The insurance landscape is always changing. New technologies emerge, client expectations evolve, and the competition gets tougher. As an independent agent or broker, staying ahead of the curve isn’t just an advantage; it’s essential for survival and growth. What worked five years ago might not be enough to carry your business forward.

Insurance sales is widely considered a good career due to its strong growth potential, stability, and the opportunity for professional advancement. Insurance also provides a great benefit by offering financial protection and peace of mind in adverse situations such as health issues, property damage, or death, adding significant value to clients’ lives. While a high school diploma is often sufficient to become an insurance sales agent, having a bachelor’s degree—especially in business or related fields—can be advantageous and is sometimes preferred by employers for those seeking management roles. Employment of insurance sales agents is projected to grow 4 percent from 2024 to 2034, reflecting steady demand in the industry.

So, how do you prepare for what’s next? Insurance companies are constantly innovating and shaping the market, influencing the products and opportunities available to agents. This article will guide you through the top insurance sales strategies you need to master for 2026.

We’ll explore proven techniques that will not only help you meet your sales goals but also build a more resilient and profitable agency. We’ll cover everything from leveraging technology to personalizing the client journey and unlocking powerful new revenue streams.

One of the key advantages of being an independent insurance agent is the ability to set a flexible schedule, allowing you to balance work and personal commitments. Many insurance agents set their own work schedules, providing additional flexibility in their professional lives.

Get ready to discover actionable strategies that can transform your business, with a special focus on how modern tools can supercharge your efforts in referrals and cross-selling.

Introduction to the Insurance Industry

The insurance industry is a dynamic and essential sector that provides individuals and businesses with financial protection against unexpected events. Insurance sales agents are at the heart of this industry, guiding clients through the often complex process of selecting the right insurance coverage. Whether it’s life, health, auto, or property insurance, insurance agents must be well-versed in the various types of insurance products available and the regulations that govern them.

Independent insurance agents, in particular, play a pivotal role by offering clients a broad selection of insurance programs from multiple providers. This flexibility allows them to customize insurance programs to fit the unique needs of each client, ensuring that prospective clients receive the most appropriate coverage for their circumstances. As the insurance industry continues to evolve, insurance sales agents must stay informed about new products, industry trends, and changing regulations to provide the best possible service. By doing so, they help clients make informed decisions and secure the protection they need for themselves, their families, and their businesses.

Benefits of Working with Independent Agents

Choosing to work with independent insurance agents offers clients a host of advantages that go beyond standard insurance offerings. Unlike agents who represent a single insurance company, independent agents have access to a wide network of insurance companies, enabling them to compare multiple insurance products and find the best fit for each client’s needs. This ability to customize insurance programs means clients receive insurance solutions that are tailored to their specific situations, whether they’re seeking coverage for their home, health, auto, or business.

Independent agents are known for their personalized approach, taking the time to understand each client’s unique requirements and providing expert guidance throughout the insurance process. Their flexibility extends to scheduling as well, allowing them to meet with clients at convenient times and locations. By leveraging their industry knowledge and broad access to insurance programs, independent agents can offer competitive pricing and a diverse range of insurance options. Ultimately, working with an independent agent ensures clients receive comprehensive, unbiased advice and insurance solutions designed to protect what matters most.

1. Embrace Hyper-Personalization at Scale

Personalization is no longer about just using a client’s first name in an email. In 2026, clients will expect you to understand their unique needs, anticipate their life changes, and offer solutions before they even think to ask. Offering personalized reviews during check-ins demonstrates long-term investment in clients’ well-being, further enhancing trust and engagement.

This is hyper-personalization, and technology is the key to achieving it at scale. Understanding the sales process helps agents balance emotion and logic in client interactions, allowing them to better anticipate client needs and deliver tailored solutions. Agents learn to refine their sales process and personalization skills through ongoing training and hands-on experience, ensuring continuous improvement in meeting client expectations.

Understanding the Modern Client

Today’s insurance buyers are used to the seamless, personalized experiences offered by companies like Amazon and Netflix. They expect the same level of service from their insurance agent. They want you to know their history, understand their current situation, and provide relevant advice that simplifies their life. To meet these expectations, it’s crucial to understand the needs of both existing clients and potential customers, ensuring you can engage and serve a broader audience.

