Outsourcing customer service might seem like a smart move. Until your clients start noticing.

Sure, handing off service calls to a third-party vendor can save you money. But what does it cost in client trust, brand consistency, and long-term retention?

The truth is that customer service isn’t just about answering questions. It’s about creating moments of confidence, speed, and clarity, especially in insurance.

We’ll break down the real pros and cons of outsourcing your agency’s customer service and introduce a better way to scale without sacrificing quality: client experience platforms like GloveBox.

TL;DR

Thinking of outsourcing your agency’s service work? Here’s what to know first:

- Outsourcing feels cheaper but can hurt your client experience.

- It creates new challenges: brand dilution, limited control, and inconsistent quality.

- Most agencies don’t need more people. They need fewer distractions.

- The better path? Streamline internal operations. Automate Tier 1 work.

Tools like GloveBox give clients what they need – fast service, fewer calls – and your team more time to sell.

Want to reduce your service workload without outsourcing?

Start by fixing your workflows and letting tech do the heavy lifting.

Why Agencies Start Outsourcing Customer Service (The Cost-Pressure Trap)

As agencies grow, service requests pile up – certificates, ID cards, endorsements, billing questions, and more. Hiring additional licensed CSRs becomes expensive fast.

The obvious answer? Cut costs by hiring offshore virtual assistants (VAs) or outsourcing to third-party service centers.

The promise: lower payroll, round-the-clock availability, and quick wins.

And in some cases, it works.

VAs can handle non-client-facing admin tasks. Outsourced teams can respond to basic inquiries.

But most agencies don’t stop to ask a more important question:

Why are we getting so many service requests in the first place? Without solving the source of the workload, outsourcing becomes a Band-Aid, not a solution.

And the cost of that Band-Aid? Client experience.

Let’s dig deeper.

The Hidden Cost of Outsourcing (When Cutting Costs Means Cutting Client Satisfaction)

Most outsourcing strategies fail for one reason: they’re built around your operations, not your client’s experience.

Agencies often try to offload Tier 1 service tasks to virtual assistants (VAs) or call centers – tasks such as issuing certificates, updating vehicle information, or answering basic policy questions.

But here’s the problem: Offshore staff usually aren’t licensed.

They’re not embedded in your systems or culture. They’re slower, less personal, and rarely proactive.

Even if you save money short-term, you’re trading away trust. And in insurance, trust is everything.

Clients don’t want to hear roosters in the background. They don’t want to repeat their story three times. And they certainly don’t want to feel like a number.

When client experience erodes, so does retention, and suddenly, those outsourcing “savings” become losses.

How Most Agencies Create Their Own Customer Service Chaos (You Have a Front-Door Problem)

Every agency wants to scale without sacrificing service.

So what to do? Hire more CSRs or outsource to cut costs. But that only solves the symptom, not the cause.

Here’s what actually happens:

You start the day with a clean desk. By noon, it’s flooded with cert requests, ID card updates, policy questions, and “quick favors.”

Why? Because you’ve trained your clients to call, email, or chase you for everything.

This isn’t a workload issue. It’s a process issue.

Most agencies never stop to ask:

How is work entering my agency? Can clients solve this themselves? Why am I spending $70k/year on tasks a customer could do in 10 seconds?

If your “front door” is broken, meaning there’s no easy, self-service access point for your clients, you’re creating manual work by default. And that’s the real reason your CSRs are overwhelmed and your VAs are underperforming.

Fix the front door, and you fix the chaos.

The True Cost of Outsourcing Customer Service (Saving on Salaries Isn’t Always Saving)

Outsourcing customer service may seem like a smart financial move, especially when salaries, benefits, and overhead costs are rising rapidly. But while it reduces headcount costs on paper, the operational downsides can quietly erode your client experience, team efficiency, and long-term profitability.

You sacrifice context

Outsourced reps don’t live inside your agency’s culture or systems.

They weren’t there when that tricky client account started. They don’t know your renewal strategy, your carrier nuances, or how your producers like to work.

