Selling your agency isn’t just about handing over a book of business.

It’s about building a business someone wants to buy and wants badly enough to pay a premium for.

Buyers aren’t just buying clients.

They’re buying systems and cash flow. They’re buying confidence that the agency will continue to run and grow without you.

And if you want to get the best deal possible, you need to start thinking like a buyer long before you ever list your agency for sale.

We’ll break down everything you need to know about selling an insurance agency – from how valuation really works to how deals are structured to the steps you should take now to maximize your agency’s worth.

Let’s dive in.

TL;DR

Thinking about selling your insurance agency? Here’s what matters most:

- Buyers care more about profitability and processes than revenue

- EBITDA drives your valuation, not premium volume

- Retention and client experience directly impact your exit price

- Most deals involve lump sums, seller financing, or a mix of both

- Choosing the right buyer means knowing what kind of deal you want

- Due diligence is easier when your docs, contracts, and systems are buttoned up

- Preparing takes 12–18 months, you can’t sell overnight

Want buyers to compete for your agency? Start building one worth competing for.

Buyers Pay for Infrastructure, Not Just Revenue

Most agency owners think buyers care most about revenue.

They don’t. They care about what’s underneath it.

Operational infrastructure is what drives the real value of an insurance agency.

It’s what tells a buyer: “This agency will survive and thrive without the current owner in the picture.”

If your agency needs you personally to chase down renewals, solve service issues, and manage every process, your valuation drops fast.

You’re not selling a business – you’re selling a high-risk job.

The agencies that command the best multiples are built around predictable, self-sustaining systems.

Not around personalities.

Not around “the way we’ve always done it.”

Here’s what buyers look for when judging your infrastructure:

Clear, documented SOPs

If you don’t have it written down, you don’t really have it.

Buyers want to see formal Standard Operating Procedures (SOPs) for every major process:

- New client onboarding

- Renewals and remarketing

- Policy servicing and endorsements

- Claims handling follow-up

- Cross-sell and upsell workflows

It’s not about creating a huge binder no one reads.

It’s about giving buyers confidence that your team follows proven, repeatable steps without asking what happens next.

If they have to rely on tribal knowledge, it’s a risk.

If they see an agency that runs like clockwork, it’s an opportunity.

Documented workflows

It’s not enough to say, “We handle renewals quickly.” Buyers want to see how it happens.

Which systems are used? Who triggers what action? How is progress tracked and followed up?

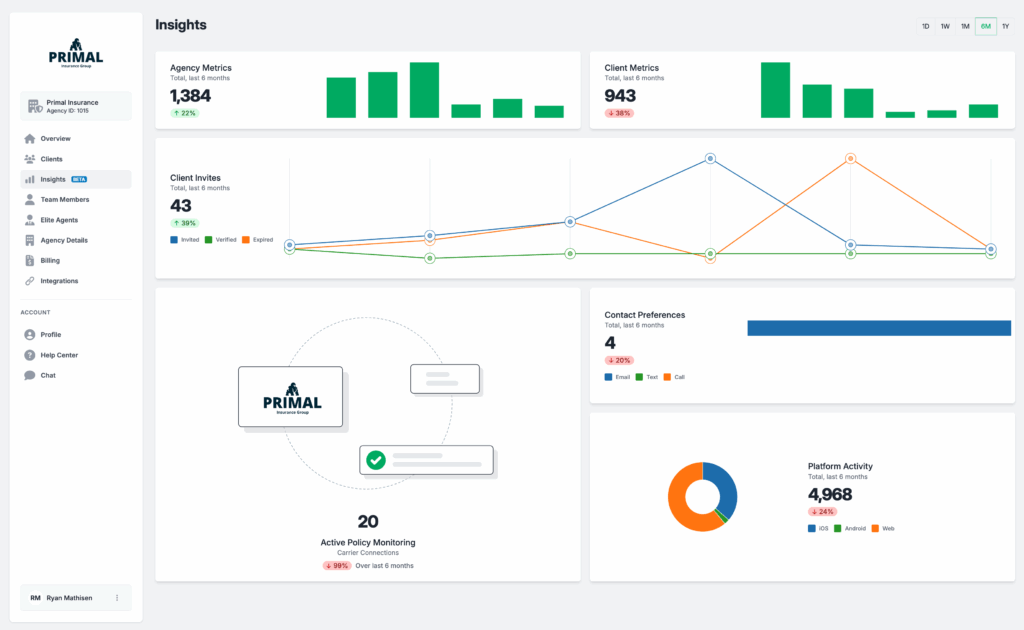

If your agency has a CRM, AMS, or client portal like GloveBox that automates and records key workflows – that’s a significant advantage.