This means moving beyond generic policy recommendations. For example, instead of just offering a standard home and auto bundle, a hyper-personalized approach involves:

Analyzing Data: Looking at a client’s profile—do they have young drivers, a new swimming pool, or a home-based business?

Anticipating Needs: If a client just bought a new, expensive car, they might need to increase their liability limits or consider gap insurance.

Proactive Communication: Reaching out with a specific, helpful suggestion rather than waiting for them to inquire.

Understanding the different types of insurance, such as life, health, auto, and home, is essential for tailoring recommendations to each client’s unique situation.

How to Implement Hyper-Personalization

Implementing this strategy doesn’t have to be overwhelming. Start by leveraging your Customer Relationship Management (CRM) system more effectively. Tag clients based on life events (e.g., new marriage, new baby, new home), policy types, and potential insurance coverage gaps. Use CRM data to identify where clients may be underinsured or missing important insurance coverage, allowing you to offer tailored solutions.

Set up automated reminders to review accounts around key milestones. For instance, if a client’s child is turning 16, schedule a touchpoint to discuss adding a new driver to their auto policy. Use policy renewals as an opportunity for personalized communication and to review clients’ insurance coverage, ensuring their needs are still being met. This proactive outreach shows you’re paying attention and adds immense value, strengthening client loyalty and setting you apart from competitors who rely on reactive service.

2. Master the Art of Digital Client Servicing

The way clients interact with their insurance is changing. While personal relationships and the traditional office setting—where agents conduct in-person meetings and manage administrative tasks—remain vital, the demand for digital self-service options is skyrocketing. In addition to these changes, insurance sales agents can maintain a passive income stream from policy renewals, providing financial stability and long-term benefits.

The Expectation for 24/7 Access

Think about how you manage your own banking, travel, or shopping. You likely use an app. Your clients want the same convenience for their insurance. They want to be able to access policy documents, make payments, and file a claim from their smartphone at any time of day, without having to call your office during business hours.

Digital tools are especially valuable for agents who have limited paid time off, as they help manage workload efficiently and ensure client needs are met even when the agent is unavailable.

Providing this level of access doesn’t diminish your role as a trusted advisor. Instead, it frees you from handling routine administrative tasks. When clients can self-serve for simple requests, you have more time to focus on high-value activities, like providing expert advice, conducting policy reviews, and building relationships.

