Insurance agencies aren’t failing because they can’t sell. They’re failing because their operations can’t keep up.

In 2025 and 2026, the agencies that win will be the ones that run lean, efficient, and scalable operations powered by the right technology. Growth no longer comes just from more producers or bigger marketing budgets. It comes from building an infrastructure that eliminates bottlenecks, reduces service load, and delivers a client experience that keeps policyholders from leaving in the first place.

The reality is that most agencies already have pieces of a tech stack: an AMS for compliance, maybe a CRM for sales, and often a patchwork of portals or raters. But tools alone don’t equal growth. The difference between a $5M agency that stalls out and a $50M agency that keeps scaling is stack discipline, choosing the right combination of systems, integrating them properly, and actually driving adoption across staff and clients.

This guide breaks down the modern insurance tech stack into four core layers:

- The backbone (AMS),

- The muscles (CRM and workflow)

- The missing piece (Client Experience Platform, such as GloveBox),

- The accelerators (automation and AI)

We’ll show you what each does, how agencies are using them today, and why the combination (done right) is the only way to scale profitably in the years ahead.

Schedule your GloveBox demo.

them today, and why the combination (done right) is the only way to scale profitably in the years ahead.

Schedule your GloveBox demo.

The Backbone – AMS (Agency Management Systems)

Every modern agency requires a solid foundation for compliance, data management, and record-keeping. That foundation is the Agency Management System (AMS). It’s the digital brain of the operation, where client data, policy details, billing, and documentation live. Without a strong AMS, growth is hindered by the weight of manual processes.

What agencies are using today

Our survey data shows the AMS layer is firmly established. Among the most common platforms:

- EZLynx (22 respondents) – popular for its all-in-one approach, especially among personal-lines-heavy agencies.

- AMS360 (21 respondents) – widely used across mid-sized agencies, particularly those leveraging the broader Vertafore ecosystem.

- Applied Epic (15 respondents) – the heavyweight system, powerful but complex, usually chosen by large agencies with dedicated ops staff.

- HawkSoft (14 respondents) and QQ Catalyst (9 respondents) – also well-represented, often appealing to smaller, independent agencies looking for usability.

Only a small minority of agencies (7 respondents) reported operating without an AMS, a clear indication that the market views this as a minimum standard.

Why it matters

An AMS provides data consistency, compliance, and centralization. It’s where auditors look, where carriers sync data, and where staff should be able to pull everything they need in one place. But it’s also where the gap begins: AMS platforms were designed for internal operations, not external client experience.

That’s why, even with robust AMS adoption, agencies still struggle with service calls and repetitive tasks. The AMS can store and organize everything, but it doesn’t empower policyholders to access or update it themselves.

The efficiency benchmark

The real measure of an AMS is how much business your staff can handle because of it. Survey results show:

- Nearly 30 agencies reported that each CSR manages fewer than 400 policies.

- Another 30 manage between 800 and 1,200 policies.

- A small but telling segment – 14 agencies reported CSRs handling more than 1,500 policies each.

That spread shows the same tool (AMS) can yield very different results depending on how it’s implemented and supported by the rest of the stack. Agencies treating the AMS as a static system hit ceilings early. Agencies integrating it with workflows and client-facing tools unlock exponential efficiency.

The Muscles – CRM & Workflow Systems

If the AMS is the brain of an agency, the CRM and workflow tools are the muscles. They move deals forward, keep producers accountable, and ensure no client falls through the cracks during onboarding, renewal, or cross-sell. Without them, the agency brain knows the information, but the body can’t act on it efficiently.

What agencies are using today

Our survey data shows fragmented adoption of CRM and workflow platforms.

