Selling insurance is complex. It all starts with how you structure your agency.

Are you a generalist chasing everyone or a specialist solving real problems for a specific group?

Do you know your total addressable market (TAM), or are you guessing?

Are you working with strong carriers in the right regions?

Most importantly, do you have exact processes that allow your team to scale?

If you want to grow, these questions matter just as much as any sales script. Insurance sales can be a rewarding career, offering opportunities for personal growth, making a positive impact, and building a fulfilling professional path.

Once you’ve got that foundation, it’s time to focus on execution. Having a clear sales plan is essential to guide your agency’s growth and ensure effective execution. And that’s where playbooks from this article come in.

They will help you reduce the noise, sell smarter, and grow without burning out your team.

No fluff. No guessing. Just the exact moves top agencies are using today.

TL;DR – How to Sell Insurance In 9 Steps

If you’re an insurance agency leader looking to increase sales, this guide is for you.

You’ll learn how to:

- Pick the right niche and target market based on size, margin, and opportunity.

- Adjust your sales strategy based on whether you sell to B2B or B2C.

- Automate simple tasks so your agents can focus on selling.

- Use digital self-service to meet modern customer demands.

- Let technology suggest new policies automatically.

- Make decisions based on real-time client insights.

- Automate your renewal process to boost retention.

- Provide your own branded platform to improve customer experience and get more referrals

- Use helpful online content to attract better leads.

In the following sections, you’ll find actionable tips for each step to help you grow your business and improve your online presence.

Ready to improve your insurance sales? Read on to learn how you can start selling insurance using these proven strategies. Step by step.

Know Who You’re Selling To

Before you sell more insurance, you need to know who you want to sell to. It sounds simple, but most agencies skip this step and chase everyone.

That’s the first step to failure you must avoid.

The best-performing agencies aren’t generalists. They’re specialists.

Instead of going a mile wide and an inch deep, they go an inch wide and a mile deep. They pick a clear niche, study it deeply, and become the prominent expert in that space. By focusing on qualified prospects—potential clients who are genuinely interested in your services—you maximize your chances of closing sales before competitors do.

- They get more trust from carriers.

- They get more targeted referrals.

- Their marketing is easier.

- Their messaging is sharper.

- They generate higher quality leads by targeting a specific niche.

And they sell more insurance with less effort.

Start with your TAM

TAM stands for Total Addressable Market, which is the number of customers you could potentially serve. You want to know if the niche you’re targeting is big enough to grow in.

If it’s a small TAM, you’ll want to target multiple lines of business – liability, comp, cyber, auto insurance, etc.

If it’s a large TAM, you can afford to go deep on one specific product.

The sweet spot is when you specialize in both the industry and the product. For example, selling cyber insurance to tech companies only. That’s a double niche and a huge advantage. You can also offer different insurance plans tailored to your niche, ensuring clients get the right coverage for their specific needs.

It lets you build deeper trust with carriers and underwriters, partner with other agents who don’t touch your niche, and create messaging that lands.

Go where others aren’t

If a niche is underserved, that’s not a red flag. It’s an opportunity.

Others may avoid it because it’s complex or hard to understand. That’s your chance to win.

Do the research. Understand your audience’s pain points better than anyone else. Establish strong relationships and credibility within your chosen niche to set yourself apart.

When you become the one who “gets it,” clients will come to you. If you try to sell to everyone, you sell to no one.

Pick your people. Study their world. Build around that.

B2B and B2C Aren’t the Same Game

How you’re going to sell insurance is not the same if you’re selling to a business or selling to a family.

The strategy changes depending on who you serve. Tailoring your insurance services to meet the unique needs of either businesses or families is essential for success. If you mix it up, you’ll waste time, lose deals, and frustrate your team.

Let’s break it down.

B2C is transactional

Most personal lines sales are all about price. No matter how great your agency is, many clients will leave you over a $15/month difference.

People shop around. They compare quotes and switch for small savings.

Price drives the decision. And agents become order-takers.

Quote. Bind. Move on to the next.

You can still grow in B2C, but only if you accept it as a volume game. To stay profitable, you need good carriers, tight processes, and strong automation.

B2B is strategic

Commercial lines are a different world. You’re selling expertise, trust, and partnership – not just price.

Sales cycles are longer. Clients are pickier.

But if you get it right, you earn higher premiums, longer relationships, and better margins. You must show up like a true advisor, not just another agent.

Build your niche authority. Show up with relevant content. Create systems that support consistent follow-up.

Choose your carriers wisely

Whether you sell B2B or B2C, your carrier mix matters. You don’t need 40 carriers, only three to five strategic ones.

