Selling an agency isn’t about finding a buyer. It’s about making someone want to buy it.

And not just buy it but compete for it.

Buyers aren’t just looking at your book of business when determining your insurance agency valuation. They’re looking at the quality of the business behind it.

One that runs without you. One that’s profitable, stable, and built to grow.

We’ll break down the exact levers that increase your agency value and what buyers actually care about when making an offer.

Whether you are planning to sell next year or five years from now, these steps will make your agency stronger, more efficient, and more profitable.

Let’s get into it.

Wondering how to increase your insurance agency valuation? Start here.

- How to calculate insurance agency valuation?

- Why do buyers care more about systems and efficiency than raw revenue?

- How to grow without bloating your payroll?

- What does EBITDA mean, and why it’s the single most important number in your valuation?

- How do retention and client experience directly impact what your agency is worth?

- Which SOPs, workflows, and documentation actually make a difference?

- How do tools like GloveBox help boost margins, loyalty, and long-term value?

Want a higher valuation? Start by building a business that can work without you.

How to Calculate Insurance Agency Valuation (The Basics You Need to Know)

There’s no one-size-fits-all formula, but there are a few common methods buyers and brokers use to estimate what your agency is worth. The insurance agency valuation process typically involves different methods, such as market valuation, income-based, and asset-based approaches, each relying on specific calculations to determine value. Over 90% of M&A deals for insurance agencies are calculated through some multiple of EBITDA, making it a critical metric in the valuation process. Additionally, the most prevalent rule of thumb for valuing insurance agencies is to apply a multiplier to total annual commissions, generally between 1.0x and 1.5x. Selecting the right method and performing accurate calculations are essential for a reliable assessment.

An insurance agency valuation calculator can also be used as a quick tool to estimate your agency’s value based on key financial metrics and industry standards. A common method for calculating the value of an insurance agency is to use the formula: IAVE = (Earnings – Operating Expenses + [Interest + Taxes + Depreciation + Amortization]) x multiple.

One widely used metric is EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization). To calculate EBITDA, add back interest, taxes, depreciation, and amortization to your net income. This figure is often used in various valuation methods to assess cash flow and profitability. Higher EBITDA margins, averaging between 15% and 20%, usually represent more successful agencies. The EBITDA multiple for insurance agency valuations typically ranges from 8x to 12x, reflecting the agency’s profitability and market appeal. Buyers normalize financial statements by removing interest, taxes, depreciation, and amortization to understand EBITDA more clearly.

In summary, valuing your agency accurately depends on using the right method and ensuring each calculation is precise. The choice of method and the accuracy of your calculations are critical for a fair market valuation. The true value of an insurance agency is often much different from simplistic estimates based on multipliers. A valuation ensures the seller receives a fair and accurate price for the agency, preventing under- or over-valuation. One such method is the discounted cash flow (DCF) method, which focuses on projected cash flows to determine the agency’s value. This approach provides a forward-looking perspective, making it a valuable tool in the valuation process. The DCF method is particularly useful for assessing long-term profitability and understanding the potential future value of the agency.

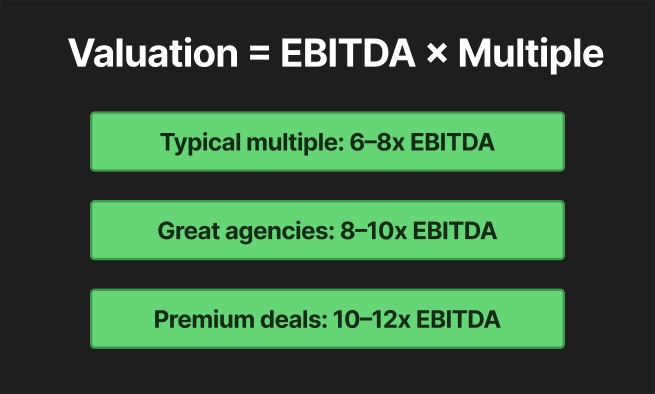

1. EBITDA multiples (most common for agencies over $1M revenue)

Once your agency crosses $1 million in annual revenue, buyers usually value your business based on EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Here’s the formula:

An EBITDA multiple is a market-based valuation metric that represents how many times your EBITDA a buyer is willing to pay for your agency. This multiple is applied to your calculated EBITDA to estimate the agency’s value.

