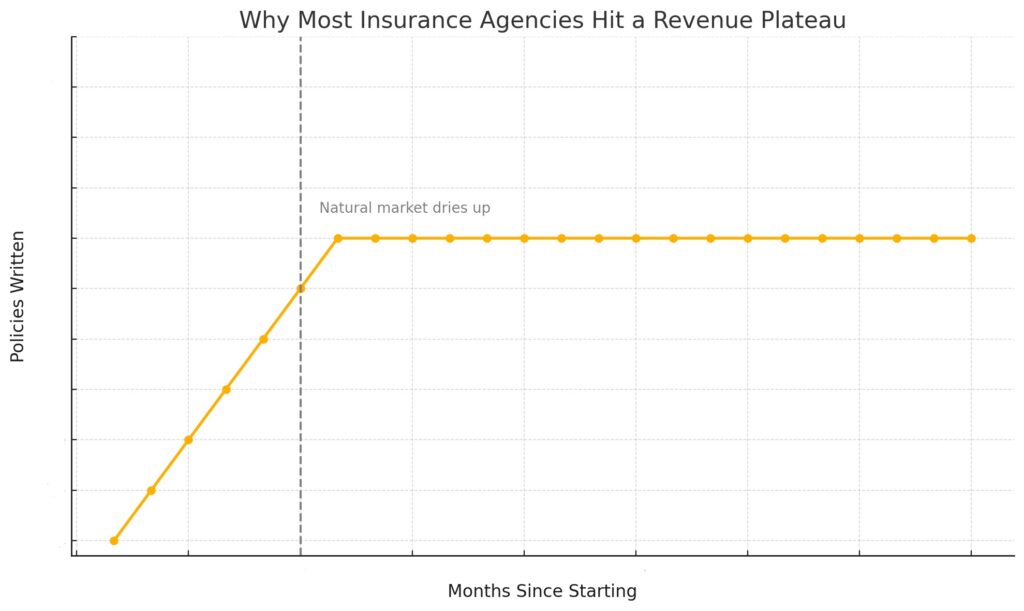

Most agencies start strong, writing policies for friends, family, and referrals.

But that well runs dry fast. And once it does, the growth flatlines.

To double your revenue, you need a real strategy. Not just more hustle.

That means knowing who to sell to, how to reach them, and how to close with speed and confidence.

This guide is packed with proven strategies used by fast-growing agencies to break through plateaus and scale smarter.

You’ll learn how to break out of the referral rut, scale your sales, and close bigger accounts without burning out.

TL;DR

Want to double your revenue? Don’t just do more. Do better.

Here’s how:

- Focus on a niche: Stop trying to sell to everyone. Specialize and win bigger deals faster.

- Leverage referrals: A tight niche makes it easier to get warm intros and word-of-mouth leads.

- Stand out by being easy to work with: Clients want speed and convenience, not more meetings.

- Shorten your sales cycle: Streamlined messaging and better intake = more closes.

- Automate low-value work: Let GloveBox handle Tier-1 tasks so your team can actually sell.

- Copy proven playbooks: Agencies like Erb & Young scaled fast by doing all of the above.

Your next stage of growth starts when your systems and your sales strategy start working together.

Why Most Insurance Agencies Hit a Revenue Plateau

In the beginning, growth feels easy. You write policies for friends, family, old coworkers, and people in your neighborhood.

But that natural market dries up fast.

After that, things get harder. You can no longer rely on warm intros. You start chasing random leads, trying to convince strangers to buy. And that’s when most agencies stall.

The truth is that scaling an agency beyond the first couple hundred policies takes more than hustle. It takes a plan.

You need a clear niche. A focused market. A reason clients choose you over the dozens of other agents just like you.

Without it, you’re stuck in a loop – quoting everything, chasing everyone, and winning nothing.

Niching Down is the Fastest Path to Revenue Growth

Selling to everyone is a great way to win no one.

The agencies that grow fast don’t just quote anyone with a pulse. They choose a niche, and they go deep.

It could be contractors. Roofers. Mortgage brokers. Lawyers needing cyber insurance.

Whatever it is, the goal is the same: become the obvious choice for that market.