Here’s the ideal setup:

- Preferred carrier – Your “go-to” for most business

- Downsell carrier – For clients who don’t qualify for the preferred option

- Non-standard carrier – For tough cases (e.g., DUI, tricky properties, etc.)

Smaller regional carriers might have better pricing or underwriting flexibility, but they often lack good tech, which creates friction for your clients and your staff.

So, choose based on both fit and functionality.

Sales cycles depend on the product

There’s no one-size-fits-all timeline for closing deals.

- Renters insurance? Might close in one call.

- Cyber policy for a tech firm? Could take weeks.

- High-net-worth client with five properties and a boat? Maybe a month or more.

- Workers comp for a business? You’re waiting for renewal, and there’s no way around it.

The rule is simple: smaller premium = faster sale. The bigger the risk, the longer the decision.

Your sales approach needs to match that timeline.

Push too hard, and you lose trust. Wait too long, and someone else will get in.

With the right client type, product mix, and strategy, your agency can grow faster and smarter. Let’s examine how to make that happen step by step.

It’s playbook time!

Overcoming Challenges in Insurance Sales

Selling insurance online presents unique challenges for insurance agents, but with the right approach and digital tools, these hurdles can be transformed into opportunities for growth. The world of insurance sales is rapidly evolving, and agents must adapt to new ways of connecting with clients, understanding their needs, and delivering value—often without ever meeting face-to-face. As more customers turn to insurance online, insurance agents need to master both the art of selling and the science of digital engagement to succeed in today’s competitive insurance market.

Common obstacles agents face today

Insurance agents today face several significant challenges in building a successful insurance business. One of the biggest hurdles is establishing trust with potential clients in a digital environment, where personal connections can feel distant. The crowded insurance market means agents must work harder to stand out, especially as many consumers are wary of traditional insurance sales tactics. Independent insurance agents, in particular, must juggle staying current with industry regulations, new products, and emerging technologies—all while managing their own book of business. Effective customer relationship management is crucial for nurturing leads, maintaining client satisfaction, and ensuring long-term success in the insurance business.

How to turn challenges into opportunities

Despite these challenges, insurance agents can set themselves apart by embracing technology and focusing on exceptional customer service. Using video conferencing tools like Google Meet allows agents to create personal, face-to-face connections with clients, even when selling insurance online. By providing tailored solutions and being responsive to client needs, agents can build trust and loyalty. Leveraging search engine optimization (SEO) and maintaining a professional insurance website can make all the difference in attracting prospective clients and generating more leads. Establishing a strong online presence through digital marketing and social media helps insurance agents reach a wider audience, drive more sales, and position themselves as trusted advisors in the insurance industry.

Tools and mindsets for overcoming setbacks

To thrive in the ever-changing world of insurance sales, insurance agents need to cultivate resilience, adaptability, and a commitment to continuous learning. Investing in ongoing education and training ensures agents stay ahead of industry trends and regulatory changes, which is essential for a successful insurance business. Utilizing tools like CRM software streamlines client management, tracks leads, and provides valuable insights into sales performance. Adopting a growth mindset—focusing on customer needs, learning from setbacks, and being willing to pivot strategies—empowers agents to overcome obstacles and achieve lasting success in selling insurance online. By combining the right tools with a proactive, client-focused approach, insurance agents can build a thriving insurance business and help more clients.

Selling Insurance Playbook #1 – Transform Your Service Burden into a Sales Advantage

Your team spends too much time doing simple tasks. Every time a client calls asking for an ID card or a policy document, your agency loses money.

Instead of talking to new customers, your agents waste hours each day sending documents and answering simple questions. Automating these service tasks streamlines the sales process, allowing your agents to focus on building relationships and ultimately sell policies.

In fact, according to our research, insurance agencies spend 38 cents of every dollar earned on basic service work. That’s almost half your money spent on tasks that don’t bring new sales or clients.

Automate simple tasks to sell more

The best insurance agencies don’t let their sales teams handle easy tasks. They use technology to do the boring stuff for them.

When you automate tasks like sending ID cards, handling payments, and answering easy policy questions, your team can focus on more important things, such as selling new policies, handling renewals, and keeping clients happy.

Your agents become sellers again, not just service workers, helping your agency grow faster and make more money without adding extra costs.

GloveBox makes automation easy for insurance agencies. Our tool called PolicyAssist™ fills out forms automatically for your clients, reducing your service workload by 30–40%. Less time filling forms means more time talking to customers and selling policies. With GloveBox, you spend less money on simple tasks and more time growing your agency.