Example:

If your EBITDA is $500,000 and you receive a 7x multiple, your valuation would be $3.5 million. Agencies with higher EBITDA typically receive a higher multiple, reflecting their greater profitability. The average multiple for insurance agencies generally ranges from 8x to 11x, serving as a benchmark for comparable sales analysis in the industry.

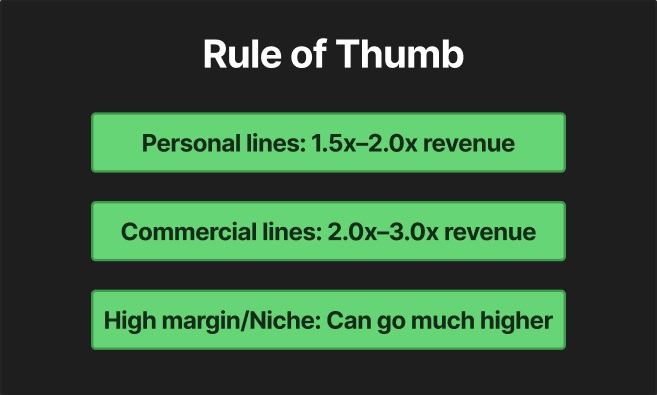

2. Revenue multiples (for smaller agencies)

If your agency is doing less than $1 million in revenue, most buyers apply a simple revenue multiple instead. While some sellers and buyers use gross revenue as a quick valuation metric, relying solely on gross revenue can be misleading because it does not account for profitability or expenses; more accurate methods, such as EBITDA multiples, are often preferred. Smaller insurance agencies often sell for EBITDA multiples of 4x to 6x, while agencies larger than $1 million typically sell for 5x to 8x EBITDA.

Typical range: 1.5x to 2.5x revenue (depending on book quality, retention, and niche). Agencies with high commission rates may command higher revenue multiples, as these rates increase income potential and overall agency value.

Example:

If your agency has $700,000 in revenue and strong client retention, you might be valued at $1.4 to $1.75 million.

3. Rule of thumb (quick estimates)

Many brokers and industry insiders use these general benchmarks when doing quick valuations. For example, the insurance agency valuation rule is a commonly referenced guideline in the industry, providing a rule of thumb business valuation based on standard multiples like EBITDA or commission revenue. These rules help estimate the value of a company, but should be used with caution as they may not reflect the unique characteristics of each business. Professional M&A advisors use a combination of methodologies to arrive at a more accurate valuation, ensuring a tailored and precise assessment.

What Really Drives Insurance Agency Valuation (It’s About Infrastructure, Not Revenue)

What are buyers actually buying?

They’re not just buying your book of business—they’re evaluating the value of your firm as a whole in the broader marketplace. The product mix offered by an agency plays a crucial role in determining its value, as a diverse range of products can attract a wider client base and enhance revenue stability.

They’re buying the system behind it, as well as the agency’s assets and asset base, which contribute significantly to the agency’s overall value. When valuing an insurance agency, it’s important to distinguish between the value of the entire agency and just the book of business.

If your agency only works because you’re holding it together, it’s not a business. It’s a liability.

The first thing that drives valuation is your operational infrastructure, but buyers also consider the agency’s market position, which can affect how your firm is valued in the marketplace.

Buyers want to know the agency will keep running if you step away.

Here’s what they’re evaluating: key factors such as profitability, growth rate, client base diversity, operational efficiencies, and other factors like staff qualifications, location, and financial metrics—all of which influence the agency’s value in the marketplace.

Are there clear, documented SOPs?

Buyers aren’t just looking at what your agency does. They want to know how it gets done – every day, without confusion.

Documented SOPs show that your agency isn’t guessing. They show that each process has been thought through, tested, and refined.

From onboarding to renewals, every step should have a standard. Not just for the team you have today but for the team a buyer might bring in tomorrow.