When you niche down, your messaging becomes sharper. Your pitch gets easier. Your close rate jumps. You stop competing on price because you start competing on expertise.

Clients want to work with specialists. And in a niche, one client leads to the next. Trade shows, referrals, association lists – it all compounds.

Generalists spin their wheels. Specialists grow fast.

Effective Strategies to Win Referrals in Your Niche

Referrals are the fastest, warmest way to grow. But not all referrals are created equal.

When you specialize, your referrals stay inside your niche and that’s the key. A referral from a contractor leads to more contractors. A referral from a mortgage broker leads to more brokers.

They move in the same circles. They go to the same events. They trust each other’s recommendations.

That’s exactly how one agency built its entire growth engine. By focusing solely on mortgage brokers, they positioned themselves as the go-to insurance expert for that vertical. And as each client referred them to colleagues in the industry, momentum took over.

So how do you do it?

You start by getting visible where your clients gather – trade shows, conferences, industry associations, and LinkedIn communities. But it’s not just about showing up. It’s about becoming known.

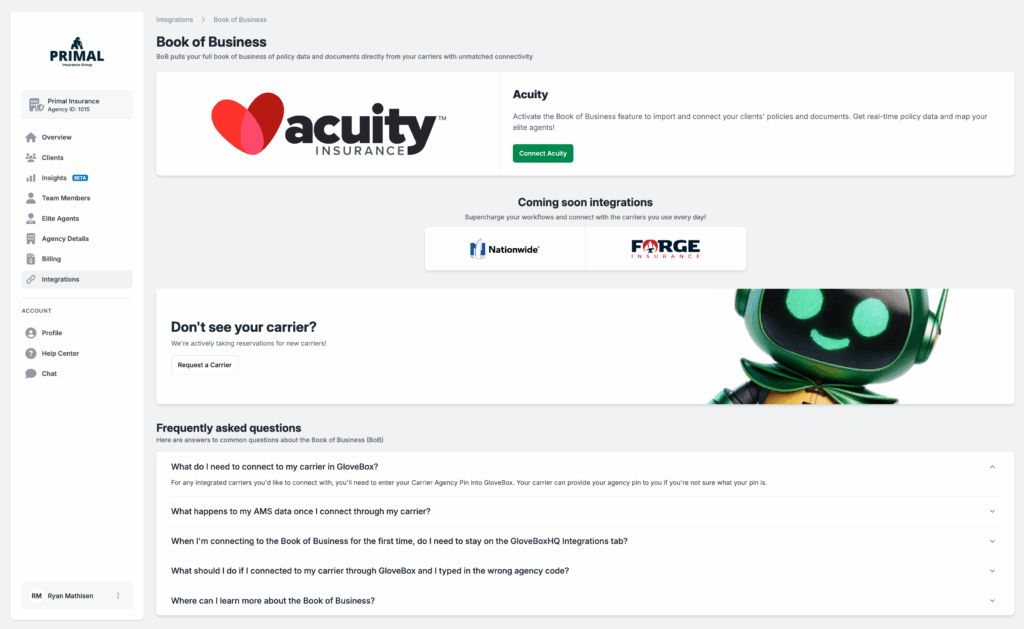

You also make it ridiculously easy for your clients to refer you. That’s where tools like GloveBox come in.

With GloveBox installed on your client’s phone, your agency’s name, logo, and contact info are always one tap away. No digging through inboxes or trying to remember your name. With built-in features like the Refer My Agent button, your clients can send a referral instantly while the thought is fresh.

You stay top-of-mind even when they’re not actively thinking about insurance. That’s how you drive more referrals without begging for them.

The easier you make it, the more it happens. And when it happens inside a niche, your growth compounds fast.

How to Differentiate Your Agency and Close More Business

Most insurance agencies lose business not because they don’t care but because they don’t see the sale through the customer’s eyes.

Your client isn’t dreaming of having a friendly chat with their agent. They want to save money, get the right coverage, and move on with their day. If you don’t deliver on those priorities, they’ll find someone who does.

To stand out and win more business, you need to master three things:

Save them money

This one’s obvious but too many agents still lead with generic pitches.