So when a customer calls about a complex issue, that outsourced rep is learning on the fly.

The result? Slower response times, inconsistent messaging, and more escalations back to your in-house team defeating the entire purpose of outsourcing.

You lose control

With outsourcing, you’re not just paying for labor. You’re also inheriting someone else’s management, training, and quality control standards. That often means retraining their staff to meet your expectations or constantly following up to ensure issues are handled correctly.

Instead of focusing on strategy or growth, your leadership team ends up monitoring tickets, double-checking answers, and managing a vendor. You haven’t removed the work but just changed who you’re chasing to get it done.

You create communication lag

When your customer service lives outside your walls (and your time zone), things start to break down. Internal updates don’t get shared. Cross-functional coordination becomes painful. Producers and CSRs stop working in sync.

That lag creates internal confusion, and worse, it shows up in the client experience. Customers receive conflicting answers, miss key touchpoints, or feel like they’re speaking to a stranger every time.

You risk your brand

Your service experience is your agency’s brand. It’s what clients remember, recommend, or walk away from.

An outsourced rep doesn’t carry your agency’s reputation the way your in-house team does. If they deliver a bad experience – rushed, impersonal, or incorrect – your client won’t blame them. They’ll blame you.

In insurance, trust is everything. You don’t get many second chances.

What to Do Instead – Build for Scale, Not Band-Aids

If your team is overwhelmed, don’t default to outsourcing.

First ask: Why are we so overwhelmed?

Is it client requests? Manual data entry? No process for renewals or follow-ups?

Fixing those pain points internally by automating and streamlining is how great agencies scale without sacrificing quality.

Develop internal systems that minimize noise and maximize output

Start by documenting your workflows.

What happens when a client calls? Who handles endorsements? How are renewals processed?

Then, remove the friction points. Use tools like GloveBox to automate Tier 1 service. Use your CRM to automate reminders and follow-ups. Create Standard Operating Procedures (SOPs), so your team isn’t reinventing the wheel daily.

Invest in your team, not just headcount

Your CSRs and producers don’t need more teammates. They need more time.

Give them that by eliminating grunt work. Automate. Document. Streamline.

It’s not about working harder. It’s about building an agency that works better.

Why Automation (Not Outsourcing) Is the Smarter Play

Most agencies don’t need more people handling client service. They need fewer repetitive tasks that eat up their team’s time.

Tasks like resending ID cards, answering billing questions, updating contact info, and tracking down policy documents – these don’t require a licensed rep. They require a system.

Automation removes the noise, allowing your team to focus on high-value activities, such as upsells, renewals, coverage advice, and relationship-building.