That’s what makes your business feel stable and worth paying more for.

Does each team member know what they’re responsible for?

When roles are unclear, mistakes are more likely to happen. And mistakes cost money.

Buyers want to see clear accountability.

Who does what, when, and how?

If those answers aren’t obvious, they’ll question everything else.

Do systems manage workflows instead of memory and habit?

Muscle memory doesn’t scale.

Buyers want processes tracked in tools.

If or your CRM automates and records service workflows, that’s a win.

If everything depends on someone remembering to check the inbox – there’s a problem.

If the business disappears without you, it’s not a business – it’s a liability.

Predictability = safety = value.

That’s what buyers pay for.

Stop Growing Like It’s 1995 (Scale Without Hiring Or Get Left Behind)

Growth matters. But how you grow matters more.

If your only growth lever is hiring, you’re not scaling.

You’re stretching.

And every time you stretch, your margins shrink. Buyers notice that.

They don’t want agencies that need to hire five new people every time revenue goes up by 10%.

They want lean, efficient operations where growth doesn’t break the system. Agents play a crucial role in driving scalable growth by implementing efficient processes and delivering value to clients.

Attracting and retaining customers is essential for agency growth, as a strong customer base directly impacts revenue and reputation. Customer loyalty further contributes to sustainable growth and increases the agency’s overall value, making it more appealing in the market.

Prospective buyers are especially attracted to agencies with strong customer bases, high customer loyalty, and scalable operations, as these factors indicate long-term stability and growth potential.

Why headcount-based growth fails

Adding staff feels like progress until your profit disappears.

Every new CSR adds cost. Every handoff adds risk.

The more people involved, the harder it becomes to stay consistent.

Eventually, your team will work harder just to keep up, rather than moving forward.

This kind of growth doesn’t scale.

It creates a bloated operation that’s expensive to maintain and risky to acquire.

What scalable growth looks like

Scalable agencies don’t rely on adding people. They rely on systems that multiply output per person.

That means:

- Service automation that handles simple requests

- Tools that surface upsell opportunities automatically

- Platforms that keep your team focused on high-value work

When your staff can handle more without feeling the strain – that’s real growth.