The Power of a Client-Facing Portal

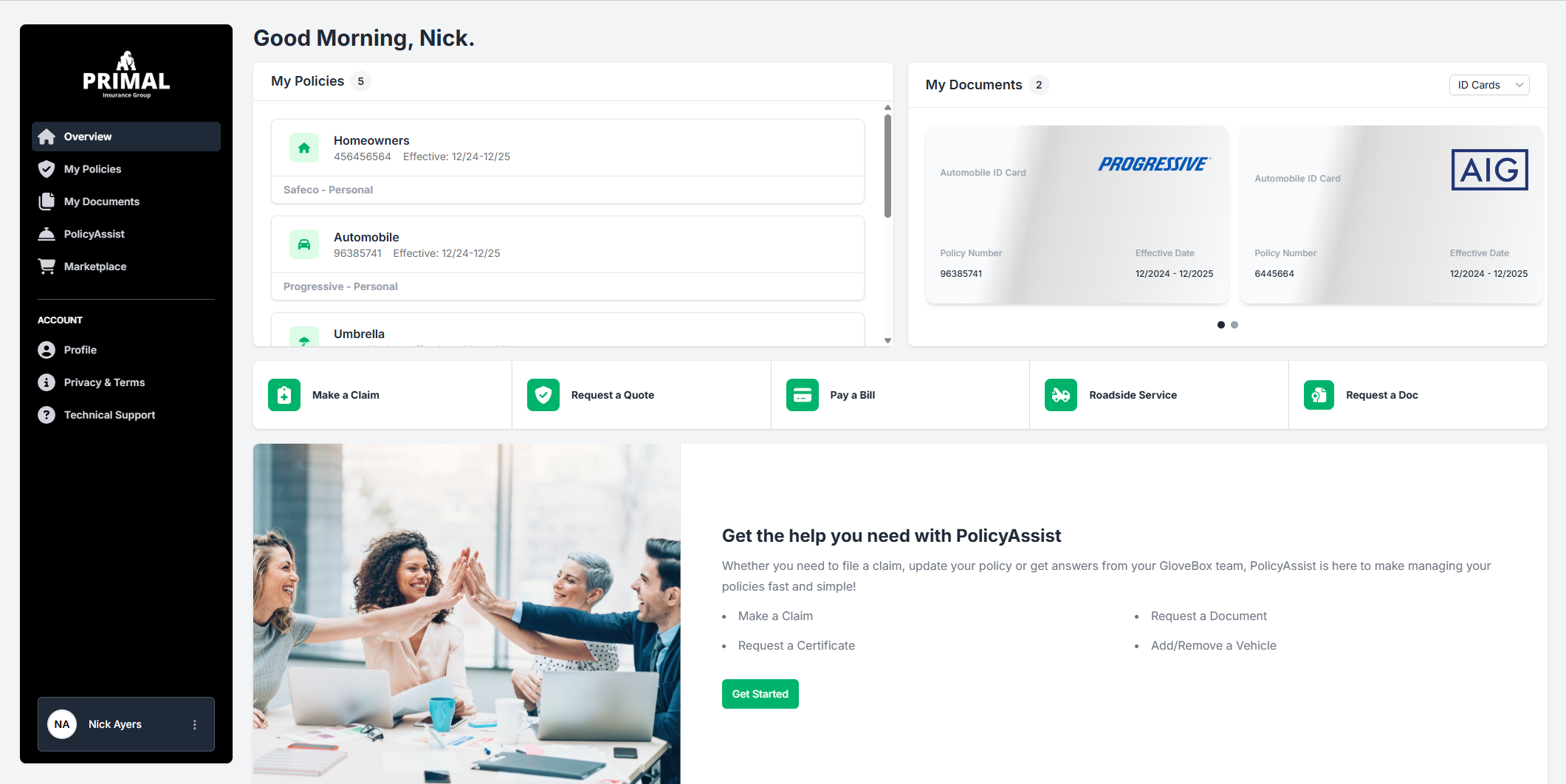

This is where a dedicated client portal becomes a non-negotiable tool for the modern agency. Platforms like GloveBox are designed specifically for this purpose. By giving your clients a branded app, you put all their insurance information directly in their pocket. A client portal also helps agents manage and expand their customer base by providing tools for client retention and cross-selling opportunities.

With a tool like GloveBox, your clients can:

Access all their policy documents from multiple carriers in one place.

Get their auto ID cards instantly.

Pay bills directly to the carrier.

Initiate a claim with the tap of a button.

These features enable agents to more effectively sell insurance products by streamlining communication and service, making it easier to address client needs and nurture leads.

This seamless experience not only meets modern expectations but also reinforces your brand every time a client opens the app. It transforms your agency from a once-a-year phone call into a daily resource, strengthening your relationship and making your agency indispensable.

3. Turn Your Client Base into a Referral Engine

Referrals have always been the lifeblood of the insurance business. A warm lead from a happy client is infinitely more valuable than a cold call, which often lacks the personal connection and trust needed to nurture leads effectively. Traditional outreach methods, such as cold calls, are typically used to contact unqualified or unresponsive leads, but they rarely achieve the same results as referrals. The challenge, however, has been creating a consistent and easy process for generating these referrals. A formal referral program can reward existing clients for bringing in new business, making it easier to generate leads while strengthening client relationships.

The Problem with Traditional Referral Methods

How do you currently ask for referrals? Is it an awkward question at the end of a call? An easily ignored line at the bottom of an email? These methods are often ineffective because they place the burden on the client. They have to remember your name, find your contact information, and then pass it along to their friend or family member. There’s too much friction in the process. Selling insurance is much more effective when it is based on trust and strong client relationships, which are built through meaningful interactions rather than impersonal referral requests.