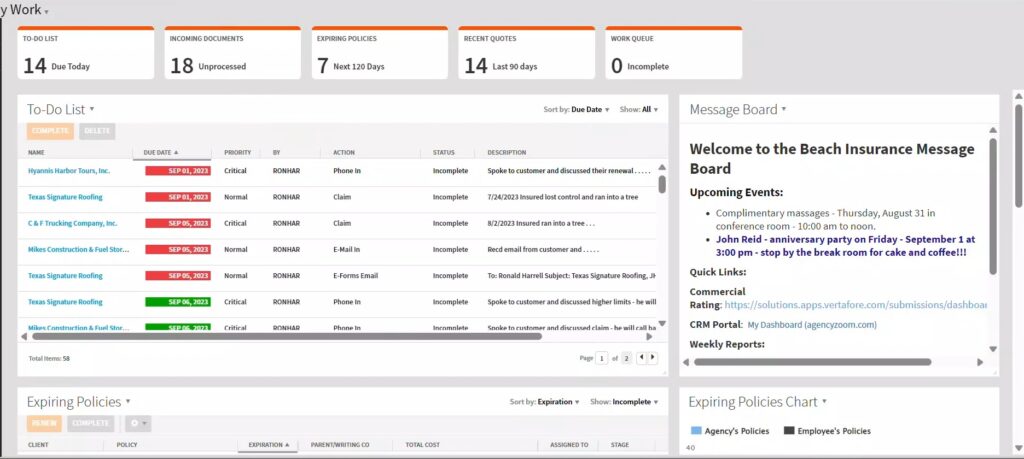

- AgencyZoom (31 respondents) and Better Agency (23 respondents) dominate among insurance-specific solutions.

- A handful use generalist CRMs like HubSpot or Salesforce (7 combined), but these require heavy customization and rarely integrate smoothly into insurance workflows.

- EZLynx (3 mentions) appears again as agencies lean on its built-in features, though most admit it’s limited compared to a dedicated CRM.

- The most alarming number: 37 agencies reported not using any CRM at all.

That means more than a third of agencies are still running on spreadsheets, email inboxes, or “tribal knowledge”, hoping producers remember to follow up.

Why it matters

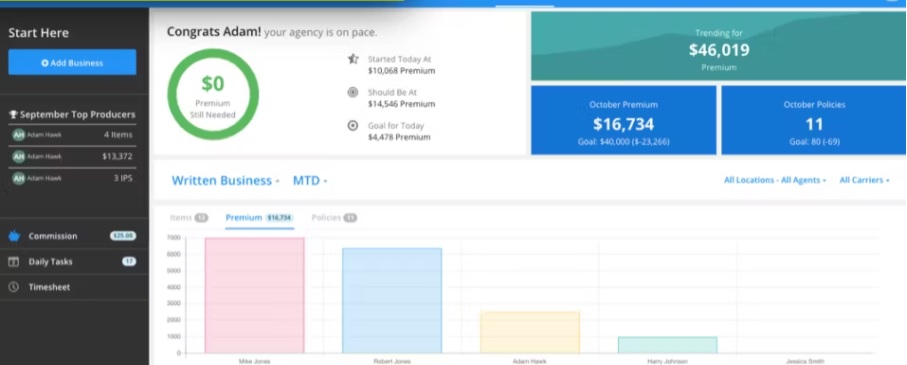

Sales bandwidth is one of the most constrained resources in the industry. Our survey showed that 70% of agencies have just 1–5 producers. That tiny group is responsible for driving all new business while juggling renewals. If they waste time on manual follow-ups, sticky notes, or cold spreadsheets, the agency’s growth engine sputters.

A CRM solves that problem by automating reminders, renewal outreach, and lead nurturing. Producers know what to work on every day. Managers get visibility into the pipeline. Clients get timely, proactive communication instead of last-minute scrambles.

The productivity gap

The impact of a CRM is measurable:

- Agencies that combine AMS + CRM + Client Experience Platform (like GloveBox) report 40% higher operational efficiency in our survey data.

- Agencies without CRMs often report bottlenecks, renewals slipping through the cracks, producers bogged down with admin work, and missed cross-sell opportunities.

The difference isn’t just about revenue growth. It’s about predictability. With a CRM in place, renewals and follow-ups aren’t dependent on memory or tenure. They’re built into a repeatable system, making the agency less fragile and more scalable.