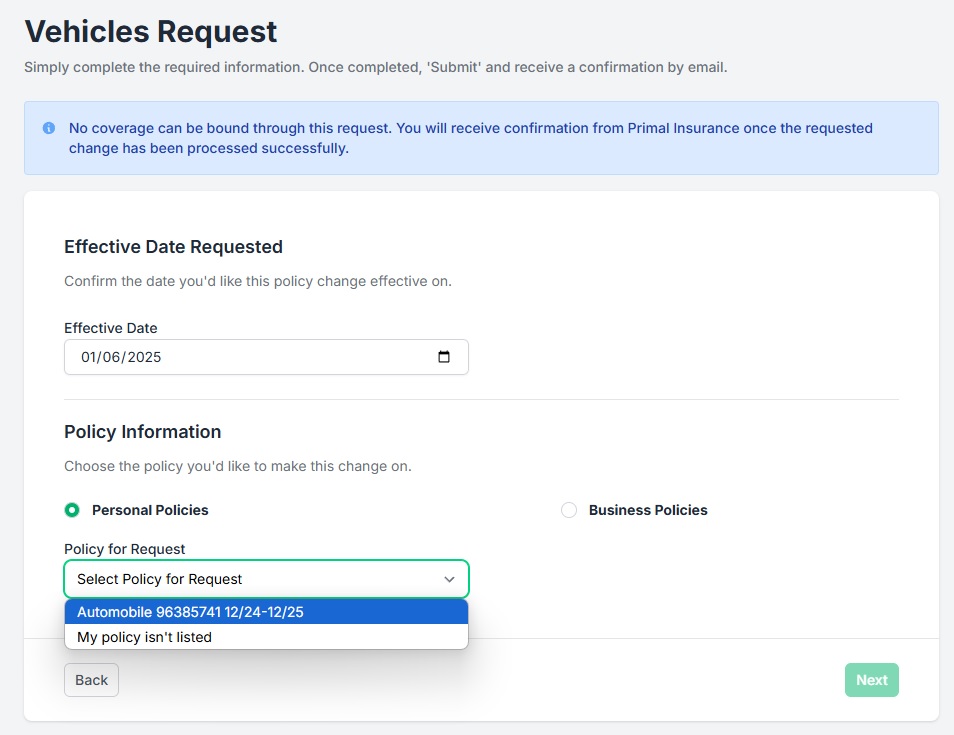

PolicyAssist pre-fills your insured’s data to eliminate errors and makes it easy for them to request service.

Selling Insurance Playbook #2 – Sell 24/7 Without Hiring More CSRs

Client expectations have changed. They expect fast, easy service at any hour of the day.

They want quick answers, instant policy documents, and immediate billing details. Waiting on hold or sending emails for basic policy questions frustrates them.

Your customers want self-service options. They want to get their insurance details on their own terms, without talking to an agent every time. Offering these features through your own website provides a seamless, branded digital platform where clients can access information and manage their policies anytime. By integrating self-service tools into your websites, you can improve customer satisfaction and increase efficiency.

If your agency can’t offer that, they will find another agency that can.

Give customers a self-service platform

Offer clients a digital platform where they can access policy information anytime. A simple website or mobile app that lets them download ID cards, pay bills, and view their policy details would do the trick.

Your agency stays open 24/7 without needing more customer support staff. Agents can focus on selling insurance instead of answering basic questions.

Stop reacting to every client call and start giving them the tools to handle simple tasks alone. Empower your customers with self-service technology to reduce calls, emails, and workload on your staff.

Your customers will become happier because they get fast, simple solutions exactly when they want.

Your team will also be happier because they get their time back for sales and client relationships.

Win-win.

GloveBox offers your agency a ready-made, branded self-service portal and mobile app. We let your customers manage policies, get documents, and handle billing instantly, anytime they want. Our portal cuts your after-hours calls and emails, reducing your team’s stress. Your agency will look professional, digital-savvy, and customer-focused without extra hiring or costs.

Selling Insurance Playbook #3 – Use Embedded Digital Experiences to Maximize Cross-Selling

Traditional cross-selling is reactive.

Most agencies only cross-sell when a customer reaches out or during policy renewal. Waiting until then means your agency misses out on easy growth.

You can’t rely on busy agents to always remember to cross-sell. Opportunities get lost, leaving money on the table.

Customers don’t know what else you offer if you don’t show them clearly and often. Embedding cross-selling opportunities provides benefits for both clients and agencies, such as increased coverage for clients and higher revenue for agencies.