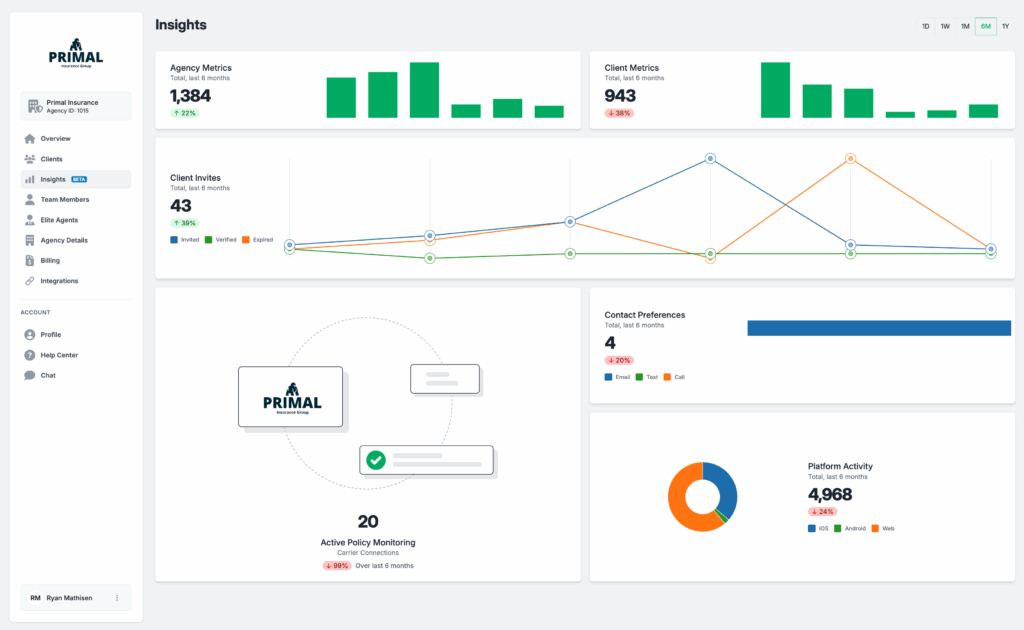

How GloveBox helps you scale smart

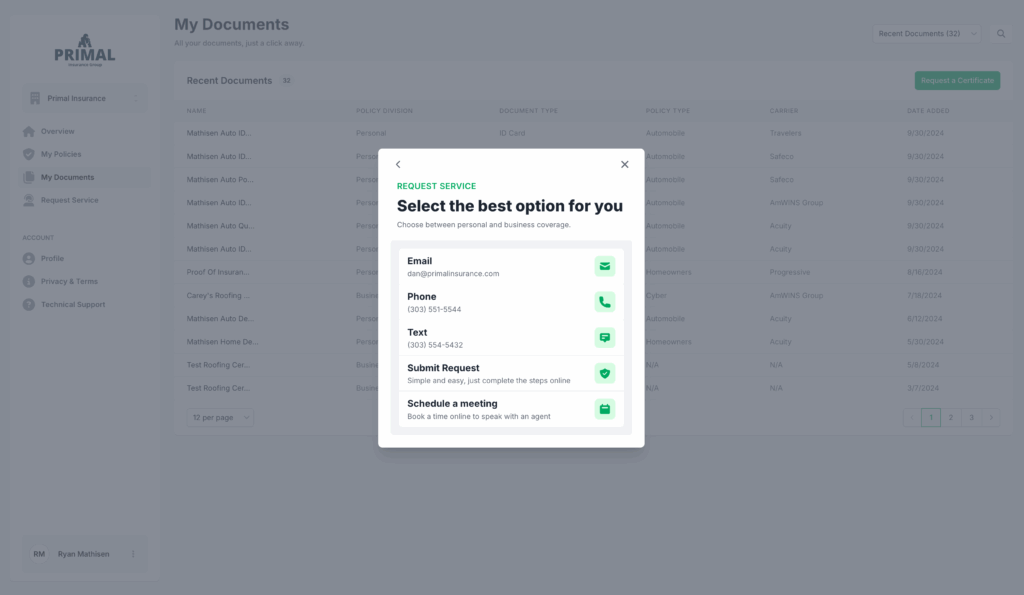

Most service work is Tier 1: ID cards, billing info, and basic questions.

Your CSRs spend hours each week handling tasks your clients could do themselves.

GloveBox takes that off their plate

It gives clients instant access to what they need, without having to call, email, or wait. That frees your team to focus on cross-selling, renewals, and actual advisory work.

More output, same headcount.

That’s what buyers want to see.

That’s how you scale like it’s 2025, not 1995.

Your First Goal Is Profit, Not Just Premium (Why EBITDA Is the Only Number That Matters)

Revenue looks impressive, but buyers don’t buy revenue.

They buy profit.

Income and profitability are central to agency valuation, as they directly influence how much your business is worth to potential buyers.

Expenses and tax play a crucial role in calculating EBITDA, since operating expenses and tax obligations are deducted from revenue to determine true profitability.

Accurate financial statements are essential for understanding your agency’s value, as they provide the data needed to assess performance and make informed decisions.

When valuing an agency, it’s important to consider the amount of capital and investment required to generate your current income levels, as this impacts the perceived return on investment for buyers.

Think of it like a bank account: the value of your agency can be compared to how much someone would pay for an account that generates a certain amount of interest or income each year, helping to illustrate valuation multiples and ROI.

Determining the actual value of your agency means looking beyond surface metrics and considering all relevant financial and operational factors.

That’s why EBITDA (earnings before interest, taxes, depreciation, and amortization) is the number that drives your valuation.

It’s the cleanest way to see how healthy and efficient your business really is.

Why multiples start with EBITDA

Once your agency crosses $1 million in revenue, most deals are structured as a multiple of EBITDA. That’s the number every buyer zeros in on.

6–8x EBITDA is the standard range.

8–10x means your agency is highly attractive.

Anything above that is rare and reserved for agencies with flawless infrastructure, growth, and retention.