GLOVEBOX VIDEO

It shows the business is built on systems, not memory.

And that lowers buyer risk while raising your valuation.

Scalable systems

The real question buyers ask is, “If this agency doubled tomorrow, could it handle it?”

If your answer is “we’d need to hire five more CSRs,” your margins and valuation suffer.

If you answer, “Our systems and service processes would absorb it,” you look like a wise investment.

Scalable systems mean:

- Service automation reduces human workload

- Clients can self-serve without calling your team

- Cross-sells and renewals surface naturally through your tech stack

When buyers see scalability built into your operations, they know growth won’t affect your profits.

And that’s the difference between selling at a decent multiple and selling at a premium one.

Key Metrics Buyers Care About (And Why)

When buyers evaluate an agency, they aren’t just looking at how big it is. They’re looking at how strong, profitable, and predictable it is.

The metrics that matter most tell buyers whether they’re buying growth or buying headaches.

EBITDA is king

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) is the most important number in agency sales.

It shows true profitability, stripped of accounting tricks and one-time events.

It answers the real question buyers have: “How much money does this agency actually make once it’s running normally?”

If your EBITDA is strong and growing, your agency becomes much more attractive and valuable.

If your EBITDA is weak, bloated by payroll, or eaten up by tech costs, buyers either walk or slash their offer.

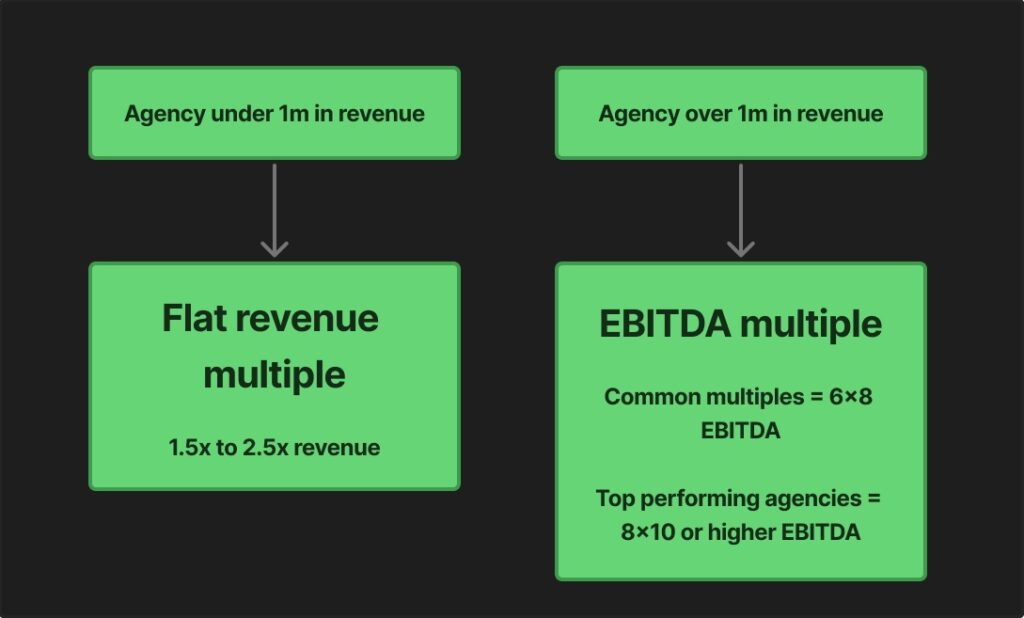

Typical valuation multiples

The value is calculated by applying a multiple to your EBITDA or revenue.