Let technology cross-sell for you

Embed cross-selling opportunities directly into your digital tools. Every time a client checks their policy, your platform can automatically suggest new coverage options.

Your customers see relevant offers exactly when they’re thinking about insurance. They become active buyers without your agents needing to lift a finger.

Turn passive policyholders into active buyers

Make cross-selling automatic – not something agents must remember to do. Use digital prompts inside your client portal to suggest additional coverages.

Show your clients products that are directly related to what they already own. For example, when clients view home insurance details, flood insurance is automatically suggested.

Your customers are more likely to buy when you prompt them at the right time.

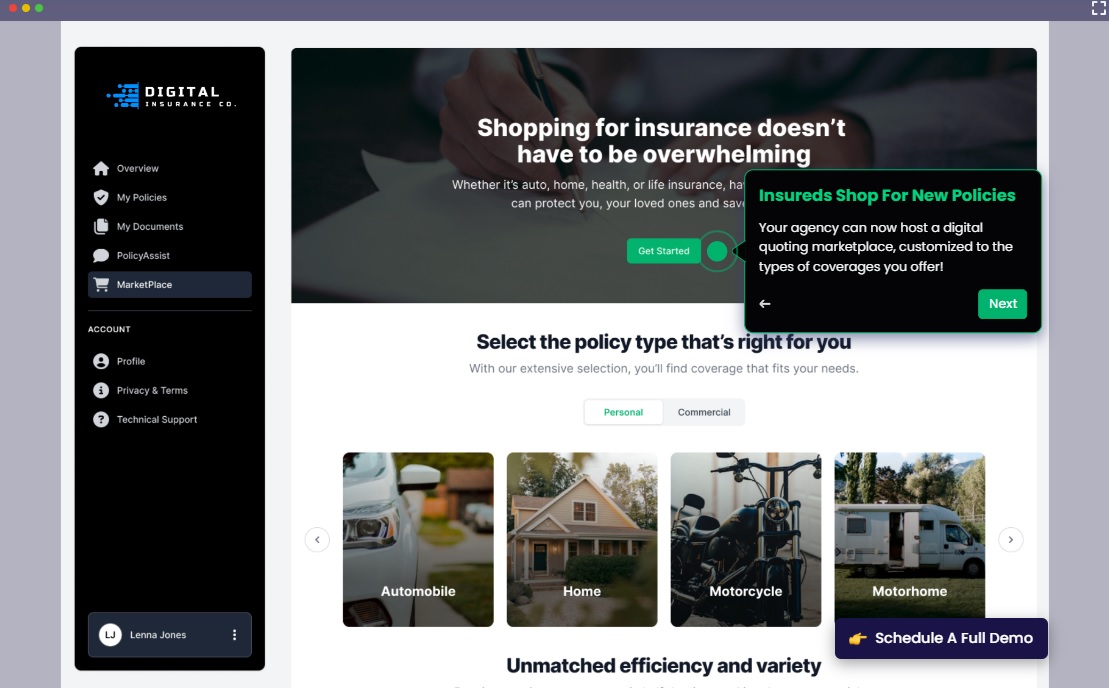

GloveBox has an Embedded Marketplace feature that allows you to automatically introduce your policyholders to new insurance products inside your branded platform. Clients see personalized offers anytime they interact with their policy.

Your agency earns more without manual intervention or extra effort from your team. Cross-selling becomes simple, automatic, and highly effective.

GloveBox’s Embedded Marketplace

Selling Insurance Playbook #4 – Use Analytics to Sell Better

Not having real-time insights is costing you deals.

Most insurance agencies guess what their customers want. Without precise data, your agents rely on gut feelings or outdated reports.

The guesswork leads to lost sales and missed opportunities. You can’t earn as many premiums as you want if you don’t see what your customers truly need.

Use data to sell what customers really want

Smart agencies use analytics to see exactly what their customers are doing. Real-time data shows you what coverages clients look at most and when they’re ready to buy.

Instead of guessing, you can use real insights to offer policies your clients want.

Check which coverages customers view online most often. If many clients check flood insurance but don’t buy, create targeted offers or educational content about flood risks.

Use data to tailor your sales conversations, making each offer more relevant. Relevant offers close faster and keep clients happier.

GloveBox connects directly with over 2,000 insurance carriers and major agency management systems. Our platform gives your team real-time insights into client behavior, policies, and interactions. With instant data at hand, your agency can spot sales opportunities and make the right offers at the right time. We eliminate guesswork so your team can close more deals.

Selling Insurance Playbook #5 – Optimize Renewals to Secure Predictable Revenue

Renewals should be the backbone of your growth strategy. They bring steady income without extra sales effort.