If your margins are thin, your multiple drops. Even if your top-line revenue is strong.

Where profit gets lost

Most agencies lose profit in the same place – the service department.

Agencies spend around 38 cents of every dollar on service work. That includes CSRs, taxes, benefits, and all the systems they use.

If every new dollar you earn requires more payroll to support it, your profit stalls.

And buyers will see that immediately.

How to make EBITDA healthier

You don’t have to cut staff. Just make them more efficient.

Start by reducing the time spent on Tier 1 service requests.

Use tools like GloveBox to let clients handle the basics on their own.

The more clients can self-serve, the more your CSRs can focus on renewals, cross-sells, and real retention work.

That’s how you protect your margin.

That’s how you grow profit, not just premium.

And that’s what turns a decent offer into a great one.

Retention Is the Hidden Gold (Why Loyalty Equals Leverage)

The revenue looks good on paper. The value of your insurance book plays a key role in determining your agency’s overall worth, as buyers closely evaluate both the size and stability of your client base.

But retention tells the truth. If your clients are leaving, your recurring revenue means nothing. Retention directly impacts the value of the agency’s book and, ultimately, the insurance agency worth, since a stable, loyal client base increases both perceived and actual value.

Buyers see churn as instability. And instability kills deals.

High retention, on the other hand, shows strength.

It says your clients are happy.

It says your business isn’t leaking value.

And most of all, it says the cash flow they’re buying will still be there next year.

Why retention matters more than revenue

You can grow revenue while still losing clients.

In a hard market, premiums go up. But that doesn’t mean you’re adding value.

Buyers aren’t fooled by inflated top lines.

They’re looking for customer stickiness.

Because that’s what drives long-term cash flow. It’s what they’re really buying.

What drives retention?

It’s not just good service. It’s the experience.

Buyers will ask:

- Can your clients get what they need without waiting on hold?

- Are they still calling for ID cards in 2025?

- Do they feel like working with your agency is easy—or a chore?

Today’s clients expect control.

If they can’t self-serve basic stuff, they won’t stick around. Not because they hate you but because someone else made it easier.

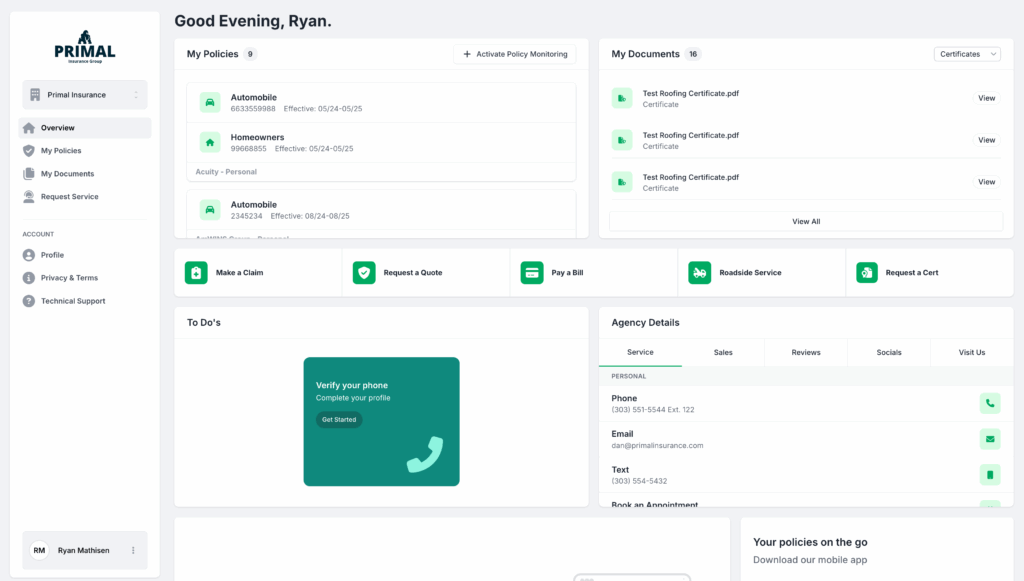

How GloveBox makes loyalty stick

gives your clients 24/7 access to their policy documents, billing info, and service requests.