A client doesn’t want to hear that you “might be able to save them a little.” They want clarity.

If you specialize in a niche, you should already know where savings opportunities live – carrier discounts, bundling strategies, and unique underwriting gaps. Lead with precision.

Protect what matters

Clients don’t just want cheap, they want peace of mind.

That means educating them on what proper coverage looks like for their specific situation. The more complex the client, the more this matters.

Don’t assume they know the gaps. Show them.

When you can articulate the risk better than their current agent, you win.

Make it easy

Here’s where most agencies fall apart.

They make quoting difficult. They respond slowly. They require phone calls for basic tasks like ID cards and certificates. That’s friction and it kills deals.

The winning play? Build a better client experience from day one.

With GloveBox, for example, you give clients a mobile app and web portal that makes everything self-service. They can download documents, request changes, view billing, and even send you referrals without calling or waiting.

That kind of convenience isn’t a bonus anymore. It’s expected.

Clients won’t stay for the service if it’s slow. They won’t refer you if the process is clunky. And they won’t switch if you don’t offer a clear advantage.

The good news? When you deliver on these three, you don’t have to sell hard. You just have to show up, prove you’re better – and close.

Mastering Your Sales Messaging

Good messaging isn’t about clever slogans. It’s about saying the right thing at the right time to the right audience.

Most insurance agencies send the same generic emails, leave the same cold voicemails, and post the same LinkedIn updates, and then wonder why nothing lands.

The truth is simple: if your message doesn’t feel relevant and urgent to your audience, they’ll ignore it.

Timing is critical.

When you reach out matters as much as what you say. Market cycles, renewal periods, and niche-specific trends should dictate your calendar.

You should also speak their language.

If you’re selling to roofers, don’t talk like a generalist. Reference roofing carriers. Mention certificate volume. Bring up OSHA compliance.

If you’re working with cyber policies for tech firms, speak to breach response timelines, SOC 2 requirements, and client contract obligations.

Generic messaging makes you blend in. Specific messaging makes you stand out.

And finally, try to mirror their reality.

Ask yourself: what is my prospect dealing with today?

Is it carrier rate hikes? Is it client churn? Is it staff turnover? Build your outreach around the real pain they’re feeling, not your product features.

The more your messaging reflects what they’re already thinking, the more likely they are to engage.

Relevance is your superpower.

Use it well, and you don’t have to scream to get attention – you just have to resonate.

Building an Effective Sales Process (Step-by-Step)

High-growth agencies don’t wing it. They run a consistent sales process – from prospecting to closing – that’s clear, documented, and optimized over time.

Here’s what that looks like, step by step.

Step 1: Identify ideal targets

Start with your niche. Don’t chase everyone. Focus on businesses or individuals who match your agency’s strengths and appetite.

Ask critical questions.

What industries do we understand best? Which types of clients are most profitable and sticky? Where do we already have traction or referrals?

Build a hit list of prospects. Prioritize based on upcoming renewal dates, potential premium size, and strategic value.

Step 2: Reach out with targeted, relevant messaging

This isn’t just about volume. It’s about relevance.

A cold call or email that says, “I work with companies just like yours” gets ignored.

A message that references industry pain points, like certificate delays, comp audits, or rising premiums, cuts through.

Top producers tailor each call and email to the target’s role, business type, and risk profile.