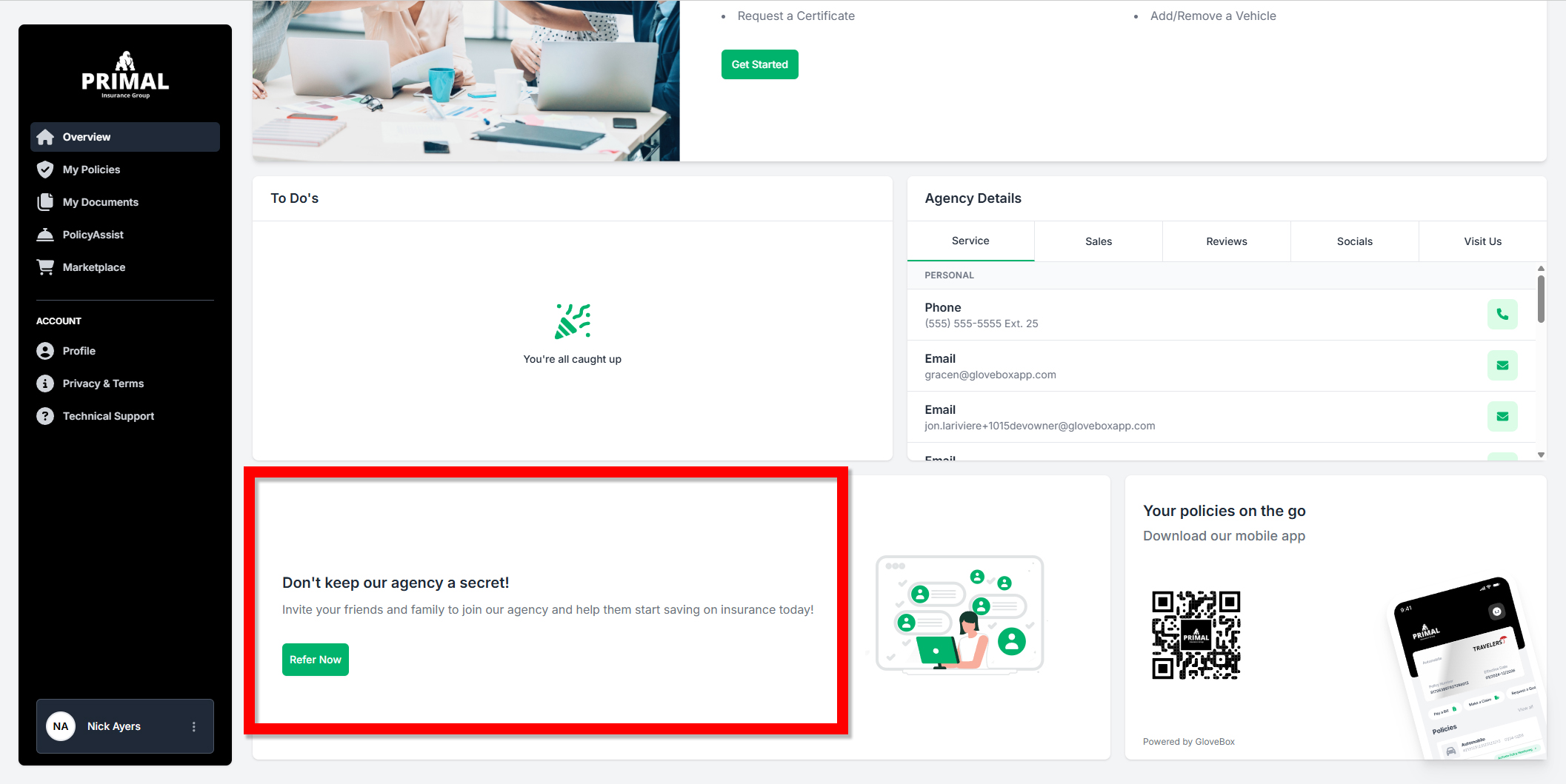

To build a true referral engine, you need to remove that friction entirely. You need to make it so simple to refer you that clients can do it in the moment they feel most satisfied with your service.

Making Referrals Effortless with Technology

This is another area where modern client-facing technology shines. A key feature of platforms like GloveBox is the ability to generate referrals with a single tap. These platforms often integrate with various insurance companies, allowing clients to manage policies from multiple providers in one place and providing a unified experience. Imagine this scenario: a client uses your branded app to instantly access their auto ID card after being pulled over. They are relieved and grateful. Right there, within the app, they see a “Refer a Friend” button.

With one click, they can share your contact information and a pre-populated message via text, email, or social media. The process takes less than 10 seconds. You’ve captured their goodwill at its peak and made it incredibly easy for them to act on it.