Example:

If your agency earns $500,000 EBITDA and sells at a 7x multiple, it would be valued at $3.5 million.

The better your operations, margins, and retention, the closer you get to the top end of that range.

Other critical metrics buyers watch closely

It’s not just about EBITDA.

Smart buyers dig deeper to check the overall health of the business:

Client retention rates

Retention is loyalty.

High client retention signals that your cash flow is stable and reliable.

Losing customers year after year is a major red flag, even if revenue appears good due to premium increases.

Retention of clients, not just revenue, is a core value driver.

Revenue growth from new business

Premium increases boost revenue but hide real growth problems.

Buyers want organic client growth – new logos, new accounts, not just bigger premiums.

Agencies that win new business consistently are more valuable because their future looks brighter.

Revenue per employee (secondary but not ignored)

How much revenue does each team member help produce?

Higher revenue per employee signals operational efficiency.

Lower numbers suggest a bloated and inefficient operation that will hurt margins after the sale.

While not the first thing buyers check, it often influences how they view your agency’s scalability.

The role of client experience in agency valuation

When buyers evaluate your agency, they aren’t just buying your book of business today. They’re buying the future cash flow your clients represent.

And future cash flow depends heavily on one thing:

Retention.

Retention isn’t just about good service anymore.

It’s about client experience – how easy, fast, and frictionless customers can get what they need.

Agencies that deliver modern, digital-first experiences are more valuable because their clients stay longer and happier.

Retention starts with convenience

Today’s clients expect 24/7 access.

They want to manage policies, download ID cards, and pay bills on their own schedule, not yours.

If your clients need to call, email, and wait days for simple tasks, frustration builds. Frustrated clients are much more likely to shop around and leave.

On the other hand, if clients can self-serve their basic needs without friction, they tend to stay loyal longer. They associate your agency with speed, control, and relief.

That loyalty translates directly into stronger retention numbers and a stronger valuation.

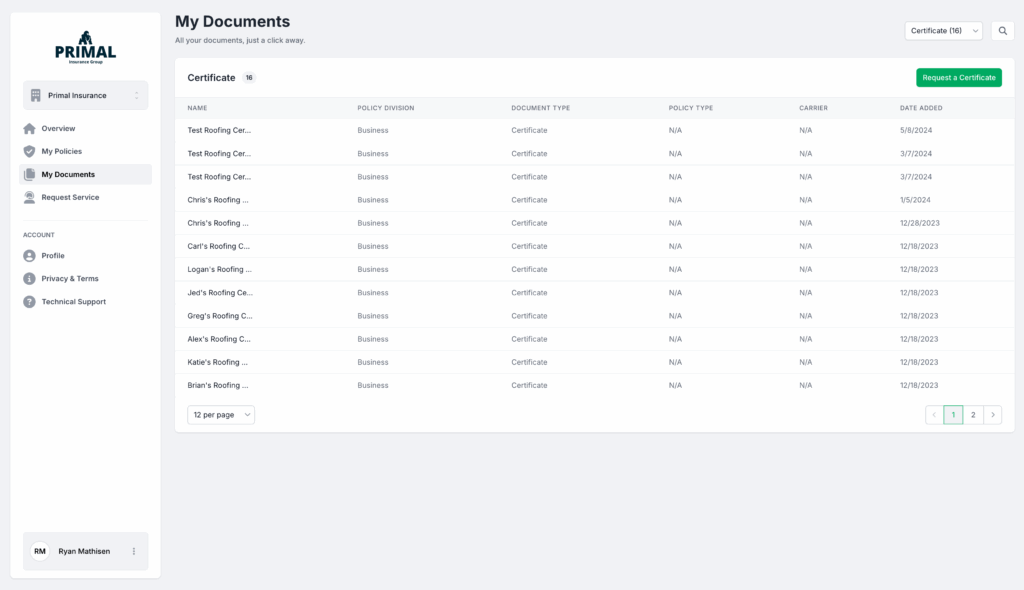

How self-service tools like GloveBox make a difference

Self-service isn’t about replacing your people.