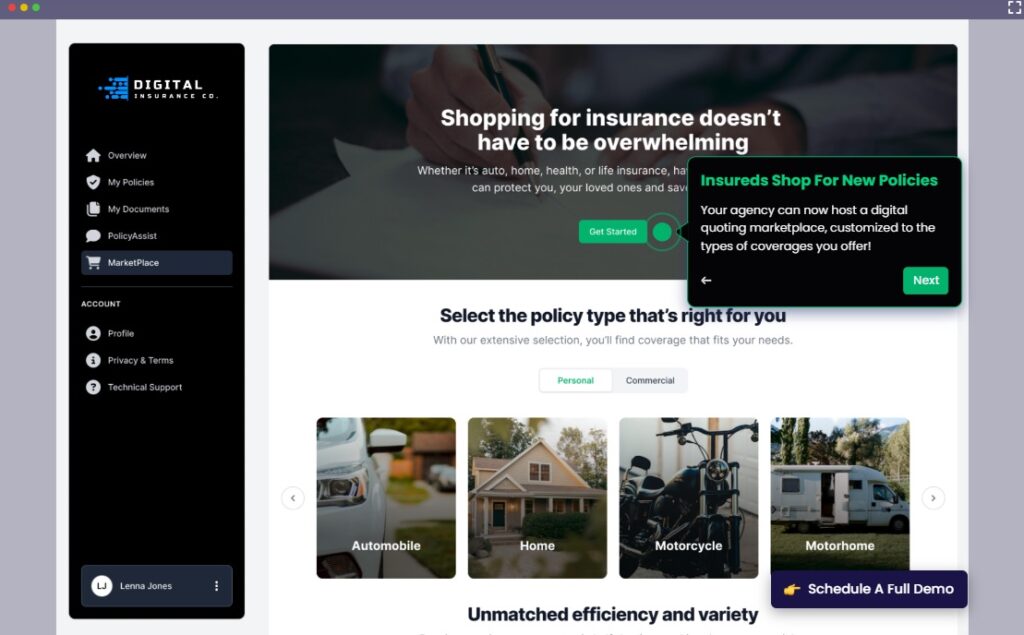

Step 3: Make quoting fast and easy

If the quoting process takes 45 minutes, you’ve already lost. Use automation to simplify data intake, cut the back-and-forth, and speed up decision-making.

GloveBox’s embedded marketplace makes this frictionless. It lets prospects shop coverage and submit info on their own time, with no call needed. You get qualified opportunities without eating up your team’s day.

This isn’t about removing the human touch. It’s about making it fast and painless for the client to move forward.

Step 4: Follow up strategically

Most deals aren’t closed on the first call. They’re won in the follow-up.

Use your CRM to set reminders, automate emails, and track every step. Don’t just “check in.”

Offer value – insights, coverage suggestions, and reminders about renewal timelines. If you’re pitching a BOR, reinforce why you’re different and how switching will actually solve a pain point.

Persistence wins. But only when it’s paired with relevance.

Step 5: Document everything

You can’t scale what lives in your head.

Top agencies document their process so every producer follows the same steps. That means:

- SOPs (Standard Operating Procedures) for outreach, quoting, follow-ups

- SLAs (Service Level Agreements) defining response times and hand-offs

- Scripts for calls and emails, adaptable, but consistent

When everything is written, tracked, and repeatable, it becomes easier to coach, measure, and improve over time.

Great salespeople are valuable. Great sales systems are unstoppable.

Build the system, then let your team run it. That’s how you scale.

The Biggest Mistakes Agencies Make in Sales Calls (And How to Avoid Them)

Most insurance agencies lose the sale before they ever quote because their sales calls are too long, too bloated, and too focused on themselves.

The average prospect doesn’t care where you grew up, how you started your agency, or how many awards you’ve won.

They care about one thing: can you solve their problem fast?

The critical errors in discovery and demo calls

1. Taking too long

The longer the call, the less likely they’ll finish it or take your next one.

Prospects don’t want a 45-minute background interview. They want to know if you can help, and they want that answer quickly.

2. Overloading prospects with unnecessary information

Insurance professionals love to show how much they know. But flooding your prospect with jargon and policy language won’t win the sale.

Too much detail too early creates fatigue and confusion.

Actionable tips to improve your sales calls

Keep it short and focused

Open with what matters: “Here’s how I think I can help you.” Then prove it.

Make it a conversation, not a lecture. And always end with clear next steps.

Simplify intake

The quoting process is often the biggest conversion killer. If your process still involves 30-minute phone calls or clunky spreadsheets, you’re already behind.

Today’s prospects expect to share information on their own time—and they expect the process to be easy.

Use automation to streamline quoting

Instead of chasing documents and manually filling forms, use tools that help automate intake.

Smart forms, CRM triggers, and automated follow-ups all reduce friction and speed up the quote-to-close timeline.

How GloveBox helps

GloveBox’s embedded marketplace allows clients to begin the quoting process without ever picking up the phone.