This isn’t just a gimmick; it’s a fundamental shift in how referrals are generated. By embedding this capability into a tool your clients are already using for convenience, you transform your entire client base into a proactive sales force. You are no longer just hoping for referrals; you are actively engineering them.

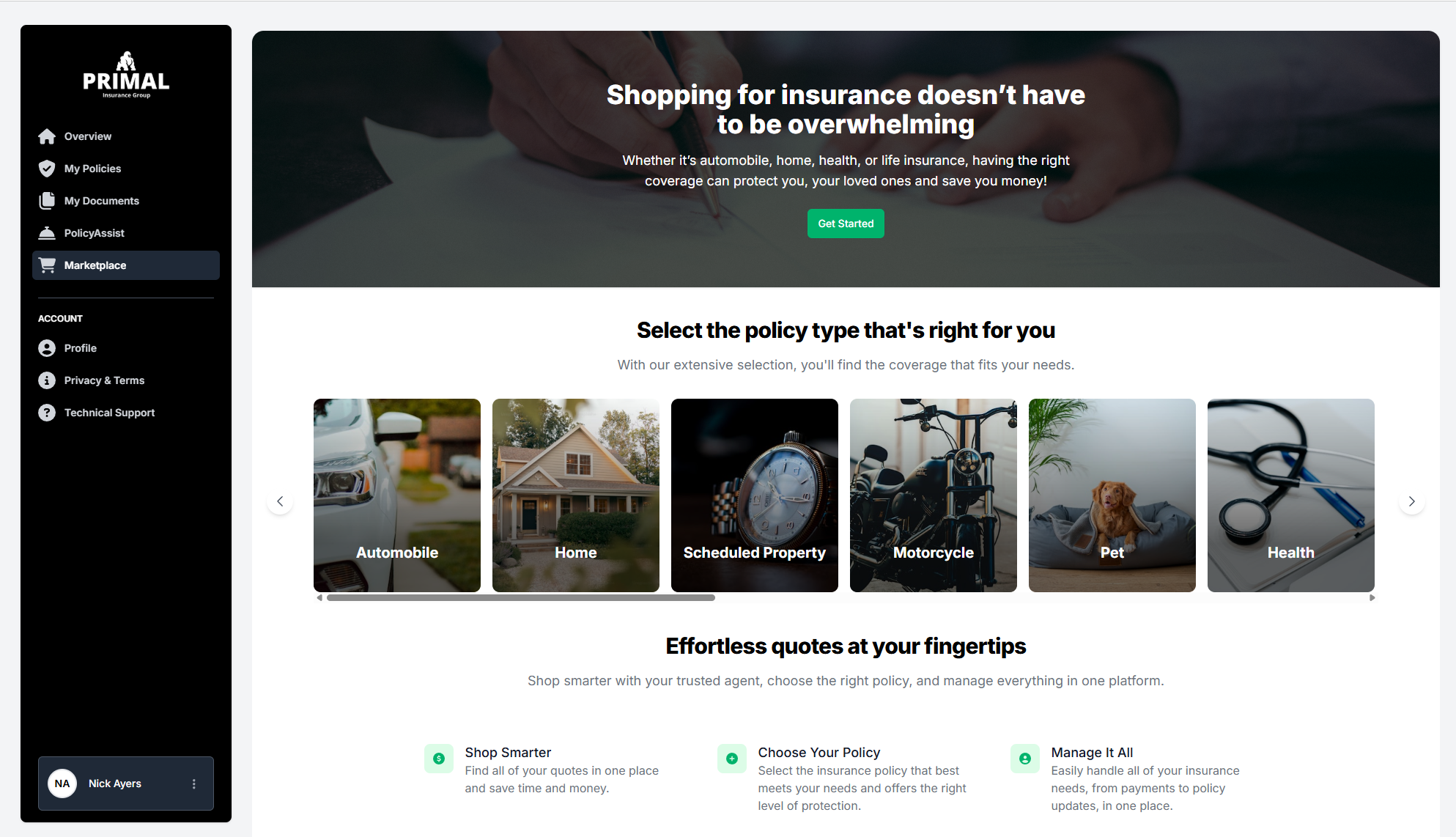

4. Unlock Hidden Revenue with the GloveBox Embedded Marketplace

Cross-selling is one of the fastest and most sustainable ways to grow your agency, but old-school approaches can feel forced and impersonal. GloveBox changes the game with its exclusive Embedded Marketplace feature, designed to turn routine service moments into seamless, automated revenue opportunities—without ever feeling pushy. Cross-selling additional coverage products to existing customers is known to increase retention and revenue, making it a vital strategy for long-term success.