It’s about freeing your people to focus on what matters most – advisory work, relationship building, and upsells.

Platforms like GloveBox allow your clients to access their policy documents instantly, handle billing questions without calling, and request service changes anytime, day or night.

Instead of overwhelming your team with simple requests, your clients help themselves. And love you more for it.

Agencies using self-service platforms consistently report higher:

- Client satisfaction scores

- Retention rates

- Cross-sell and upsell success

All of these factors feed back into better margins, better cash flow, and better buyer interest.

Why buyers pay for client experience

It’s simple:

Agencies with happy, loyal clients are safer investments.

When clients feel empowered, they don’t churn.

They don’t chase cheaper quotes. They stick, and they spend more.

Buyers know that.

They look for agencies that make life easy for clients because those agencies produce more stable, predictable cash flows over time.

In the end, the modern client experience isn’t nice to have.

It’s an asset buyers are willing to pay a premium for.

How Deals Are Structured in Insurance M&A (What to Expect When Selling Your Agency)

When the time comes to actually sell your agency, the deal isn’t always simple.

It’s not just, “Here’s the money, thanks for the keys.”

Insurance M&A deals usually follow a few common structures, and knowing what to expect can help you negotiate smarter.

Lump sum payout

In a lump sum deal, the buyer agrees to pay you a fixed amount upfront for the entire agency.

You hand over the business – they hand over the check. It’s clean and fast.

And it’s attractive if you want a clean break.

However, lump sum deals often come with slightly lower valuations than more complex structures.

Why? Because the buyer takes on more risk by paying everything upfront.

You get security but sometimes leave a little money on the table compared to seller-financed options.

Seller Financing

In seller financing, you become the bank.

Instead of one big check, the buyer pays you over time – typically on a monthly or quarterly basis – with interest.

You hold a “note” on the agency, and the buyer agrees to make regular payments.

Terms usually last between 3 to 7 years, depending on the size of the deal and the parties involved.

Seller financing often results in a higher overall payout because you’re taking some risk alongside the buyer. But it also means you don’t get all your money at once, and you’re betting that the new owner can manage the business successfully.

Mixed structures: upfront + earnout or bonus

Some deals blend lump sums with performance-based bonuses or earnouts.

For example:

You get 70% of the price upfront. The remaining 30% is paid out over the next 2–3 years based on hitting certain revenue or retention goals.

This structure helps buyers protect against surprises and rewards you if the agency continues to perform well after the sale.

It’s a middle ground between safety and upside.

Staying on after the sale

In many cases, buyers require the seller (you) to stay on for a transition period.

Typical stay-on periods:

12 to 36 months, depending on the complexity of the agency and the buyer’s needs.

During this time, your role might shift to:

- Acting as a producer

- Advising new leadership

- Helping retain key accounts

- Training the new team

The more critical you are to client relationships and internal operations, the longer buyers will likely want you around.

And often, part of your payout may be tied to how smoothly that transition goes.

Who Your Buyer Might Be (And How to Evaluate Them)

Not all buyers are the same.

Who you sell to can be just as important as how much you sell for.

Each type of buyer comes with different expectations, timelines, and deal structures.

Choosing the right buyer isn’t just about getting the biggest check but finding the best fit for your goals.

Types of buyers

Strategic buyers (other agencies)

Strategic buyers are typically other insurance agencies looking to grow through acquisition.

Their goals might include:

- Expanding into new geographic areas

- Gaining access to your niche expertise (like high-net-worth clients, trucking, healthcare, etc.)

- Acquiring your carrier relationships

- Growing their top-line revenue quickly

Strategic buyers often value your book of business and your team. They may want you (and your top producers or CSRs) to stay on during the transition.

Deals with strategic buyers can sometimes be more flexible because they understand the day-to-day realities of running an agency.

Private equity firms

Private equity (PE) firms are financial investors looking for profitable, scalable assets they can grow and resell later.

They care deeply about EBITDA margins, growth potential, and operational efficiency.

PE firms often buy multiple agencies, combine them, and later sell the larger platform for a higher valuation.