Prospects can input their information on their own time – quickly, securely, and without a long discovery call. From there, your team can move faster, quote faster, and close faster.

The result? A better client experience and a much higher conversion rate.

Traditional Sales Tactics vs. Modern Digital Strategies

Let’s be clear – cold calling still works. Some of the best commercial producers are on the phones every morning dialing prospects.

The problem isn’t that traditional sales tactics are broken. It’s that they don’t scale fast enough on their own.

Today’s top agencies pair old-school hustle with smart digital automation.

The traditional sales model still matters

The foundational playbook is still alive:

- Cold calling to secure appointments

- In-person meetings to build trust

- Broker of Record (BOR) strategy to win accounts without quoting

These methods are tried and true. But relying on them alone limits your growth. They require time, energy, and manpower, and they don’t work well when you’re chasing hundreds of leads.

How digital strategies make it scalable

Smart agencies use digital tools to do the heavy lifting:

CRM automation keeps your pipeline moving with task reminders, email sequences, and deal tracking.

Email marketing keeps your brand at the forefront of prospects’ and clients’ minds without needing daily manual input.

GloveBox helps automate post-sale communication, referral outreach, and ongoing client engagement so you can stay connected without constant effort.

Together, these systems build momentum that cold calling alone can’t sustain.

Specific modern strategies that work

Account-based marketing (ABM)

For high-value commercial prospects, ABM is a game-changer.

Identify target accounts, personalize outreach, and coordinate across channels (email, LinkedIn, direct mail) to earn attention and drive meetings.

Digital funnels and lead nurturing

Use content to attract inbound leads. Drive them into funnels that qualify, educate, and warm them up before your team ever reaches out.

Combine this with automated follow-ups to maximize your conversion rate.

Cross-sell automation

Existing clients are your easiest wins.

Set up automated campaigns based on policy triggers or renewal windows to suggest relevant coverage – auto for home, umbrella for auto, and so on.

Targeted advertising

Use niche-focused ad campaigns to stay visible in your target markets. Whether you’re selling cyber to law firms or contractors’ insurance to roofers, targeted social and search ads can drive consistent opportunity.

You don’t have to abandon traditional sales. But if you’re not pairing them with scalable digital strategies, you’re playing catch-up.

The agencies growing fastest today are the ones building the best of both worlds.

Leveraging Technology to Scale Your Revenue Faster

You can’t double revenue by doing everything manually. Growth today depends on the systems you build.

That starts with your tech stack.

High-performing agencies rely on three key tools, each playing a different role in supporting sales, retention, and scale.

1. AMS (Your internal brain)

Your Agency Management System is your internal source of truth. It stores client records, policies, claims, commissions, and documents.

But it’s not built for growth. AMS tools are back-office systems. They’re essential but they don’t close deals, cross-sell, or automate touchpoints.

They organize. They don’t drive revenue.

2. CRM (The sales engine)

A CRM is what keeps your sales and marketing efforts moving.

It tracks leads, manages follow-ups, schedules automation, and ensures your team doesn’t drop the ball.

Email campaigns, cold outreach, referral follow-ups, renewal reminders – it all lives here.

Agencies that use CRMs effectively close more business, faster, and with less manual effort.