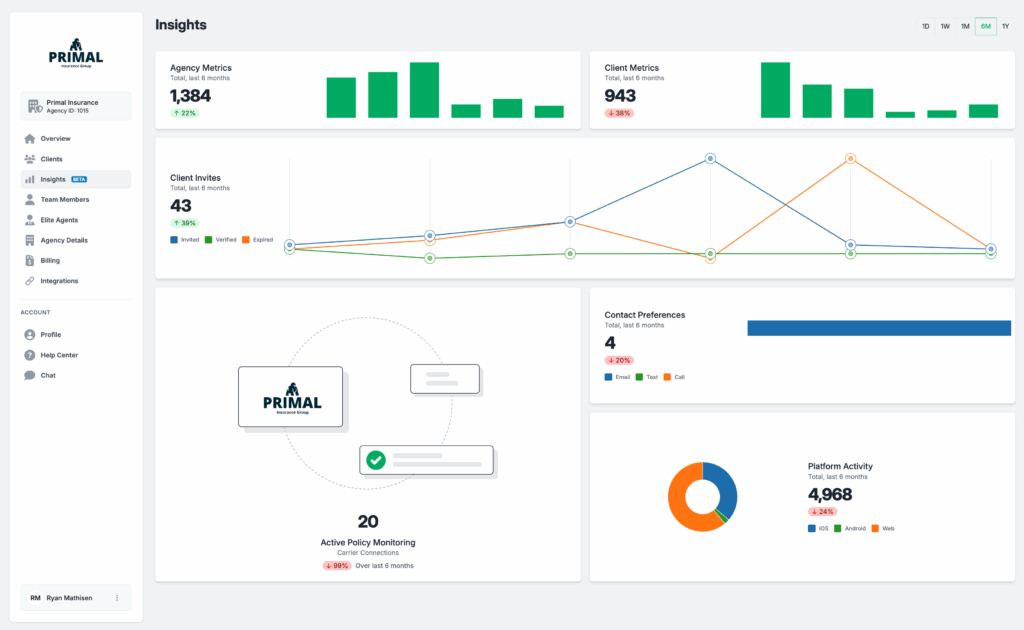

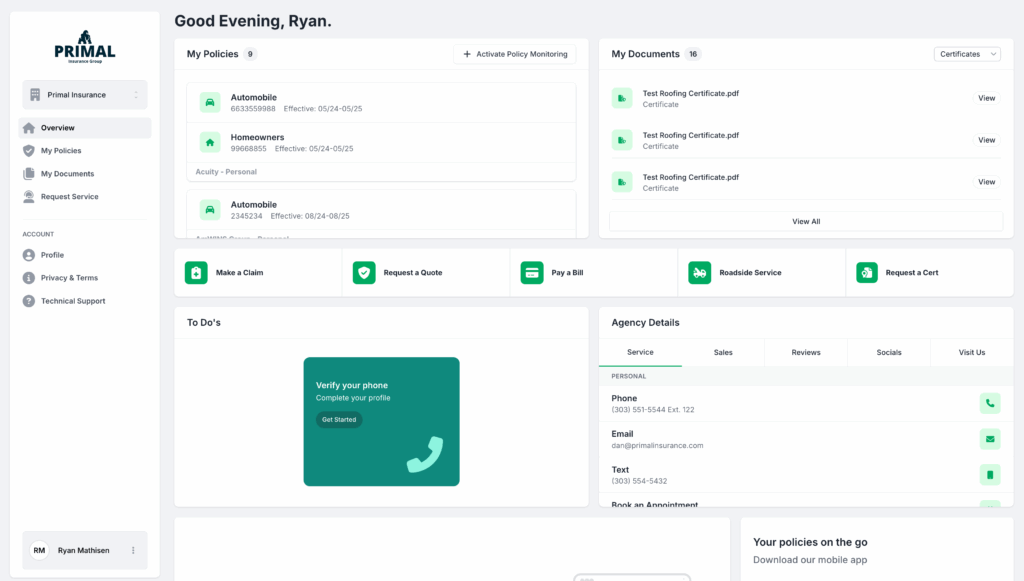

GloveBox handles Tier 1 service requests instantly

GloveBox gives your clients a branded self-service portal where they can download ID cards and policy docs, access billing and payment info, submit service requests, and get answers without calling.

It isn’t just “convenience.” It’s a scalable service that reduces ticket volume by 30–50%. Your CSRs don’t get bogged down, and your clients stay happy.

It feels better for the client and better for your team

Clients don’t want to wait on hold. And your team doesn’t want to play email ping-pong all day. GloveBox solves both problems by giving customers what they want (access and control) while freeing up your staff to do work that actually moves the needle.

When agencies implement GloveBox, they see:

- 3x CSR capacity

- Fewer escalations and callbacks

- Higher retention and NPS scores

The best part? No handoff risk.

You don’t lose context, quality, or brand trust because the system runs inside your agency, not outside it.

The Bottom Line

Outsourcing customer service isn’t a long-term strategy – it’s a short-term band-aid.

If you’re trying to grow a modern, profitable insurance agency, you don’t need to offload your problems. You need to solve them.

That means fewer emails, fewer calls, and fewer distractions without sacrificing service quality.

GloveBox helps you do exactly that.

By automating Tier 1 requests and giving clients what they want – self-service, fast answers, easy access – you free your team to focus on real growth work.

Don’t outsource the problem. Eliminate it at the root.