If a PE firm buys your agency, expect:

- Strong emphasis on financial performance

- Pressure to hit growth and margin targets post-sale

- More structured expectations about roles, reporting, and timelines

They may or may not want you to stay involved in the long term. It depends on their strategy.

How to pick the right offer

Selling your agency isn’t just a math problem.

It’s a personal decision.

Here’s how to weigh your options.

Compare deal structures, not just purchase price

A bigger number isn’t always better.

Look at how much is paid upfront.

How much is tied to future performance (earnouts, bonuses)?

How much risk are you taking by staying involved?

Sometimes, a slightly lower upfront offer with cleaner terms is worth more than a complicated earnout-heavy deal.

Understand the expectations

Before signing anything, determine whether you need to stay on as an employee or an advisor. And for how long?

What performance targets must be met to get full payment?

How much control do you retain (if any)?

If you stay, you need to know exactly what your new role and responsibilities will be and how you will be compensated.

Choose based on personal goals

Ask yourself: “Do I want a fast exit and full separation from the agency?”

Or am I okay staying involved for a few years to maximize the total payout?

Do I care about preserving my brand, team, and legacy, or am I ready to move on completely?

The right buyer is the one whose vision for your agency and deal terms align with your goals for the next chapter of your life.

The Due Diligence Process (And How to Survive It)

Once you accept an offer, the real work begins.

Due diligence is the part of selling your agency where the buyer lifts the hood and looks inside everything.

It’s where they confirm whether what you promised on paper actually matches how your agency operates day-to-day.

If you aren’t ready for it, due diligence becomes stressful, slow, and expensive.

If you prepare the right way, it becomes a fast, smooth process that strengthens the buyer’s confidence in closing the deal.

Here’s what buyers will dig into:

Financials

Expect them to ask for your profit and loss statements, balance sheets, tax returns, and detailed accounting records.

They’re not just looking for revenue – they’re verifying profitability, cash flow patterns, and any financial red flags.

Contracts

Every agreement matters.

Buyers will want to see your carrier contracts, technology vendor agreements, lease terms, and any employee-related contracts, such as non-solicitation agreements or compensation plans.

Client base and retention data

It’s not enough to show revenue growth.

They will want a breakdown of client counts, churn rates, average account size, and any major dependencies (for example, if 40% of your revenue comes from two accounts, that’s a risk).

Operational SOPs

If your agency runs on muscle memory, the cracks will show fast.

Buyers will check whether you have structured, documented workflows or if your team is improvising on a daily basis.

Tools like GloveBox make this part easier.

With automated workflows, better client data visibility, and reduced manual handling, your agency will appear more organized and attractive during due diligence.

How long preparation takes (and when to start)

You can’t wake up one morning, decide to sell, and expect buyers to line up with premium offers.

If you want top dollar for your insurance agency, you need 12 to 18 months of serious preparation before you hit the market.

Buyers don’t just evaluate where you are today.

They want to see a history of consistent growth, healthy profitability, and operational discipline.

A good month or two isn’t enough.

They’re looking for patterns over time, proof that your success isn’t an accident.

That’s why you can’t rush it.

If you wait until you’re tired, burned out, or desperate to sell, your valuation will suffer. Buyers will spot last-minute fixes and start discounting their offers immediately.

Real preparation means starting early.

It means tightening operations, boosting margins, cleaning up client experience, and documenting your processes while you still have a runway.

You don’t build a business worth buying overnight.

You build it by showing, month after month, that your agency runs smoothly, scales predictably, and grows without chaos.

And that foundation takes time.

If you want buyers to fight over your agency instead of picking it apart, the work starts today, not when you feel ready to sell.

The Bottom Line

Selling your agency isn’t about luck or timing.

It’s about building a business someone wants so badly they’re willing to pay a premium to win it.

Buyers don’t pay top dollar for messy operations, weak processes, or one-person shows. They pay for systems, profitability, and predictability.

If your agency runs without you, retains clients easily, and grows without adding headcount – you’re in the top tier.

Tools like GloveBox help make that possible. They cut service costs, boost client satisfaction, and give your agency the operational strength that shows up directly in your valuation.

Want to sell for more later? Start working on it now.