With the marketplace, agents can offer specialized policies, such as those covering assisted living services and medical care for senior clients, ensuring comprehensive coverage options for every stage of life. Selling policies involves not only presenting these options but also explaining complex policies, negotiating terms, and maintaining strong client relationships to ensure policies are kept up to date and properly managed.

Transforming Service into Sales—Effortlessly

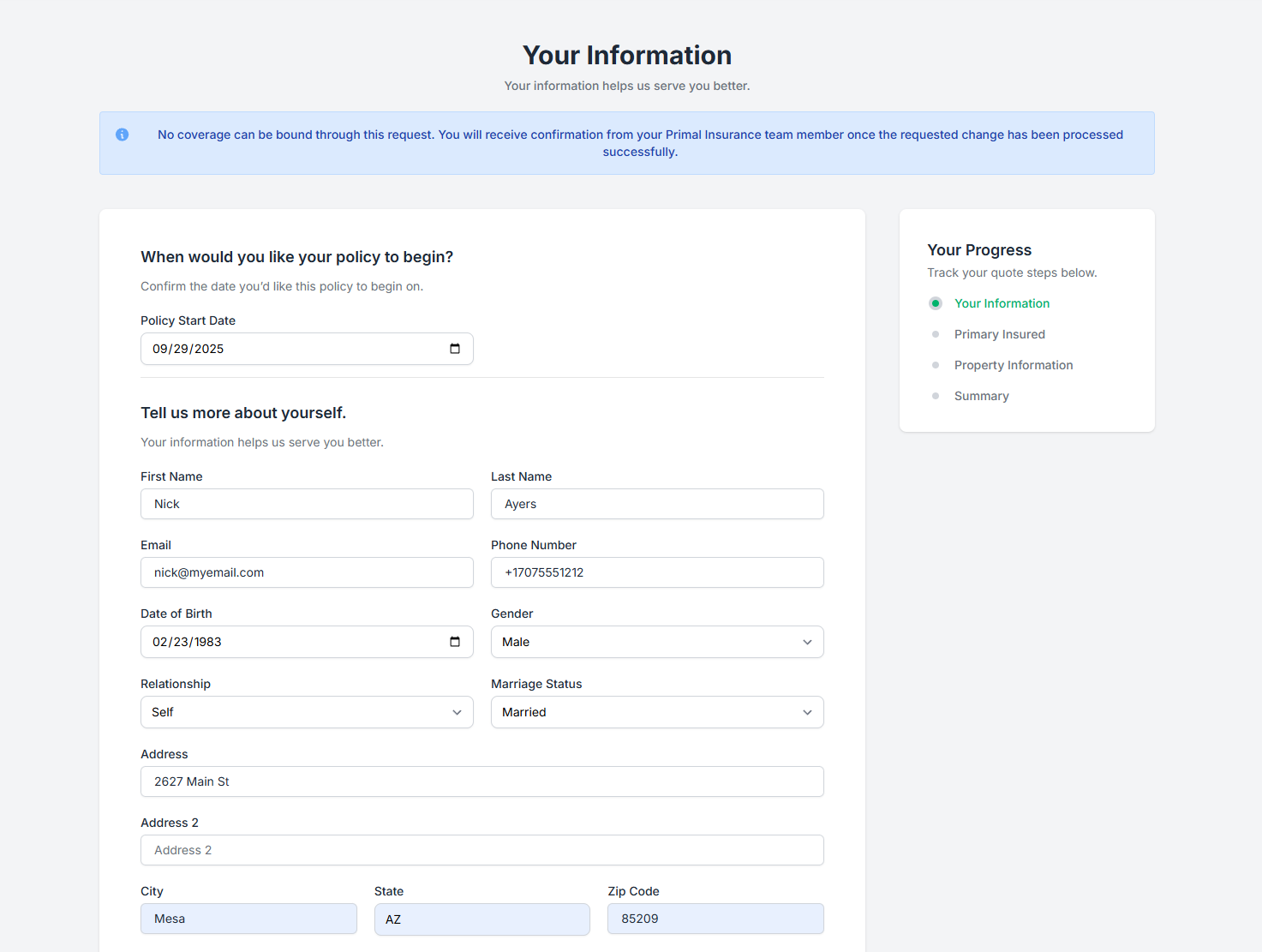

With the Embedded Marketplace, every client interaction becomes a chance to add value. Whether someone logs in to check ID cards, pay a bill, or request a policy change, your agency-branded portal immediately identifies relevant insurance gaps and presents additional coverage options you actually offer. Clients can browse and request quotes for personal and commercial lines—right as they’re already engaged with your agency. Life insurance agents can also use the marketplace to present tailored life insurance options to clients, ensuring specialized coverage is easily accessible.

Intelligent, Timely Recommendations Powered by Real Data

What truly sets the GloveBox Embedded Marketplace apart is its use of real client data. Each recommendation is driven by factors such as identified coverage gaps ensuring that the products suggested are timely, relevant, and meaningful. Agencies can also hire candidates with strong data analysis skills to maximize the effectiveness of these tools and ensure intelligent recommendations. For example, if a client has home insurance but not auto, the system will prompt them to bundle—using native quote forms that are already prefilled with their existing data.

Frictionless, Personalized Experience

Clients enjoy a self-service experience that’s every bit as smooth as online banking or shopping, with no tedious data reentry. Many agencies seek agents with a bachelor’s degree to ensure a high level of professionalism and expertise, further enhancing the quality of service clients receive. Only the products your agency is licensed to offer are shown, so options are always tailored, compliant, and aligned with your business goals. Prefilled forms and integrated workflows make requesting new quotes or expanding coverage effortless and fast.

Keep Cross-Sell Volume High—While Maintaining Client Trust

Unlike generic upsell tactics, the Embedded Marketplace supports your consultative, trusted advisor relationship by surfacing options at just the right moment—when clients are already thinking about their insurance needs and engaging with your brand. The marketplace helps clients identify and expand their insurance coverage, ensuring they have the protection they need. You become their go-to resource, expanding your wallet share with each satisfied customer, and driving growth without extra manual effort for your team.