CRM as the bridge

Think of the CRM as the bridge between the AMS and the client experience. The AMS stores the record, but the CRM drives the motion, renewal reminders, quote follow-ups, and automated campaigns. Without this bridge, the AMS is just a filing cabinet. With it, the agency has a growth engine.

The Missing Piece – Client Experience Platforms (CXP)

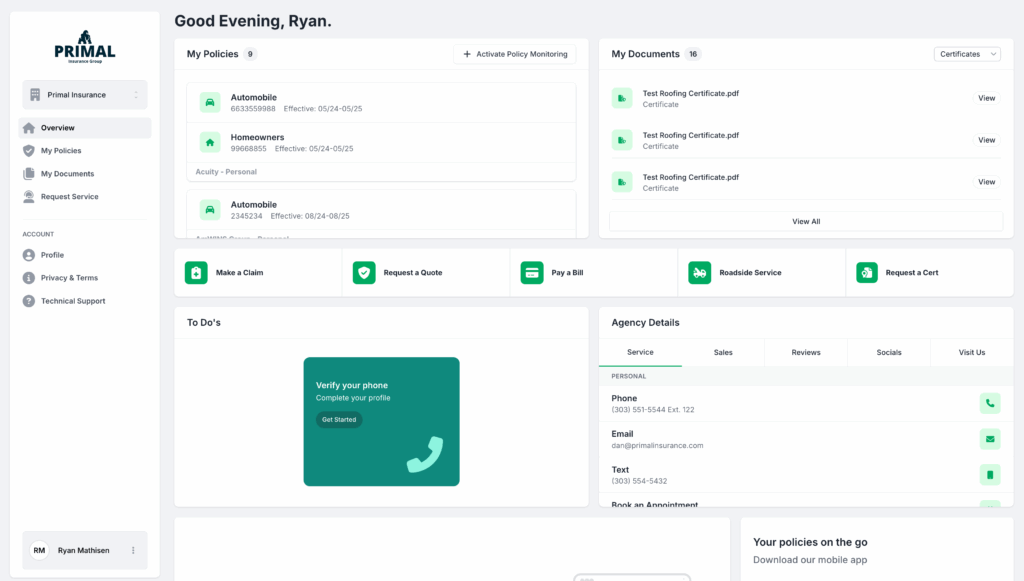

The AMS and CRM together provide agencies with structure and motion, but neither is designed for the person who matters most: the policyholder. That’s where Client Experience Platforms (CXPs) come in.

Why CXPs matter in 2025

Insurance isn’t just about selling policies, but also about retaining them. And in 2025, retention depends on whether policyholders can self-serve. They don’t want to call for ID cards, wait on hold for billing, or email a CSR for a declaration page. They want it the same way they handle their banking: fast, digital, and on their own schedule.

Our survey showed just how critical this is:

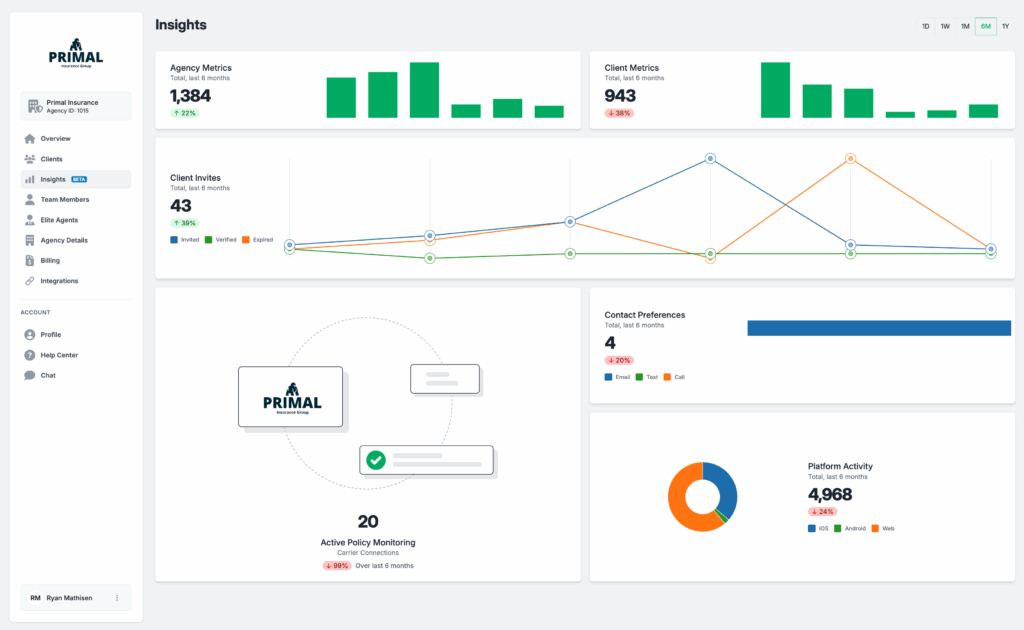

- 78.9% of agencies already use a CXP, most naming GloveBox.

- Agencies using GloveBox reported 3–5x higher retention and CSR capacity compared to those relying on carrier portals.

- Those who didn’t have a CXP almost universally admitted that their portal adoption was “low” or “nonexistent.”

Every support ticket that could have been handled in-app is payroll wasted. Every clunky login experience is a retention risk.

The adoption gap

Most carriers throw in a “portal” as part of the PAS package. But adoption rates are dismal, often under 5% of policyholders. Why?

- Portals require account numbers and registration steps that no one remembers.

- Features are limited, with no billing, claims submission, or dynamic content, often just a static PDF.

- Apps are outdated, rarely updated, and often crash.

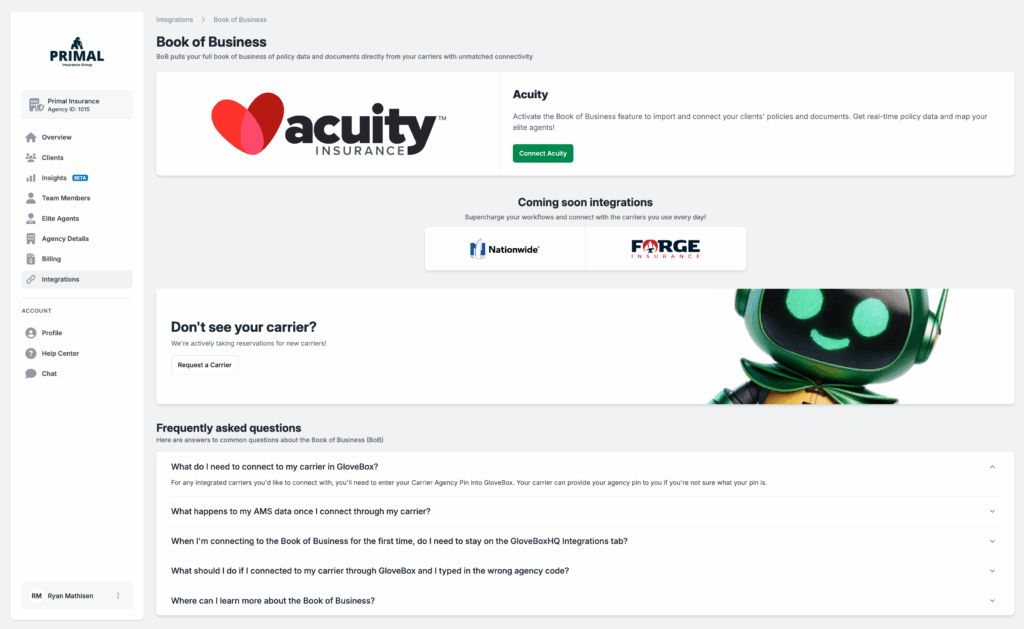

By contrast, CXPs like GloveBox have cracked the adoption problem:

- Login via email or phone + one-time code (no policy numbers).

- White-labeled experience that feels like the agency’s own brand.

- Real-time sync with PAS and AMS data – billing, docs, ID cards, claims.

- Agent-first workflows, so service requests route back to the writing agent, protecting relationships and driving loyalty.

