Tasks: AI tools can handle repetitive tasks like tracking commissions, sending reminders, and managing client communications. This automation frees up your team to focus on high-value activities that drive business growth.

- Make Data-Driven Decisions: Access to real-time insurance specific data empowers your agency to make informed choices about your tech stack, marketing strategies, and service offerings. This leads to smarter investments and better outcomes for your entire business.

By embracing data analysis and AI, insurance agencies can stay ahead of the competition, deliver a superior client experience, and achieve measurable savings. The right combination of insurance technology, analytics tools, and a comprehensive system will position your agency for long-term success.

How to Choose Your Tech Without a Consultant

Ready to build your stack? You don’t need to be a tech expert. Just follow these simple steps.

- Identify Your Biggest Pain Point: Where is your agency bleeding time and money? Are you losing leads? Is your team drowning in service calls? Start with the tool that solves your most urgent problem.

- Research and Request Demos: Look into the popular options listed above. Schedule live demos and ask questions specific to your agency’s workflows. Don’t be shy—make the vendor show you exactly how their tool will solve your problem.

- Involve Your Team: The best software is the software your team will actually use. Get their feedback during the evaluation process. A tool they help choose is a tool they are more likely to adopt.

- Prioritize Integration: Ensure the tools you choose can work together. A good AMS, CRM, and CXP should be able to connect, creating a seamless flow of information across your agency.

Implementing Your Insurance Software: Best Practices for a Smooth Transition

Rolling out a new insurance agency management system can feel overwhelming, but with the right approach, independent agencies can ensure a smooth transition and set the stage for long-term success. The key is to plan ahead, involve your team, and focus on solutions that fit your agency’s unique needs.

Start by assessing your agency’s daily workflows and identifying the features that matter most—whether it’s advanced data analytics, seamless integration with carrier systems, or flexible payment plans for clients. Evaluate software solutions that align with your business goals and make sure they can connect with your existing tools and systems. Prioritizing integration will help your agency avoid data silos and keep information flowing smoothly across your entire business.

Training is essential. Invest time in onboarding your team, providing hands-on training, and making sure everyone is comfortable with the new management system. Many software providers offer dedicated support and resources to help agencies get up to speed quickly. Encourage open communication and gather feedback from your team to address any challenges early on.

Don’t overlook the importance of client engagement and retention. Choose a system that enhances client relationships, supports personalized communications, and makes it easy to track and improve client retention rates. Leverage data analytics to monitor your agency’s performance and make informed decisions that drive growth.

By following these best practices, your agency can unlock the full potential of your insurance agency management system, streamline operations, and deliver a superior client experience. With the right software solutions and a thoughtful implementation plan, your agency will be well-positioned to thrive in today’s competitive insurance business.

Take Control and Start Saving

You don’t need to spend a fortune on consultants to build a tech stack that powers growth. By focusing on these three foundational pillars—AMS, CRM, and CXP—you can create a lean, powerful system that automates workflows, enhances relationships, and delights clients.

Stop letting the fear of making the wrong choice hold you back. Take control of your agency’s future, empower your team with the right tools, and reinvest that $10,000 consultant fee back into your business. The path to a more efficient and profitable agency is clearer than you think.