By making cross-sell and upsell opportunities part of the natural client journey, the GloveBox Embedded Marketplace empowers you to keep more business in-house, grow revenue, and strengthen loyalty—all while offering a modern, branded experience your clients will love.

5. Prioritize Value-Driven Content Marketing

Finally, to tie all these strategies together, you need a strong content marketing plan. In 2026, being an expert isn’t enough; you have to prove it. By consistently creating and sharing valuable content, you can attract new prospects, nurture existing clients, and establish your authority in the market.

Email campaigns are an effective tool for personalized marketing to both prospects and current customers, ensuring your content reaches the right audience at the right time.

Educate, Don’t Just Sell

Your content should focus on answering your clients’ most pressing questions. Think about the topics you discuss with them every day:

How much liability coverage do I really need?

What’s the difference between replacement cost and actual cash value?

When should I consider an umbrella policy?

Turn these conversations into blog posts, short videos, or social media updates. You can also use content to explain the unique offerings and strengths of various insurance companies, helping clients understand which provider might best suit their needs. When a prospect finds your article explaining the nuances of uninsured motorist coverage, they see you as a knowledgeable and trustworthy resource before you’ve even spoken.

Integrating Content with Your Sales Funnel

Your content should work hand-in-hand with your other sales strategies. Share your articles in your email newsletter to prompt policy reviews. Post a video about the importance of flood insurance on social media, then direct viewers to your Embedded Marketplace to request a quote. Use your content to educate clients on why they need a dedicated portal like GloveBox to manage their policies. Additionally, create content that helps clients understand their insurance coverage options, empowering them to make informed decisions about protecting their health, property, and possessions.

By providing consistent value, you build trust and stay top-of-mind. When a life event triggers an insurance need, you’ll be the first person they think to call.

Measuring Success in Insurance Sales

Success in insurance sales is measured by more than just the number of policies sold—it’s about building lasting relationships, achieving sales goals, and delivering value to clients. Insurance sales agents track key performance indicators (KPIs) such as policy sales, client retention rates, and the acquisition of new clients to gauge their effectiveness. Experienced agents often set ambitious sales goals and monitor their progress by evaluating the growth of their client base and the revenue generated from new and existing clients.