The result? Adoption rates that are 8–10x higher than traditional portals.

Why it’s the missing piece

Without a CXP, the AMS and CRM do not directly interact with the client. The agency is left with bloated service teams handling Tier 1 requests and producers chasing manual follow-ups. With a CXP in place, the agency finally connects its back office to its clients.

In other words, the AMS is the brain, the CRM is the muscle, but the CXP is the face. Without it, the agency is invisible to the people it serves.

The Insurance Tech Accelerator – AI & Automation

By 2025, AI in insurance has moved past the hype stage. It’s no longer about experimenting with chatbots or testing a proof of concept but about embedding automation into the daily workflows of agencies. Our survey data makes this clear: more than half of agencies (52.6%) are already using AI tools in some capacity, and another 28.9% are actively exploring them.

Where AI is actually working

Most agencies are looking for tools that cut out repetitive, low-value work. The most common use cases today include:

- Email & Communications: drafting, templating, and personalizing client emails at scale.

- Marketing: generating content for social media and campaigns without hiring more staff.

- Document Handling: parsing policy documents, certificates, and billing statements.

- Client Service: powering FAQ responses, summarizing tickets, or triaging service requests before they reach a CSR.

- Quoting Support: speeding up pre-underwriting inputs and comparisons.

These aren’t flashy; they’re practical. And they’re delivering immediate ROI because they save hours every week per staff member.

The adoption divide

The survey also revealed a growing split. Agencies that regularly use AI reported significantly higher satisfaction with their operations compared to those that don’t. On the other side, 18.4% still said they “never” use AI tools, which represents a group that risks falling behind fast.

This is the new dividing line in the industry: agencies that embed automation will handle growth without adding staff. Agencies that don’t will face higher costs, slower service, and frustrated employees.

Why it matters for scale

The economics are simple. If 30–40% of a CSR’s day is still spent on Tier 1 tasks, and AI-driven workflows can cut that in half, the impact is massive:

- Fewer hires needed as the agency grows.

- Lower burnout rates because staff focus on meaningful work.

- More producer time freed up for revenue generation.

When paired with a strong AMS and a CXP, AI becomes the accelerator – the layer that ensures efficiency keeps pace with client demand.

The next 12–18 months

Expect AI adoption to shift from “optional” to “assumed.” Carriers and agencies alike are realizing that without automation, growth stagnates. The difference between agencies that thrive and those that stall will be the willingness to embed AI into everyday tasks, not just keep it on the roadmap.

Right-Sizing the Stack

The fastest way to waste money in insurance technology is by over-buying tools you don’t adopt or integrate. Agencies often chase the “latest thing” only to discover that half their stack collects dust while staff revert to email and spreadsheets.

The winning approach is about balance. A right-sized stack grows with you instead of overwhelming your team.

Starter pack: AMS + CRM + CXP

The essential foundation for small agencies. Your AMS keeps data and compliance in check, the CRM organizes pipeline and renewals, and a CXP like GloveBox ensures your clients can self-service instead of calling.

Scaler pack: AMS + CRM + CXP + targeted automation

For agencies in growth mode, targeted automation (renewal workflows, email sequences, quoting assist) helps staff handle scale without doubling headcount.

Pro pack: AMS + CRM + CXP + full automation suite + AI-driven workflows

The mature model. This stack layers AI and deep automation across quoting, service, and retention, eliminating Tier 1 tasks and giving producers more time to sell.

Right-sizing means resisting the urge to buy everything at once. The stack should evolve with revenue and headcount.

The Bottom Line

The agencies that thrive in 2025 and 2026 won’t be the ones with the biggest sales teams or the most expensive tech budget. They’ll be the ones who built the right stack and used it well.

The AMS keeps your data clean and compliant. The CRM drives pipeline discipline. The CXP, led by platforms like GloveBox, eliminates service friction and builds retention. Automation ensures that every process becomes faster, leaner, and more scalable.

That combination isn’t optional anymore. It’s the difference between an agency that scales without adding headcount and one that drowns in its own service volume.

Schedule your GloveBox demo.