No calls. No emails. No delays.

That kind of convenience becomes a habit.

Once clients get used to that experience, they don’t want to give it up.

And when your tech becomes part of their routine, your agency becomes harder to leave.

Retention goes up.

Insurance agency valuation goes up.

Because loyalty builds leverage, and leverage gets you paid.

Clean Up the Bottlenecks (What Stalls Deals Before They Even Start)

Most deals don’t fall apart because the agency isn’t valuable. They fall apart because the buyer can’t see how it works. The valuation process often uncovers hidden risks or weaknesses in an agency that could affect its value. Overvaluation of an insurance agency can scare away potential buyers and prolong the sales process. When things feel messy, unpredictable, or owner-dependent – buyers walk. Even strong agencies lose deals because they haven’t cleaned up what’s behind the scenes. Consulting with M&A advisors helps avoid potential undervaluation or overvaluation of insurance agencies, ensuring a smoother transaction process.

Insurance agency owners and agency owners play a crucial role in preparing for transactions by ensuring their operations and financials are transparent and well-documented. Owners can maximize value before a sale by streamlining processes, improving profitability, and addressing any operational weaknesses. Insurance agencies are valued during transactions using industry benchmarks, recent sales data, and financial analysis to establish fair pricing. Knowing the agency’s value helps in long-term business planning, growth strategies, and succession planning. The value of an agency is determined by comparing it to other agencies in the same market, using methods such as EBITDA multiples and rules of thumb. Understanding market value and obtaining professional valuations are essential steps in the sale process to ensure a successful transaction. Additionally, lenders and banks often require a professional valuation to assess loan eligibility and risk, making accurate valuation even more critical.

They fall apart because the buyer can’t see how it works. M&A advisors have experience in insurance agency transactions and can guide owners through unique challenges, helping them address operational inefficiencies and improve transparency to make the agency more appealing to buyers.

When things feel messy, unpredictable, or owner-dependent – buyers walk. Even strong agencies lose deals because they haven’t cleaned up what’s behind the scenes.

Here are the three biggest deal killers. Valuation by M&A advisors can help agency owners understand market dynamics better for negotiations, ensuring they are well-prepared to address buyer concerns and secure favorable terms.

No documentation

If your processes aren’t written down, they don’t exist. Buyers won’t dig through your inbox to figure out how you manage renewals or onboard new clients. Agencies often benefit from M&A advisors’ expertise in assessing market conditions for better valuation outcomes, as they can identify areas for improvement and highlight strengths to potential buyers.

Buyers won’t dig through your inbox to figure out how you manage renewals or onboard new clients.

They want to see SOPs. Agency owners can maximize their returns by consulting with M&A advisors during valuation processes, leveraging their insights to enhance operational efficiency and market appeal.

They want documented systems, not just verbal explanations.

If everything runs on habit or memory, they know it won’t survive without you.

And if it can’t survive without you, they won’t buy it or will cut their offer in half.

Fragmented tech stack

Too many tools doing too many disconnected things is a red flag. Buyers don’t want to inherit a tangle of software that doesn’t talk to each other.

They want efficiency.

They want clean workflows.

They want to log in and see how the business runs in one place, not across eight logins and three spreadsheets.

If your agency is still stuck switching between tabs for quoting, servicing, and communication – it’s time to clean it up.

No new business growth

If your agency’s revenue has gone up, but your client count hasn’t, buyers notice.

They know premium increases aren’t the same as new sales.

Predictable, repeatable new business growth is what buyers want.

They want to see your agency is winning deals.

If you want a higher insurance agency valuation, you don’t start by chasing offers.

You start by building a business that runs without you.

Buyers want systems, not chaos.

.

They want profit, not just production.

They want proof that the business works with or without the founder.

With strong operations, scalable systems, and a loyal client base, you don’t have to chase offers.

You’ll have buyers lining up.

And when you get it right, the conversation shifts from “Is this agency worth buying?” to “How much are we willing to pay to win this deal?”

Tools like GloveBox help agencies improve valuation faster by cutting service costs, improving client experience, and making your operations buyer-ready.