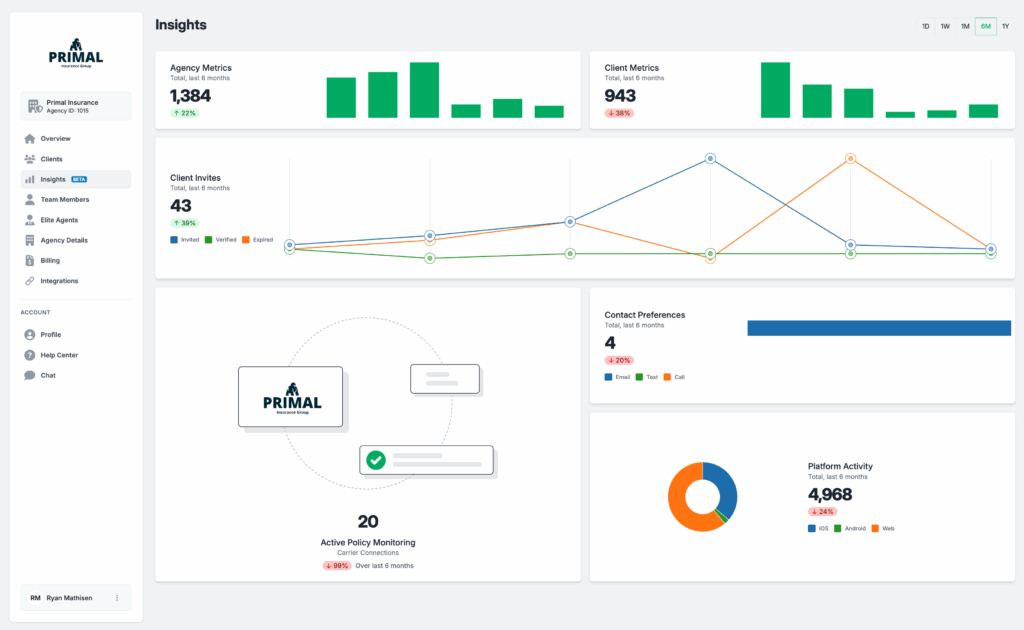

3. GloveBox (The client-facing powerplay)

Even the best AMS and CRM won’t solve the real issue: how your clients interact with your agency.

That’s where GloveBox comes in.

It’s a client experience platform (CXP) that sits in front of your AMS and CRM, giving clients 24/7 access to their policies, documents, billing info, and service requests.

Here’s what that means for your growth:

- Fewer service calls: Clients handle Tier-1 tasks themselves, like downloading ID cards or checking billing.

- More selling time: CSRs and producers aren’t bogged down by repeat questions or simple requests.

- Better cross-sell rates: The embedded marketplace suggests relevant policies at the right time – automatically.

- Stronger retention: Clients who engage digitally are stickier and more loyal.

In short, GloveBox automates the parts of your business that shouldn’t be done by humans so your team can focus on the parts that must be done.

The result? Higher productivity. More profitable operations. And more time to grow.

A Real-World Success Story – How One Agency Doubled Revenue

It’s one thing to talk strategy. It’s another to watch it work in real life.

Erb & Young, an independent P&C agency, didn’t just grow. They scaled smart, doubling revenue from $3 million to $6 million in just three years.

Here’s how they did it.

1. Defining their niche

Erb & Young got focused. Instead of trying to serve everyone, they zeroed in on the types of clients and lines they could serve best.

That focus made everything else easier – messaging, targeting, marketing, and especially referrals.

Once you become known for something specific, referrals follow naturally.

2. Expanding client capacity without hiring

Their biggest bottleneck wasn’t leads. It was service bandwidth.

Before GloveBox, each CSR could handle 400–500 households. Beyond that, things broke.

Once GloveBox was in place, their service model changed. Clients could access ID cards and documents instantly, handle billing and service requests on their own, and submit changes without calling or emailing.

The result? CSRs now manage 1,400–1,500 households each, a 3x productivity gain with no added headcount.

3. Automating the right workflows

With GloveBox handling Tier-1 service, the team had time for what actually drives revenue:

- Upselling and cross-selling existing clients

- Proactive renewal conversations

- Personalized outreach to high-value prospects

CSRs weren’t just reactive. They became true client advisors.

4. Driving growth with digital experience

By putting their brand in their client’s pocket (with the GloveBox mobile app), they stayed top-of-mind.

Clients could refer to them at the tap of a screen. No business cards. No missed opportunities.

This wasn’t just about better service. It was about building a scalable growth engine powered by technology and process.

When your team has the tools to do more with less, and your clients actually enjoy working with you, revenue doesn’t just grow. It multiplies.

The Bottom Line

Doubling your revenue isn’t about working harder but smarter.

The fastest-growing agencies aren’t cold-calling their way to success. They’re focused, strategic, and operationally sharp.

They know their niche, speak directly to their audience’s pain points, and use technology like GloveBox to remove friction from the entire sales and service cycle.

If you want to scale, start by streamlining your process, tightening your messaging, and giving your team tools that help them win.

Clients don’t want more noise. They want less hassle.