But many agencies overlook renewals and lose easy money. Every client who leaves at renewal costs you money twice: lost renewal revenue and extra spending to find new clients.

Keeping current customers is cheaper and easier than finding new ones.

Boost renewals without adding extra work

Renewing a policy should be simple, fast, and automatic. Use technology to track policies and automatically remind customers when it’s time to renew.

Automating renewals reduces client frustration and helps your team save time. Happy clients will usually renew their policies, keeping your revenue steady.

You can even set up automatic renewal reminders for your customers. Clearly explain what happens next, what actions they should take, and when.

Make renewal processes easy enough that customers rarely think about switching. Boost client satisfaction and increase the number of customers who stay year after year.

gives your agency real-time policy tracking and automated renewal reminders built right into your client portal. Our system proactively reminds your clients about renewals, reducing confusion and keeping your team free from repetitive tasks. Your clients renew policies faster and more efficiently, and you earn predictable revenue while reducing manual tasks for your staff.

Selling Insurance Playbook #6 – Differentiate Your Agency by Offering a Superior Client Experience

Differentiation and exceptional service beat pricing battles.

Many insurance agencies try to win clients by offering lower prices. However, competing on price alone isn’t sustainable and cuts into profits.

Customers would rather choose agencies based on convenience, digital ease, and great experiences. A superior digital experience not only delights existing clients but also attracts potential customers and increases conversion rates. Agencies that offer these things can charge fair prices and still easily win customers.

Stand out with a digital-first service

Make managing your clients’ insurance easy and enjoyable. Provide a simple digital platform branded as your agency where customers can handle everything they need.

A good digital experience makes clients feel good about your agency and keeps them loyal. Giving them one easy place online to access policy documents, make payments, and ask for changes is all they need.

When you have your own app, you get happier and more loyal clients who stay with you longer (and even bring you referrals).

gives your agency its own branded mobile app and web portal that your customers can use. Your personalized platform gives clients easy, 24/7 access to their insurance details, helping your agency stand out, win better clients, and keep them loyal year after year.

GloveBox Mobile App

Selling Insurance Playbook #7 – Master Digital Prospecting to Generate High-Quality Leads

Outdated prospecting kills growth.

Many agencies still rely on cold calls or buying lists of leads. People don’t answer calls from numbers they don’t know anymore. The old-school approach drains your resources without giving much back. Cold calling, once a staple of insurance sales, is now far less effective than modern digital prospecting methods like social media outreach, websites, and digital advertising.

Agencies that stick to these methods will lose to agencies that do things differently.

Use content to attract better leads

Instead of chasing leads, create helpful online content that makes prospects come to you. Write articles, make videos, and share ideas that your customers care about.

Pick topics your ideal customers search for, such as reducing insurance costs or understanding coverage options.

Engage on social media to answer questions and share insights. Post regularly on LinkedIn, where business owners and decision-makers spend their time.

When you do this consistently, high-quality leads start to reach out because they trust your expertise. Digital prospecting brings leads directly to your inbox, ready to buy.

The Bottom Line

Insurance sales have changed. Agencies that don’t adapt will get left behind by those that do.

Today, an insurance agent can build a successful business by selling insurance from home, leveraging digital marketing, social media, and online platforms. Selling insurance remotely allows for flexible work hours, cost savings from not needing traditional office space, and the ability to reach more clients. To operate legally and professionally, it’s essential to obtain the necessary business licenses and pass a background check. Whether you are an independent agent, independent insurance agent, life insurance agent, or broker, remote work offers the flexibility to manage your own schedule and grow your business. A reliable internet connection is crucial for managing client relationships, accessing online directories, and conducting virtual meetings.

There are many types of insurance products to offer, including life insurance policies, health insurance, and various plans, each requiring specialized expertise. Life insurance agents and brokers can use online platforms to generate leads and expand their reach, making it easier to impact clients’ lives in meaningful ways. Selling insurance from home or as an independent insurance agent is not only rewarding but also allows you to adapt to the evolving industry landscape.

These seven playbooks show exactly how top agencies win today. From automating routine service tasks and enabling 24/7 self-service to smarter cross-selling and streamlined renewals, each strategy makes your agency stronger, faster, and better at selling insurance.

Agencies using these methods already see actual results. For example, NCM Insurance cut its service expenses by 30%, and Erb & Young increased their team’s efficiency threefold.

Your agency can achieve these results too. Explore how GloveBox can boost your sales, cut costs, and free your team from endless busywork.

Book a free demo of GloveBox to sell more and reduce time spent servicing clients by over 40%