Insurance companies also play a role in measuring agent success, using metrics like premium growth, claims ratio, and customer satisfaction to assess performance. These benchmarks help sales agents identify strengths and areas for improvement, allowing them to refine their sales strategies and better serve their clients. Top-performing agents are frequently recognized and rewarded by their companies, providing additional motivation to excel in the competitive insurance industry. By focusing on these success metrics, insurance sales agents can build a thriving career and make a meaningful impact on the lives of their clients.

Overcoming Challenges in Insurance Sales

Insurance sales agents operate in a dynamic environment where change is constant. From shifting regulations to rising client expectations and rapid technological advancements, insurance agents must be agile and resourceful to succeed. Overcoming these challenges is essential not only for meeting sales goals but also for building lasting relationships with clients and maintaining a thriving insurance sales career.

Navigating Regulatory Changes and Compliance

For insurance sales agents, staying compliant with ever-evolving insurance laws is a top priority. The insurance industry is subject to frequent updates in regulations, especially in areas like health insurance, life insurance, and auto insurance. Independent insurance agents, in particular, must keep a close eye on state-specific requirements to ensure their practices align with current laws. By proactively monitoring regulatory changes and participating in ongoing education, insurance agents can avoid compliance pitfalls and provide clients with accurate, up-to-date advice. This commitment to compliance not only protects your agency but also builds trust with clients, who rely on your expertise to navigate the complexities of insurance sales.

Adapting to Evolving Client Expectations

Today’s clients expect more than just a policy—they want insurance agents who truly understand their unique insurance needs and can offer tailored insurance solutions. Insurance sales agents must be skilled communicators, able to listen carefully and explain complex insurance products in a way that clients understand. Independent agents often serve a diverse client base, requiring them to offer a wide range of insurance policies, from life insurance policies and health insurance options to auto insurance and beyond. By staying attuned to changing client preferences and being responsive to their questions, insurance agents can deliver personalized service that sets them apart. This client-centric approach not only increases satisfaction but also fosters loyalty and long-term relationships.

Managing Technology Adoption and Integration

As the insurance industry becomes more technology-driven, insurance sales agents must embrace new tools to stay competitive. Effective technology adoption means more than just using software—it’s about integrating these solutions into daily workflows to better serve clients. Independent brokers, for example, can leverage technology to customize insurance programs, streamline the claims process, and provide timely insurance quotes. By utilizing digital platforms to manage client data and automate routine tasks, insurance agents can focus on delivering value and building relationships. Embracing technology not only improves efficiency but also enhances the overall client experience, making your agency a trusted resource in a fast-paced insurance market.

Handling Increased Competition

The insurance industry is more competitive than ever, and insurance sales agents must find ways to stand out. Whether you’re an experienced agent with an established client base or a new insurance sales agent just starting your career path, differentiation is key. Building strong relationships, offering exceptional customer service, and developing a compelling sales pitch are all essential strategies. Experienced agents may focus on deepening connections with many clients and providing expert guidance on complex insurance needs like medical malpractice or workers compensation. New agents can highlight their fresh perspective and commitment to informed decisions. Staying current with industry trends, pursuing continuing education, and maintaining a proactive approach will help insurance agents achieve their sales goals and build a rewarding career. While a high school diploma is typically required, many employers value a college degree or bachelor’s degree for those looking to advance. With the right skills and mindset, insurance sales agents can overcome industry challenges and deliver great benefits to their clients.

The Future-Ready Agency

The insurance industry of 2026 will belong to the agents who are adaptable, client-focused, and technologically savvy. Success will be defined not by who has the lowest price, but by who provides the most value and the best insurance experience. Delivering an exceptional insurance experience will be a key differentiator for future-ready agencies.

By implementing these strategies—hyper-personalization, digital servicing, effortless referrals, and embedded cross-selling—you can build an agency that doesn’t just survive, but thrives. You can create a business that is more efficient, more profitable, and more deeply connected to the clients you serve.

The tools to make this a reality are here today. Stop chasing referrals and let your clients send them to you with a single tap. Stop making awkward cross-sell pitches and let your clients discover their coverage needs in a self-service marketplace. It’s time to elevate your agency.

Ready to see how GloveBox can power your sales strategies for 2026 and beyond? Schedule your Discovery Call today and let us show you the future of insurance.